Weekly TLDR - The Bear (Market) Necessities

We talk about the gap between wage and inflation growth, all sorts of risk coming out of China, Russia banning Meta products, and very positive regulatory news for cryptocurrencies

The TLDR

In the first weekly TLDR since we have officially entered bear market territory, we talk about the gap between wage and inflation growth, all sorts of risk coming out of China, Russia banning Meta products, and very positive regulatory news for cryptocurrencies coming from both sides of the Atlantic.

Chart of the Week:

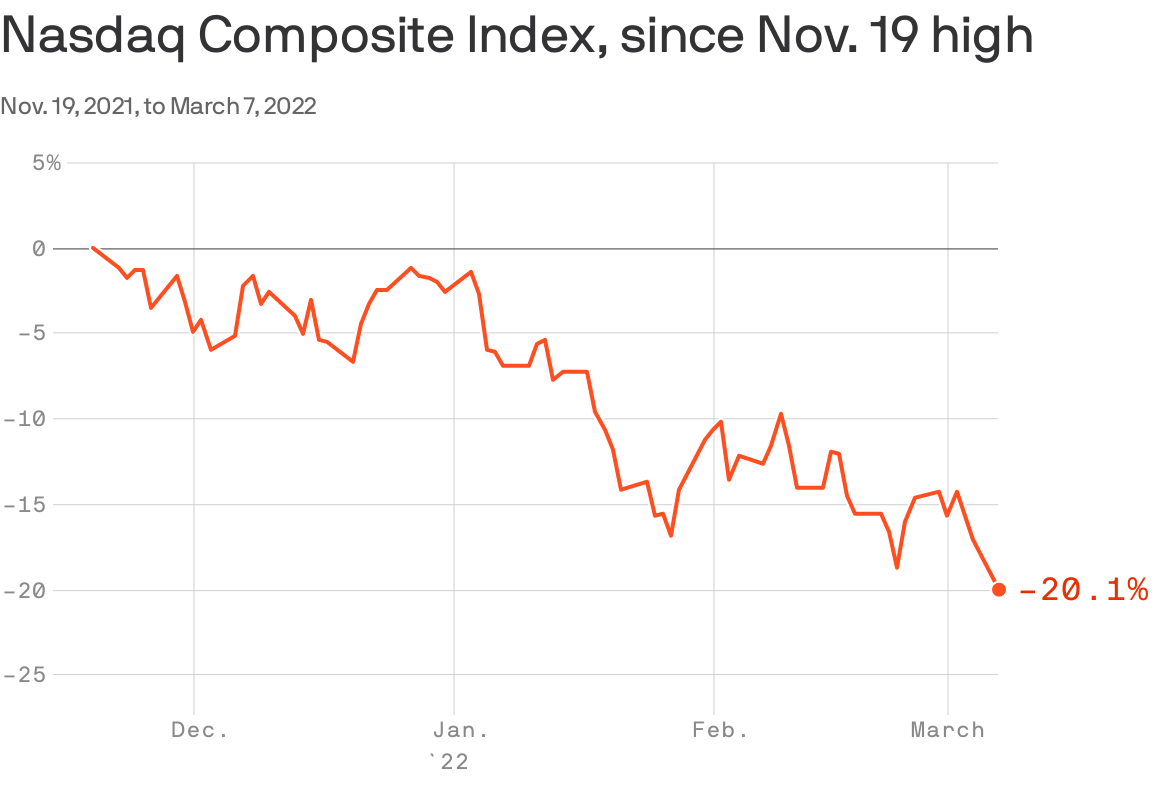

We are officially in bear market territory for the Nasdaq with the index down over 20% from the prior peaks. It’s a strange thought that it took a new Covid wave (Omicron), Fed rate tightening, high inflation (7.9%), and a war in Ukraine for the market to correct 20%. The story changes if you look at “high growth tech” with some stocks down 70% or more from peaks. If this is your first bear market, our advice to you is to not let your emotions get the best of you. Predetermine entry and exit points for your trades / holdings and keep to them. Adjust those points when major changes to your thesis come out but don’t trade on emotion. With the crazy volatility, the market has a way of playing on your emotions and leaving you holding the bag. Good luck out there!

Stock Market TLDR

7.9% inflation vs 5.8% wage growth. The most updated economic figures show a 2.1% gap between wage growth and inflation. If you have been paying attention at all to the recent headlines around oil prices and other commodities, you are likely also coming to the conclusion that inflation is going to get worse before it gets better. This puts wage growth and the job market in an interesting position. Will the growing price of necessities make the labor market less picky when it comes to jobs or will the trend of higher pay and more benefits continue? Our bet is that job wage growth will continue and that businesses will need workers even more with input prices increasing.

China’s long Covid. China has announced the lockdown of Shenzhen and travel restrictions from Shanghai, two of China’s biggest cities and hubs for technology and finance. The restrictions are due to surging Covid cases as China’s zero Covid policy and a less effective vaccine has led to a population with lower overall immunity. From a stock perspective, expect delays and limited supply for many electronics as Shanghai and Shenzhen, in particular, act as manufacturing, system integration, and shipping focal points for the entire electronics supply chain. Even Apple is being impacted so expect all other electronics providers to have it even worse.

China delisting. Bad news continues to rain for US listed Chinese companies. The SEC announced warnings to specific Chinese companies around satisfying audit requirements at the risk of being delisted. As we wrote earlier in the year, US-listed Chinese stocks have a murky ownership structure and have significant risk to any buyer. Funds from all across the world are finding this out in real-time right now as many investors treat these Chinese companies as “uninvestable”. Although Monday's drop in Chinese stocks looks bad, I imagine there are many slower moving funds that have still yet to exit their relatively large positions. For Chinese companies with dual-listings in both US and Chinese markets, it may represent an interesting arbitrage opportunity between both listings and the Chinese RMB vs US dollar. We expect the Chinese markets to be buyers of these companies while the US market to be sellers.

Russia ban on Meta. After not complying with Russian governmental requests, Meta (Facebook) is facing bans for Facebook and Instagram. We don’t expect Facebook to comply so it looks like the writing is on the wall for Russian influencers and users of Meta’s platforms. Russia accounts for roughly 1.5% of Meta’s advertising revenue or around $2 billion in total revenue so the impact is small but not negligible. More importantly, as Russia’s economy collapses and its geopolitical position deteriorates, it's going to be interesting to see what happens to politically motivated ad spend as we head further into the election year. Will the Russian disinformation campaign pump its brakes as it tackles problems closer to home? As Russia becomes the obvious bi-partisan antagonist for both Republicans and Democrats, will Facebook’s murky relationship with the Russian propaganda machine present regulatory risk? It takes the luster off of a beaten up stock for us for sure. In the smallest of silver linings, Whatsapp is not facing a ban despite being owned by Meta. We always wondered why Meta has not made Whatsapp more fully featured and maybe this is a reason why. I imagine not pushing users to Telegram and encrypted messaging is another reason why Russia is not banning Whatsapp.

Making EVs is hard. Rivian is finding that out the hard way as it cut its 2022 production forecast in half. Thinking back to the early days of Tesla, production delays and supply chain disruptions were common even though Elon pushed his team to the brink. This is probably a lesson to all investors for new EV concepts. Sell the news on production forecasts and orders before disappointing production ramps happen.

Crypto TLDR

Ethereum 2.0 is about to launch, and JPMorgan expects Eth2 staking to be a $40 billion industry. The Eth 2.0 launch date, known as Serenity, is slated for June 2022. If executed properly, this will be the largest ever upgrade for a blockchain. Ethereum will transition from a proof of work consensus algorithm to a proof of stake consensus algorithm, thus tremendously reducing its environmental impact and greatly rewarding existing Ethereum holders instead of GPU farm owners. Last year, JPMorgan published a report predicting the Eth 2.0 staking industry to reach $40 billion, with a staking yield of up to 12%. Currently, you can already stake Eth 2.0 on a “beacon chain” but with yields of only 4-5%. The uptick in yield is from all the transaction fees going from miners to Ethereum stakers. However, keep in mind that this tentative June 2022 upgrade date could easily be pushed back again.

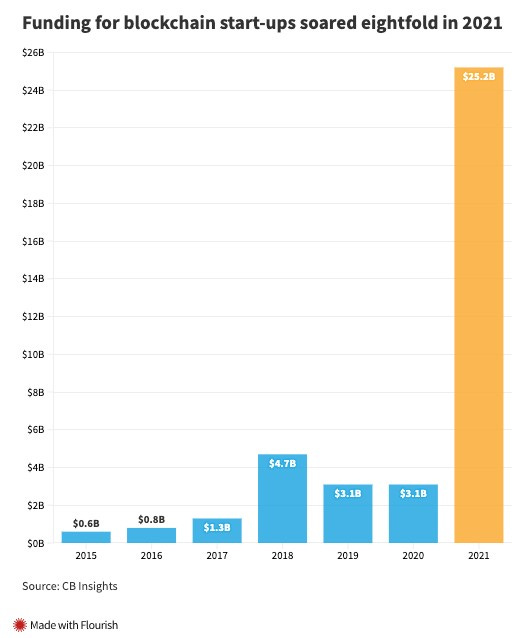

Yet another crypto startup, Consensys, concluded a massive fundraising round. Despite the shaky global markets, looks like the euphoria in crypto private equity isn’t done just quite yet. ConsenSys, a long time key player in the Ethereum developer infrastructure space (they own MetaMask and Infura), just concluded a fundraising round raising $450 million at a $7 billion valuation. This is double its valuation from a November 2021 fundraising round. In a very unconventional move, ConsenSys has also announced that it’ll convert all the proceeds from this round to Ether. Investors in the round include Microsoft, SoftBank, and Temasek (the Singaporean government’s venture arm). ConsenSys’s portfolio of blockchain infrastructure products powers the vast majority of Ethereum Web3 activity. MetaMask is the de facto wallet to interact with the Ethereum blockchain and Infura, with 430,000 developers, is one of the first Ethereum-node-as-an-API service providers out there and powers the backends of many Ethereum Web3 projects.

The EU government narrowly avoids banning Bitcoin. A European Union Parliament committee voted 31-4 on Monday to advance a crypto legislation called Markets in Crypto Assets (MiCA). This follows Biden’s signing of an executive order on crypto last week. The legislation initially contained draft language that could have banned proof-of-work blockchains like Bitcoin and Ethereum 1.0 on environmental impact concerns but this was removed prior to the vote. Ultimately, the EU agreed to a broader goal of including crypto mining in an EU framework for sustainable activities by 2025. The rest of the legislation isn’t much of a surprise for the crypto industry, containing reasonable legislation on topics like stablecoins, issuance of digital tokens, as well as transparency and supervision of crypto transactions. This is yet another formal recognition of cryptocurrencies by a major government. Read more about the MiCA legislation here.

Terraform CEO makes a huge $10 million public bet. Terraform Labs CEO Do Kwon just finalized a $10 million public bet with a crypto influencer known as GCR (Gigantic Rebirth) over the price of Terra (LUNA). The bet is based on the price of LUNA in one year’s time. Kwon is betting that LUNA’s price one year from now is higher than today’s price of $88 while GCR is betting against it. Both parties sent $10 million in stablecoins to an escrow account to substantialize the bet. This follows a smaller $1 million bet Kwon made with another crypto influencer with the same terms.

Crypto market unfazed by Biden executive order. Last week, Biden signed a highly anticipated executive order on cryptocurrencies. This was a formal recognition of cryptocurrencies by the US government and could’ve been great or very bad for the burgeoning industry. Fortunately, for the cryptocurrency industry, the executive order took a supportive stance and attempts to fix the lack of a regulatory framework in the US for cryptocurrencies. The lack of regulatory clarity has been a sore point for critics, analysts, and industry participants, and is widely considered to be a barrier to greater institutional adoption. This executive order marks a very positive starting point on the creation of reasonable, and even favorable, regulation around cryptocurrencies in the US. “[It’s] unequivocally bullish for the crypto ecosystem over all timeframes,” Travis Kling, CEO at Ikigai Asset Management, is quoted as saying to CNBC. “It’s easy to lose sight of how much ground this ecosystem has covered in the last two years in terms of legitimacy and stance from the US government, but this E.O. makes it clear the US government is not banning crypto, it is embracing it.”