Weekly TLDR - Earnings Expectations

Let’s talk earnings. We’ll start with an in-depth overview of how earnings expectations work and follow up with a lightning round of recent earnings reports.

The TLDR

In this week’s TLDR, we are veering from the usual format. The theme is earnings and we’ll start with an in-depth overview of how earnings expectations work, followed by a lightning round of recent earnings reports. The crypto section’s format remains unchanged.

Earnings Expectations

This week, companies representing about half of the S&P 500 market cap will report Q2 earnings. This includes the five tech giants, Apple, Alphabet, Microsoft, Amazon, and Meta. There’s no better time for earnings talk.

Let’s start with an in-depth overview of how earnings expectations work!

Who Sets Earnings Expectations?

The widely publicized earnings expectations we see in the media are typically set by sell-side analysts. These analysts publish in-depth research on stocks that typically includes a financial model for the upcoming quarter or year. They also constantly engage with “buy-side” investors (e.g. mutual funds, hedge funds, pensions) that want research and projections on stocks to inform their trading. As such, sell-side research is generally what the market anchors itself to for earnings expectations.

🤫 The Whisper

Things get a bit more complicated when you factor in the “whisper”. The whisper is a set of shadow expectations that differ from what sell-side analysts believe and publish. Whispers start when buy-side investors (typically hedge funds) have contrarian opinions and actively share their unique expectations hoping to change the market’s collective opinion. In general, they already have contrarian trade positions established before spreading their whispers and if the market is convinced, or the whispers turn out to be true, the ensuing sentiment shift will yield massive profits. Some call this “talking up one’s book”.

Whispers often have a lot of time to spread. Sell-side analysts are required to be transparent and publicly publish their research days to weeks before a company reports earnings. The long time between the publishing of sell-side research and the reporting of earnings sometimes leads to stale estimates. Stale estimates is a common source of whispers.

How Are Earnings Expectations Set?

The process of setting an expectation is actually simpler than many expect. Most analysts start with company guidance provided by management teams in prior quarters. This is a “best guess” forecast by the company. It’s generally a good forecast since companies (1) have the best visibility into internal figures like revenue and expenses, and (2) are already about one month into the quarter by the time they report earnings for the previous quarter.

The midpoint of company guidance is usually the baseline that sell-side research analysts take for their financial estimates. For companies that don’t provide guidance, sell-side analysts will extrapolate future performance by looking at the company’s past performance trends as well as other tertiary information.

This baseline is then adjusted by various factors. Immediate adjustments may include the history of the company’s management team and their level of conservatism while giving guidance. If a company has a historical tendency of outperforming their guidance, sell-side analysts will adjust upwards from the baseline. Adjustments are also made based on the analyst’s or company’s “personal” outlook for the stock.

Throughout the quarter, as news comes out for the stock (e.g. competitors, product launches, macro economic conditions), sell-side analysts will adjust their estimates based on this new information. For example, news of supply constraints at a company’s key supplier may cause an analyst to reduce their revenue forecast for the company.

Another common way estimates are adjusted happens when companies in the same industry report earnings. This is often why you see companies in the same industry trade in a correlated fashion after one of them reports earnings. A good example of this is Snapchat’s recent disappointing Q2 earnings report. SNAP’s sell-off led to pessimism around the state of the overall advertising industry and caused the stocks of much larger ad publishing companies like Meta and Alphabet to sell off as well.

Stock Market TLDR

Earnings Lightning Round

Snapchat: Results: Miss Revenue / Miss Earnings / Beat Users - Bad Q3 Outlook

Twitter: Results - Miss Revenue / Miss Earnings / Miss Users

Alphabet: Results - Miss Revenue / Miss Earnings

Tesla: Results - Miss Revenue / Beat Earnings

General Motors: Results - Beat Revenue / Miss Earnings

Netflix: Results - Miss Revenue / Beat Earnings / Beat Subscribers

Highlights:

A strong dollar is impacting companies with international businesses. Alphabet saw a -3.7% (~$2.5B) revenue impact from the strong dollar, Twitter saw a -3% revenue impact etc.

Weak advertising trends and low visibility into advertising spend in Q3 is affecting major ad publishing companies like Twitter, Snapchat, and Alphabet. TikTok is eating everyone’s lunch.

The automotive industry is still supply constrained. Even Tesla is experiencing constraints in its supply of battery cells (and other components) which has led to gross margins dropping by 5% quarter-over-quarter.

Major tech companies are dramatically cutting costs (e.g. Snap, Alphabet, Apple). This often translates to significant hiring slowdowns.

Walmart Cuts 2022 Forecast

The Short: Walmart cut its profit outlook for 2022 due to inflation and excess inventory. This is a bad sign for the US economy at large.

The Long: Walmart is seen as “America’s Grocery Store” and a bellwether for the American economy. Prior FinanceTLDR issues have discussed Walmart, Target and other retailers overstocking on the wrong inventory as an overreaction to global supply chain troubles last year. Worries about inventory problems and inflation have prompted Walmart to cut its earnings outlook by 8 to 9% in Q3 and 11 to 13% for the year. Amazon, which reports Thursday, is the other big retailer that folks will keep a close eye on for Q2. Amazon may not hold as much inventory as Walmart but 3rd party merchants do and their troubles could spill over into Amazon’s results.

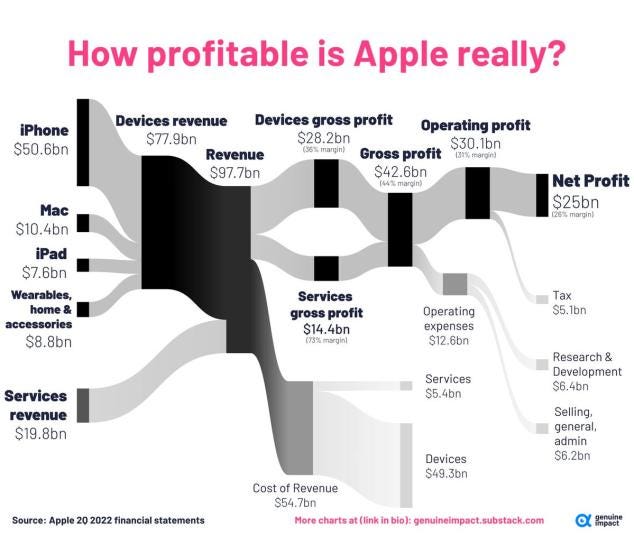

How Profitable Is Apple?

A few issues ago, we shared a chart on where Amazon’s profits are coming from. Here’s another chart from Genuine Impact breaking down Apple’s profits. Unlike Amazon, which has a massive difference in margins between its top two businesses, Retail and Cloud, the difference in margins between Apple’s Devices and Services businesses is much smaller. Hardware margins tend to be low, but Apple’s Devices business benefits from high margins due to the “luxury” status of most of its products.

Here’s a relevant quote about the margins of luxury goods from Bernard Arnault, the co-founder, chairman, and chief executive of the world’s largest luxury goods company, LVMH.

Crypto TLDR

Spot Down, Derivatives Up

The Short: Coinbase’s spot trading volume has collapsed since last year but trading interest in its recently launched nano Bitcoin futures product is skyrocketing.

The Long: “Spot” refers to underlying assets. For Coinbase, that would be cryptocurrencies like Bitcoin and Ethereum. “Derivatives” refer to securities that are financial contracts whose value is dependent on an underlying asset. An example of a crypto derivative is Bitcoin futures. Coinbase launched a nano Bitcoin futures product in June (cash-settled, with each contract representing 1/100th of a Bitcoin) and its trading volume has surged in July, from just under 50,000 contracts traded per day on 7/13 to over 200,000 on 7/19. This volume still pales in comparison to Coinbase’s spot trading volume but strong customer interest in the trading of other asset types bodes well for the company’s competitive advantage as it continues to launch markets for different crypto-based assets. Having a more diversified set of tradable assets on the exchange will also slightly reduce the volatility of its trading revenues.

Coinbase Investigated By SEC

The Short: The SEC is investigating Coinbase for allowing the trading of several cryptocurrencies that the SEC thinks are securities.

The Long: This news was first reported by Bloomberg on Tuesday. It follows news last week that a former Coinbase product manager, his brother, and his friend were arrested for alleged wire fraud. The product manager worked within Coinbase’s assets listing team and repeatedly tipped his brother and friend about new coins that were about to be listed on Coinbase. The three profited at least $1.5 million from this insider trading scheme. In parallel with this case, the SEC filed an insider trading complaint against Coinbase. In it, the SEC boldly declared nine cryptocurrencies as securities. Seven of which are currently listed on Coinbase! In a July 21st blog post, Coinbase vehemently denied the SEC’s claims.

This once high-flying crypto exchange is now finding itself fighting two fronts: collapsing trading interest in crypto threatening its top and bottom lines, and an investigation from a powerful government organization that wants to make an example out of the company for the rest of the crypto industry. Coinbase’s current predicament is exemplary of the fast-shifting fortunes in the business world.

Work From The Bahamas

The Short: Susquehanna International Group, a large quantitative hedge fund that operates in both traditional finance and crypto markets, is opening an office in The Bahamas. Leading international crypto exchange FTX is already headquartered in The Bahamas.

The Long: Who wouldn’t want to work from the Bahamas? You have great weather, great views, great parties, and low taxes. What’s to hate? Did I mention low taxes? It also helps that The Bahamian government is incredibly amenable to crypto.

Could Susquehanna also want to locate close to FTX so that it can work closely with the world’s second largest exchange by volume to get access to, and profit from, exclusive crypto market information? 🏝️🥂