Weekly TLDR - Manic Macro, Manic Markets

In this week’s TLDR, we talk about confusing macro-economic signals, a declining video game market, Amazon sucking up Roomba, and Ethereum’s major upgrade.

The TLDR

In this week’s TLDR, we talk about confusing macro-economic signals, a declining video game market, Amazon sucking up Roomba, and Ethereum’s major upgrade.

Manic Macro, Manic Markets

In the past two weeks, we saw the release of a flurry of confusing macro-economic data. Is inflation 8.5% or 0%, are interest rates going up or down, is the job market hot or getting worse, etc. The market has been equally manic. Although we’re in the midst of a major rally since June’s lows, we’ve certainly experienced significant turbulence as the market melted upwards.

So what is it? Are we out of the woods, or is this yet another bear market fake out? Let’s dissect these confusing macro signals.

Signal 1: Inflation

July CPI came in at +8.5% year-over-year but didn’t change month-over-month. This means that prices were up versus the same time last year but remained flat when compared to June. For consumers, month-over-month changes are more important than year-over-year changes.

.

Digging into the July CPI report, we see that a fall in energy prices helped to offset rising prices in just about everything else. Energy prices are an input cost for most items in the CPI so declining energy prices in July may imply a contracting CPI in August. Good bye inflation?

The market reacted positively to July’s relatively meek CPI print. Investors are expecting the Fed to slow down interest rate hikes as inflation appears to have peaked and is possibly even declining. However, as we mentioned in the most recent Market Forecast newsletter issue, the market may be too optimistic for a relenting Fed. +8.5% YoY inflation is still way above the Fed’s 2% inflation target, and there’s historical precedence of inflation rebounding from a Fed that slowed rate hikes too early (i.e. during the tenure of infamous Fed chair Arthur Burns).

As such, we think the Fed will keep a firm foot on the monetary brakes for a lot longer than the market bulls are hoping for.

Signal 2: Jobs

The most recent jobs report showed that the US added 528,000 new jobs in July, more than double the 258,000 jobs economists were expecting.

A strong job market gives the Fed a lot more leeway to be aggressive with interest rate hikes without needing to worry about economic armageddon. This is both good and bad for stocks. While no one wants economic armageddon, the higher interest rates get, the more they pull stock prices down.

Signal 3: Company Earnings

Over the past couple weeks, we saw many companies report lackluster Q2 earnings results that were surprisingly well received by the market. The results were Bad But Not That Bad. Many investors were clearly overly pessimistic heading into the Q2 earnings season.

However, with so many companies laying off staff, especially in the real estate and tech sectors, we expect earnings estimates to continue to decline throughout the rest of 2022. How many Bad But Not That Bad quarters can we go through before things turn into Bad, Just Bad?

If we were to make a guess about what’s likely to happen given all this new macro data, we think that (1) the job market will remain strong for the lower end of the job market but weaken for the higher end. There are a lot fewer high-paying jobs than low-paying jobs and a tapering at the top end of the job market will be poorly reflected by overall job market data. This will allow the Fed to remain aggressive with rate hikes. (2) As such, we think the Fed will continue raising rates by 75 basis points at each FOMC meeting until 2023, and then moderate afterwards. (3) We also think that earnings results, and thus expectations, will continue to fall throughout the rest of the year. This will cause companies to be overly conservative with their guidance for next year, thus setting us up for a 2023 bull market as companies easily outperform their conservative guidances.

Stock Market TLDR

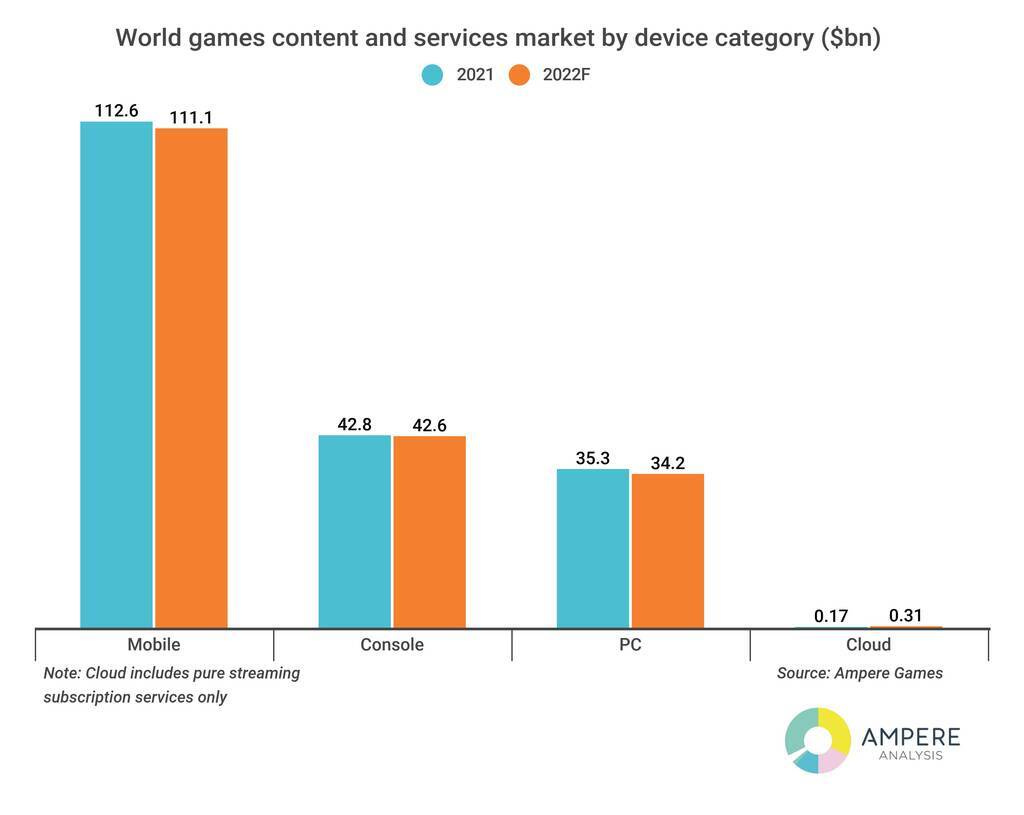

Video Game Market Expected To Decline in 2022

The Short: Independent research firms are expecting the video game market to decline in 2022. These expectations have recently been partially confirmed by weak Q2 earnings results from Activision Blizzard and other gaming companies.

The Long: A reversal of pandemic-era user behavior is no surprise as the economy, and society at large, reopens. This is the first real post-lockdown summer and people are spending much more time outside than at home. Although investors may see the gaming market’s ongoing weakness as temporary due to a reopening economy, the valuations of gaming companies could still fall meaningfully.

Why? Let’s explore how these companies are valued.

Investors focused on gaming companies primarily value them as a portfolio of IP (Intellectual Property) supported by a collection of development teams. The estimated value of a video game IP is generally based on the sales performance of the IP’s most recent title. For example, the Dark Souls IP got a huge valuation boost after the release of Elden Ring. Naturally, this raised sales expectations for the next Dark Souls game. For gaming companies launching major IPs into a weak 2022 market, poor launches could lower the value of their IPs, which then lowers the value of the overall company.

Amazon Sucks Up Roomba

The Short: Amazon acquires Roomba maker iRobot for $1.7 billion. This acquisition expands Amazon’s footprint in smart home automation.

The Long: Amazon is looking to expand its smart device footprint by acquiring the market’s most popular robot vacuum cleaner. After this acquisition, Amazon will have Echo devices, Ring doorbells, and Roomba machines in its home automation device portfolio.

Amazon is currently in search of a 3rd (4th if you include Prime) revenue pillar after AWS and Retail. Home automation is one business segment where they could find this new revenue source, but it’s still years away from significantly contributing to the company’s top line. We see Amazon’s iRobot acquisition as a long-term investment and we don’t expect the company to see any meaningful upside from it anytime soon.

No Vision For SoftBank

The Short: In one of the longest running train wrecks that everybody could see from a mile away, SoftBank reported a $23.1 billion loss in Q2. That’s right, $23.1 billion!

The Long: The performance of the SoftBank Vision Fund has been so poor that it’s fortunate the fund only invests in illiquid private equity investments. If the fund wasn’t so illiquid, its investors would have pulled their money out a long time ago.

Looking forward, SoftBank will likely be forced to sell more of its holdings the moment they become liquid as disappointed investors rush to exit the fund. The fund has already sold a few of its “higher quality” investments such as Cruise, SoFi and Uber (SoftBank was once Uber’s largest shareholder but the entire investment was sold in the past quarter). All these companies took a valuation hit when SoftBank exited. If you own a public company with SoftBank as an investor, be wary of a rushed SoftBank exit that could hurt the investment.

The slow collapse of SoftBank’s private equity venture arm is, at the end of the day, good for the private equity investment industry. SoftBank and Tiger Global together poured so much money into private equity that many ill-prepared start-ups were elevated to outrageously high valuations and given truckloads of cash that they had no idea how to efficiently deploy. The two giants’s imprudent investing style also significantly reduced the efficiency of private markets as other venture capital firms dropped all caution in order to compete with the two. One positive aspect of rising interest rates is that it put an end to this nonsense and both funds are now paying a hefty bill for their recklessness.

Crypto TLDR

Ethereum 2.0 Is Almost Here

The Short: The long-awaited Ethereum 2.0 upgrade is slated to happen on September 15th. This is a huge upgrade and will likely usher in a sea change in the crypto industry.

The Long: It’s finally happening. The much delayed Ethereum 2.0 upgrade is only a month away from launch. Once launched, Ethereum will be a Proof of Stake blockchain consuming a tiny fraction of the energy it once consumed. The total supply of ETH will also start contracting instead of expanding. Finally, many of Ethereum’s scalability problems will become a thing of the past.

The 2.0 upgrade should be a huge boon to Ethereum’s market cap and will obsolete many Ethereum-alternative blockchains. Some analysts even expect this upgrade to be the catalyst that propels Ethereum past Bitcoin to become the most valuable cryptocurrency by market cap.

Top Gas Consumers On Ethereum

Here’s a chart of the top gas-consuming Ethereum applications going back to 2017. Every Ethereum transaction requires a fee that’s paid in “gas”. As such, the more gas an Ethereum application consumes, the more popular it is. The decentralized exchange 0x used to consume the lion’s share of gas on Ethereum but it has since faded into obscurity with the emergence of better decentralized exchanges like Uniswap.