Weekly TLDR - Recession on Your Mind?

In this week’s TLDR, we talk about the possibility of a recession, the Twitter vs Elon Musk boardroom drama, ARK’s sky-high price target for Tesla, and Louis Vuitton selling NFTs.

The TLDR

In this week’s TLDR, we talk about the possibility of a recession, the Twitter vs Elon Musk boardroom drama, ARK’s sky-high price target for Tesla, and Louis Vuitton selling NFTs.

Chart of the Week

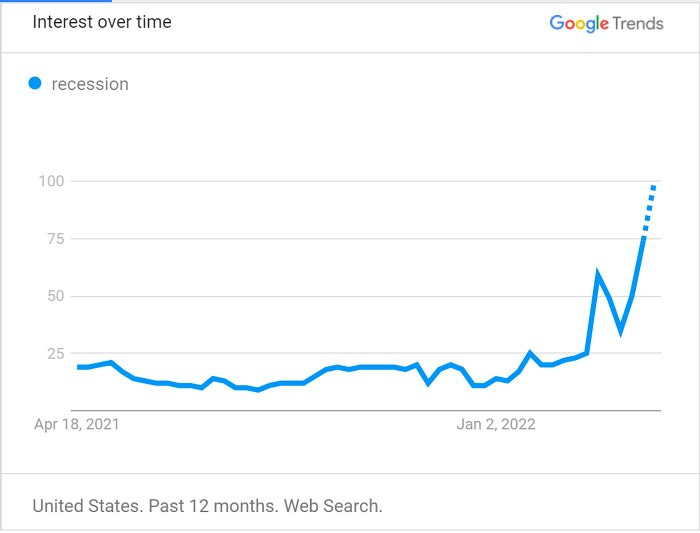

Let’s talk about recession.

It seems like that’s on everyone’s minds these days, at least if you tune in to CNBC or Bloomberg. But why’s that? Didn’t we just come out of one of the strongest consumer, housing, and stock markets in recent memory? One reason the financial airwaves is suddenly filled with talk about a possible recession is the sky-high inflation we’re seeing globally and especially in the US and Europe, which is destroying consumer confidence and buying power. Another reason is the Federal Reserve’s aggressive rhetoric in the past few months to counter this inflation by increasing interest rates and selling off its balance sheet. This will further stymie consumer demand. The Fed seemingly wants inflation down at all costs.

Trying to tamper inflation in a strong economy with high consumer demand is par for the course for the Fed. However, that's not what's happening right now. Rather, inflation is happening in an economy with weak consumer demand. This inflation is driven by supply shocks from the war and strict lockdowns in the other side of the globe. The combination of weak consumer demand and a Fed that wants to avoid inflation at all costs is perhaps why the who’s who of the financial world are worried about a recession.

Will a recession happen? We think it’ll depend on the global supply chain situation moving forward. If supply chains reorient themselves and are not disrupted again by another major global event, like more lockdowns or a worsening war, we will see inflation fall drastically. People are just not in the mood to spend. However, if lockdowns in Asia persist and even expand, or the war intensifies, global supply shocks could be prolonged and fuel inflation. At that point, the Fed will likely be forced into a “lesser of two evils” situation of tightening monetary policy during a weak economy. This has a high chance of triggering a recession.

Stock Market TLDR

Twitter’s Boardroom Drama

Many of us have already heard of the boardroom drama between Elon Musk and Twitter. Musk wants to acquire Twitter, but Twitter’s board is balking at the idea of giving it over to Musk, despite a bid that’s 18% above the company’s market cap at the time of the bid. The board hates selling the company to Musk so much that they adopted a “poison pill” where if anyone buys more than 15% of Twitter without the board’s approval, other shareholders will be allowed to purchase additional shares at a steep discount. This dilutes the would-be hostile acquirer.

However, one wonders whether this board deserves to protect themselves. Under their guidance, Twitter’s stock has languished for almost a full decade below it's peak IPO day price of $50. In fact, as of today, Twitter’s stock is still below this price. In contrast, Google’s stock price, for example, has grown more than 5x since Twitter's late 2013 IPO. Even Snapchat’s stock price is outperforming Twitter’s. In the years since Twitter has gone public, it has suffered from slow product development and misguided decisions. For example, Twitter owned the original and highly popular precursor to TikTok, Vine, but instead of letting it flourish, shut the product down in 2016. Given TikTok’s success today, Twitter’s failed management of Vine is certainly regretful. In addition, Twitter’s ad business, which is their main source of revenue, has been so ineffective that they haven’t received a single antitrust lawsuit from the US or EU governments. Perhaps this is why even former CEO Jack Dorsey recently lambasted the company’s board on Twitter, calling it “consistently…the dysfunction of the company”.

Musk might not be the right acquirer for Twitter, but this board certainly isn’t the right board for the company.

ARK’s Sky-High Tesla Price Target

ARK has come out with yet another shockingly bullish price target for Tesla. The investment firm predicts that Tesla’s stock price will be at $4,600 in 2026, with a bullish ceiling of $5,800 and a bearish floor of $2,900. They released an open-source financial model to reach this conclusion. The primary drivers of this super high price target are a skyrocketing number of cars sold (900,000 in 2021 to 17 million in 2026) and self-driving taxis. ARK predicts that revenue from car sales could reach $513 billion in 2026 from $46 billion today while revenue from self-driving taxis could reach $486 billion from $0 today.

Even though this price target seems astronomically high, the model is respectable and backed with high quality and in-depth analyses. However, it appears some of the model’s assumptions may be too optimistic. The primary concerns with the model's assumptions are two-fold: (1) whether Tesla will continue to dominate the EV market and (2) whether they will be first-to-market with self-driving taxis. It seems that with almost every major automaker embracing EVs and aggressively ramping up production, Tesla will become Yet Another EV Company. It’s hard to see Tesla going from selling 900,000 cars in 2021 to 17 million in 2026 in such a competitive landscape. In addition, Tesla seems to be very far behind GM’s Cruise and Google’s Waymo with self-driving cars. Tesla may have one of the best driver assistance softwares out there but having no driver onboard is a different story and a much much harder challenge. Tesla is heavily investing in driver assistance software, but have made zero inroads in driverless software. Cruise and Waymo, on the other hand, are already operating driverless cars on the streets of San Francisco and Phoenix, and feel confident enough in their technology to be actively working with local governments for favorable regulations.

It’s highly commendable that ARK has made their well-researched and in-depth Tesla financial model public, but we think that some of the assumptions are too optimistic. It’s hard to see Tesla resoundingly crush both the EV and self-driving taxis market by 2026, and the chances of Tesla middling or even falling behind the competition is non-trivial.

Crypto TLDR

Robinhood Buys Ziglu

Part of Robinhood’s growth strategy is to grow internationally, and it seems like the company is spearheading its international expansion strategy through crypto with the latest acquisition of London-based crypto platform Ziglu. Ziglu is regulated by the UK’s financial watchdog the Financial Conduct Authority (FCA) and is only the third firm to receive approval from the FCA to offer crypto services in the UK. Ziglu offers trading services for 11 cryptocurrencies as well and also allows users to earn yield on their crypto holdings. This latest acquisition signals that Robinhood is serious about its crypto business and will likely aggressively compete with Coinbase, and also that the company is ready to push for international expansion. FinanceTLDR is of the mind that it’d be best for both companies if Robinhood and Coinbase merged.

Indian Crypto Exchange Raises $135 million

Private equity frenzy in crypto has been a common theme across Weekly TLDR issues. This week, the headline fundraising news is that of Indian crypto exchange CoinDCX raising $135 million in a Series D funding round led by Pantera Capital and Steadview. This brings CoinDCX’s valuation to $2.15 billion. The round comes hot on the heels of a previous $90 million Series C that happened in August of last year, which valued the company at $1.1 billion. CoinDCX is now the highest valued crypto company in India and plans to significantly ramp up company size and accelerate product development. CoinDCX is one of many crypto exchange companies worldwide that have grown and flourished in their respective domestic markets. Most of them have raised massive war chests from private markets in the past couple years.

Louis Vuitton Releases NFTs

Louis Vuitton has launched free NFT rewards in their stand-alone mobile game Louis: The Game. The game, first launched in August 2021, brings players into a world where they can dress up an LV brand-inspired avatar and explore the world to collect postcards that teach the brand’s 200-year history. Players who collect enough free NFTs will have a chance to qualify for an NFT raffle that runs until August 4th.

LV’s incursion into NFTs is another signal in a broader trend of growing NFT interest among global luxury brands. For example, Gucci launched their SUPERGUCCI NFT collection just a couple months ago and is already planning their next NFT partnership with 10KTF to create a virtual floating “New Tokyo” world powered by a new NFT collection called Gucci Grail. It’s unclear where this burgeoning love for NFTs among luxury brands will head (they’re definitely seeing this as just an interesting experiment) but it’ll certainly set the tone for corporate adoption of NFTs moving forward.

Gucci’s CMO Robert Triefus had this to say about NFTs in a recent interview: “When it comes to NFTs, it’s going to require a lot more time to understand what they represent in terms of customer experience or value-add… But you’ve seen a significant number of brands within the sector saying, okay, we believe that NFTs have relevance, we’re not 100 percent sure yet what that relevance is but we’re going to pilot [this], we’re going to experiment and have some learnings and insights as a result.”