Weekly TLDR - Goldman Sachs's Circus

Let's talk about the lag between a slowing economy and falling inflation, China possibly moving away from its zero-c*vid policy, Walmart’s hybrid cloud aspirations, and crypto’s bear market woes.

The TLDR

In this week’s TLDR, we talk about the lag between a slowing economy and falling inflation, China possibly moving away from its zero-c*vid policy, Walmart’s hybrid cloud aspirations, and crypto’s bear market woes.

Charts of the Week

Rising interest rates are slowing down the economy but inflationary measures like food and energy prices have yet to come down.

With ongoing supply chain issues, there could be a pretty severe lag between a slowdown in demand and falling prices. This doesn’t bode well for the Fed who’s urgently trying to tame inflation. Real estate is a great example of this as mortgage demand nears decade lows but housing prices keep on rising due to low supply and may remain high for a while. If the overall economy follows real estate, we may be in for a lot of pain (long recession) without much to gain (inflation remains).

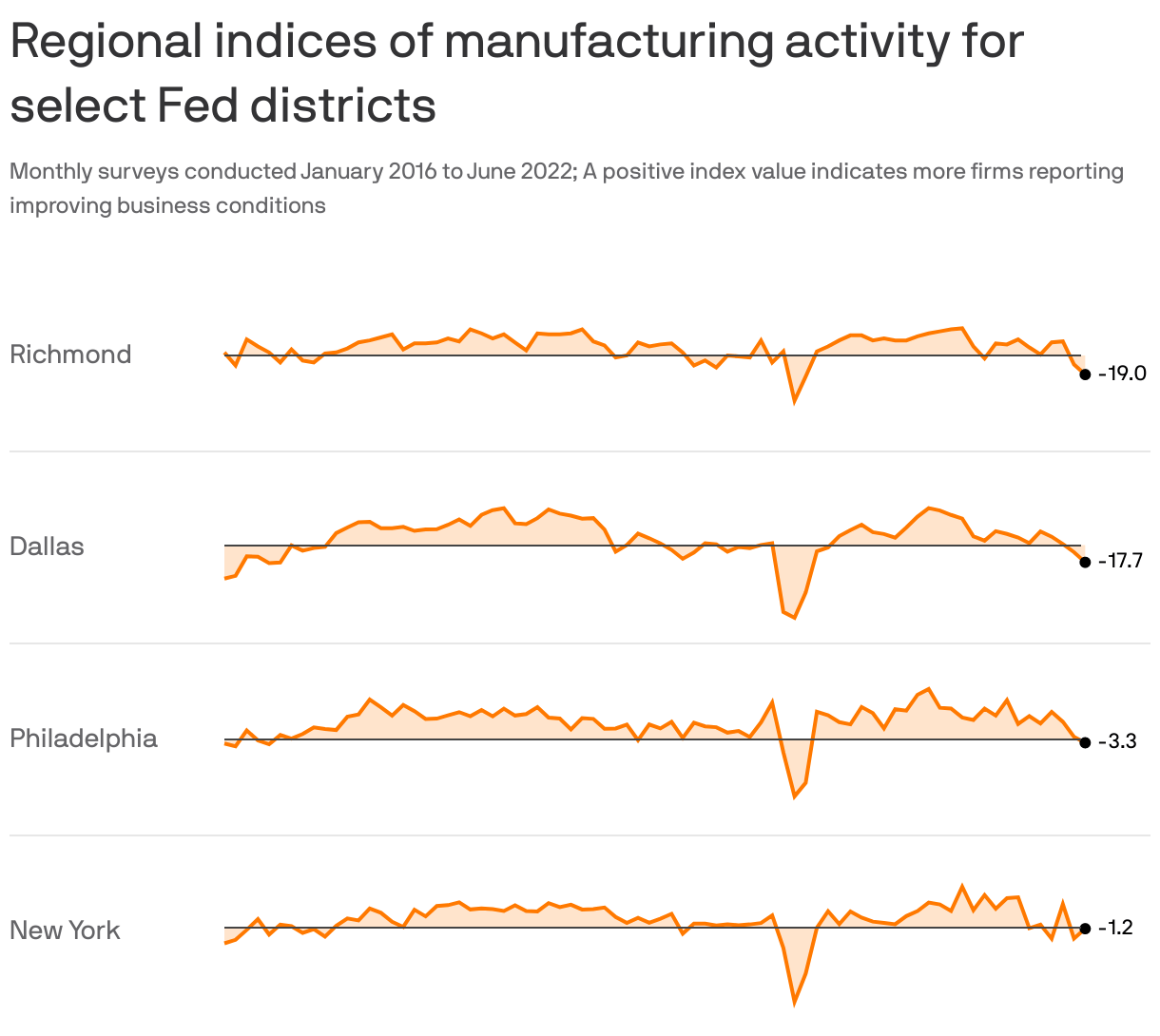

The charts we want to highlight from top to bottom are (1) signs of manufacturing slowing down and (2) declining tech stocks. The result of both is (3) reduced job growth and (4) increased expectations of wage loss.

If you’ve enjoyed FinanceTLDR’s content so far, and you use Gmail, be sure to check your Promotions tab for FinanceTLDR issues. Gmail occasionally drops newsletter issues in there and the best way to make sure FinanceTLDR consistently hits your inbox is to drag and drop emails from the Promotions tab to the Inbox tab.

Thanks for sticking with FinanceTLDR! We greatly appreciate your readership and will keep working hard to deliver high value and informative content to your inbox.

Stock Market TLDR

Goldman Sachs’s Circus

Goldman Sachs upgraded HOOD from Sell to Neutral… but dropped their price target from $11.50 to $9.50.

Someone needs to remind Goldman’s sell-side analysts that the stock market isn’t a circus! 😅

China Moving Away From Zero-C*VID Policy?

The Short: China is loosening its quarantine requirements for international travelers. This is the first sign of a departure from its infamous zero-c policy and could be a positive sign for the global supply chain, global inflation, and China’s domestic economy.

The Long: China’s zero-c policy has been a thorn in the global supply chain for the entire pandemic. Major cities have shut down completely with little warning and have left companies like Tesla with idle factories due to a lack of a workforce and component parts. This small but public turnaround in China’s pandemic policy may signal a policy shift away from zero-c (which, paired with a less effective vaccine, hasn’t really worked). A looser and more sensible pandemic policy would likely mean more consistent production and shipping from China. This should hopefully reduce global inflation.

Exporting Inflation to Europe

The Short: Inflation is rising in Europe. A slower response from European central banks could pit the US against Europe in a battle against inflation.

The Long: Europe’s central banks have been more measured in increasing their interest rates. This makes sense when you consider the more precarious situations of economically weaker European countries like Italy and Greece. Being slow to raise interest rates may mean that some inflationary pressures are escaping the US and flowing to Europe. Higher interest rates generally increases the value of a country’s currency. This reduces domestic inflation while increasing inflation in the country’s trade partners. The British CPI topped out at 9.1% in May, far surpassing US CPI. Pair this with the increasing restrictions on Russian energy supplies to Europe and it’s very likely that European inflation will soar in the second half of the year. No wonder Bridgewater has put on a multibillion-dollar short position on Europe.

Walmart Adopts A Hybrid Cloud Approach

The Short: Walmart recently announced that it has created its own hybrid cloud solution allowing it to seamlessly use, and switch between, its own infrastructure and third party cloud providers. This allows Walmart to not only be less reliant on any one public cloud provider but also quickly shift costs to the cheapest provider. The downside is, of course, more operational burden.

The Long: Walmart has created its own system to juggle between public cloud offerings and its own servers located at Walmart stores. This move makes a lot of sense for Walmart as it doesn’t want to go all-in on AWS considering their competition with Amazon. If I had to guess, Walmart’s hybrid approach for its own services will be a stepping stone to offering hybrid cloud as a service to other companies and expanding its own server footprint. In the near-term, Walmart gets to use its XXL status to get the best pricing and features from cloud vendors like AWS, Azure, and GCP.

Crypto TLDR

Bear Market Woes… and Opportunities

If history is any guide, this crypto bear market will last for quite a while and there’s certainly a high chance of further price declines. We shouldn’t forget that Bitcoin fell to under $4,000 while Ethereum fell to under $90 during the pandemic bear market.

Volatility is the price you pay for crypto. As long as its story remains strong, investors that can stomach volatility and are brave enough to buy during bear markets have consistently been well rewarded.

Three Arrows Capital Ordered to Liquidate

The Short: Crypto hedge fund Three Arrows Capital was just ordered by a British Virgin Islands court to liquidate its assets. The embattled hedge fund failed to meet margin calls from its lenders earlier in the month.

The Long: Three Arrows Capital underwent a high profile blow-up recently as the once high-flying crypto hedge fund with $18 billion in assets under management at its peak failed to meet margin calls from its lenders earlier in the month. The rumor is that the fund’s troubles started with the complete collapse of Terra Luna, which turned a $200 million investment into dust in just a few days. As the crypto market fell off a cliff, the fund’s other reckless investments in high risk DeFi instruments, often with leverage and without hedges, quickly collapsed as well. The fund is now likely insolvent and a British Virgin Islands court has ordered the liquidation of its remaining assets. This could spell further trouble for lending platforms that have exposure to the fund.

As we watch the unravelling of Three Arrows Capital, let’s not forget this tweet from the fund’s founder. Talk about unfounded hubris.

MicroStrategy Continues to Buy Bitcoin

The Short: Multibillion-dollar software giant MicroStrategy doubled down on its massive Bitcoin position despite the ongoing bear market by purchasing 480 BTC for about $10 million from May 3rd to June 28th. The company holds approximately 129,699 BTC. At BTC’s peak price, this was worth $8.8 billion! It’s now worth $2.6 billion.

The Long: The eccentric CEO and founder of MicroStrategy, Michael Saylor, transformed his software company into a lackluster Bitcoin ETF over the last two years. MicroStrategy’s core software business has become just a cash flow generator to acquire more Bitcoin. It has even taken on hundreds of millions of dollars in leverage to buy Bitcoin, causing many to speculate that the company is now at risk of a massive margin call. So far, MicroStrategy has avoided this fate but if the crypto market continues to fall, the company will be forced to pay its dues for poor risk management. This massive liquidation will crater the crypto market. It’s interesting how bull markets can warp mindsets and cause investors to throw caution to the wind. “Bitcoin jumped 20% over the last week, what’s the point of risk management anyways?”