Weekly TLDR - Race to the Bottom

In this week’s TLDR, we talk about China’s struggling real estate sector and the race by central banks all over the world to raise interest rates (except Japan).

The TLDR

In this week’s TLDR, we talk about China’s struggling real estate sector and the race by central banks all over the world to raise interest rates (except Japan).

Raising interest rates is one way to counter and export inflation, but higher interest rates hurt domestic economies. As such, this race to raise interest rates is quite literally a Race to the Bottom.

Chart of the Week

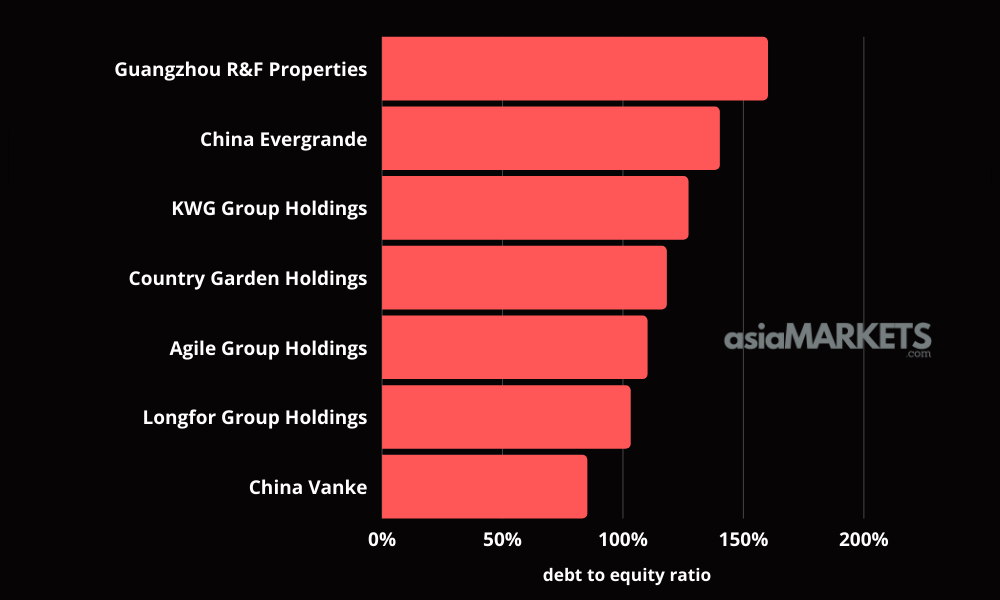

China is the primary GDP growth driver for the world and there are concerns that the country’s ongoing real estate crash can spill over and bring down the global economy. Let’s dig in.

The Chinese Dream

Owning a house is core to the “Chinese Dream”. A house is a means of security, progress, and courtship. As such, it’s no wonder that demand for houses in China has significantly outpaced wage growth and home ownership has become more and more unaffordable for the average Chinese family. For example, the average house price in Beijing is 14x the average salary of Beijing workers before tax (Housing Affordability in Chinese Cities, 2020)!

Leverage Saves the Day?

While housing affordability in the US has been buoyed by easy access to cheap personal loans often backed by the government, in China, housing affordability is largely backed by what’s known as “developer-led mortgages”. Big real estate development companies borrow money from banks to construct new developments and pre-sell unfinished units to hopeful homeowners by issuing mortgages.

Although developer-led mortgages are generally more affordable, they have a couple big caveats: first, these mortgages aren’t backed by the government and second, there is a lack of regulations for them.

Over the years, as China’s housing market grew, real estate developers have increasingly used leverage from issuing developer-led mortgages as a means to outcompete each other. This is an incredibly fragile business model for not just China’s real estate sector, but for China’s society at large.

A Controlled Demolition

The global pandemic put significant strain on China’s highly leveraged real estate sector and forced the Chinese government’s hand. The government stepped in in August 2020 to implement a controlled demolition of the country’s real estate sector by imposing strict new leverage limits called the “three red lines” policy:

Liability-to-asset ratio excluding advance receipts of less than 70 per cent

Net debt-to-equity ratio of less than 100 per cent

Cash to short-term debt ratio of 1

This new policy immediately prevented many highly leveraged real estate developers from raising new money through debt and thus put them in danger of insolvency. The most internationally well-known among them is Evergrande, China’s second largest real estate developer. The company is massive! Its land bank comprises of 214 million square meters of gross floor area (nearly four times the land area of Manhattan) and its property management arm manages 400 million square meters of real estate!

The company is currently on the brink of insolvency while the Chinese government appears intent on making an example out of the company, choosing to impose maximum pain on the company and its operators rather than bailing them out. At the same time, the government is trying to implement programs to support affected individual home buyers.

What Now?

Experts believe the economic impact of the current real estate crisis will be contained but if it can’t, China’s financial sector is the next domino to fall. The impending chaos is likely to be China’s version of the US’s 2008 Financial Crisis, with the global economy suffering significant collateral damage in the process.

Let’s hope the controlled demolition of China’s real estate sector remains controlled.

Stock Market TLDR

Race to the Bottom

Inflation is an ongoing global problem. One strategy that countries can use to fight inflation is to reduce import costs by strengthening their national currencies. The easiest way to do so is to raise national interest rates. Central banks know this and are racing each other to raise rates.

The problem is, higher interest rates hurt economies because they make it harder for governments, corporations, and individuals to service existing debt and raise more money. This reduces an economy’s money velocity which results in lower overall economic activity. Over time, this means lower wages and higher unemployment.

The race to raise rates is quite literally a Race to the Bottom but the alternative of uncontrolled inflation is worse.

Europe Wakes Up

The Short: The European Central Bank (ECB) raised interest rates by 75 basis points on Thursday last week. The ECB is finally making a real effort to raise interest rates after hesitating for months while the US, and the rest of the world, raced ahead.

The Long: In the post-pandemic era, with inflation soaring all over the world and especially in the Eurozone, the ECB has stubbornly kept its policy interest rate low (in negative territory!) even as other major economies raised theirs. This has caused the Euro to rapidly devalue against other currencies. For example, last month, the Euro fell below parity with the US Dollar for the first time in two decades.

The growing pain of a falling Euro and super hot inflation in the Eurozone forced the ECB to relent in July when it raised its policy interest rate by 50 basis points. This was the bank’s first rate hike since 2011. It was a good start but nowhere near enough to match the interest rate raises of other major central banks.

The good news is that the ECB appears to be finally taking runaway inflation in the Eurozone seriously and embarking on its own aggressive rate hike policy. Last week, the bank raised its policy interest rate by a massive 75 basis points (matching the size of the US’s recent individual rate hikes) and signaled that more large rate hikes are to come.

The age of easy money is over and many central banks are reluctantly being forced to face the uncomfortable choice of stifling economic growth or risking uncontrolled inflation.

The Bank Of Japan Blinks

The Short: Keeping to the theme of central banks raising interest rates, the Bank Of Japan’s (BOJ) steely resolve to keep Japanese interest rates low finally appears to be faltering in the face of a rapidly devaluing Yen.

The Long: Last week, we wrote about the BOJ stubbornly keeping Japanese interest rates low despite months of rapidly rising global interest rates in an almost desperate bid to support the Japanese economy.

However, sticking to low interest rates while everyone else is raising theirs comes at a heavy cost to one’s national currency. Although Japan’s central bankers expected the Yen to devalue against other currencies through this policy, the speed and scale of the devaluation have caught the policymakers off-guard and they’ve finally blinked.

Last week on Thursday, Japan’s top currency diplomat Masato Kanda made several urgent comments regarding the falling Yen to reporters at a press conference. Here’s a quick summary:

The Japanese Government and BOJ are extremely worried about the Yen

Agreed at meeting on need to watch markets with strong sense of urgency

Recently seeing speculative, one-sided rapid yen moves

Recent yen decline cannot be justified based on fundamentals

The moves are clearly described as excessive volatility

Will not rule out any steps, ready to take action in FX market

All options are on the table

Although the BOJ is alarmed at the pace of the Yen’s devaluation, they still seem to be stubbornly sticking to their low interest rate policy, preferring currency market interventions over raising interest rates.

We believe that it’s only a matter of time before the BOJ relents and is forced by the market to lift its iron fist on Japanese interest rates.

Crypto TLDR

The Ethereum 2.0 upgrade is almost here. Excitement for the upgrade, also known as “The Merge”, has been so high that Google has even implemented a custom countdown for the upgrade in its search results page.

This is a major event for not only Ethereum, but the entire crypto industry. We’ve written about this upgrade quite a few times before but if you want to learn more, this is an amazing resource to do so.