Weekly TLDR - The Inflation Hot Potato!

In this week's TLDR, we talk about inflation as an export, Elon vs Twitter, Uber setting a bad example, and Coinbase rescuing Celsius.

The TLDR

In this week's TLDR, we talk about inflation as an export, Elon vs Twitter, Uber setting a bad example, and Coinbase rescuing Celsius.

Chart of the Week

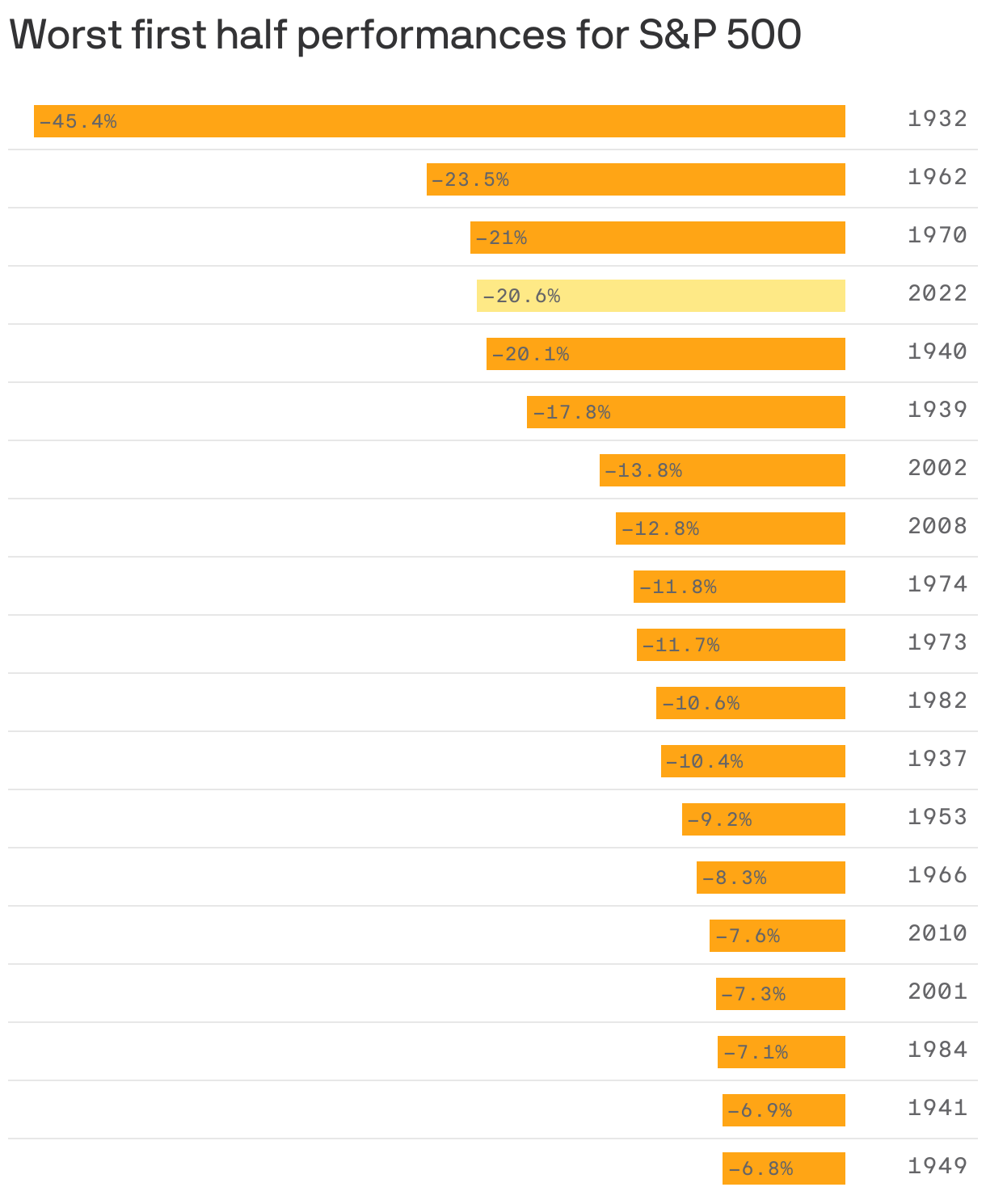

Investors everywhere will have a “back in my day” story as the S&P500 dipped 20.6% in the first half of 2022, its 4th largest first half drop in history. Tech investors are having a particularly rough time as high flying sectors have had their wings clipped while “boring” sectors like energy and utilities have outperformed. Hedge funds that were once mocked for severely underperforming the S&P500 in the low volatility environment of the last decade are now proving their worth with volatility up significantly in the past year.

Well… some of them at least.

Ray Dalio’s Bridgewater Associates saw a +32% return for the first half of 2022 and outperformed the S&P500 by 53%. On the other hand, Tiger Global, which optimized for an easy money, low volatility environment saw its $20.5 billion main fund get cut by more than half in the first five months of the year while its long-only stock fund fell 61.7%!

Stock Market TLDR

Exporting Inflation - AKA “It’s Your Problem Now”

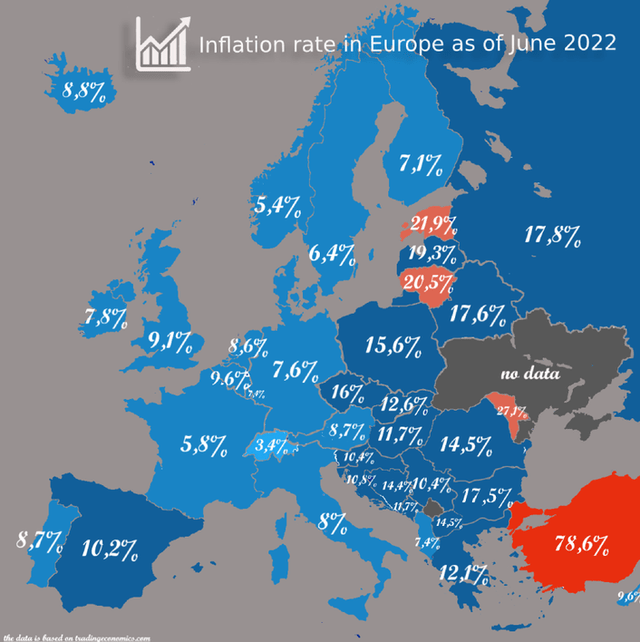

The Short: Domestic inflation in the US has forced the Federal Reserve to rapidly raise interest rates. This has left the European Central Bank (ECB) in the dust, unable to keep up with the rate hikes due to the risk of blowing up economically weaker countries in the EU like Italy. This has caused the Euro to fall precipitously against the Dollar, even hitting parity with it on Monday. This hasn’t happened since 2002. A weak Euro has worsened inflation in the Eurozone as import costs soar.

The Long: In a previous Weekly TLDR issue, we talked about the US exporting inflation to the rest of the world by being early with aggressive interest rate hikes. The EU is now suffering for it. All signs point to runaway inflation in Europe, but expectations of aggressive rate hikes by the ECB to counter inflation are muted. This is manifesting as a rapidly depreciating Euro, which is aggravating inflation even more as import costs soar. To make matters worse, Europe’s energy dependence and the conflict with Russia is causing energy prices to skyrocket, with natural gas in the Eurozone costing nine times more than natural gas in the US!

Talk about a perfect storm for inflation.

We’re also seeing little snippets of inflation export happening in the US between the states. California, for example, announced a $17 billion inflation relief package last month that includes giving stimulus checks up to $1,050 to 23 million Californians to help offset inflation. Although stimulus checks help families in need, handing out $17 billion at once in such a broad-based fashion is not ideal if you want to lower inflation. Besides, as we’ve mentioned before, US consumers in aggregate are still flush with cash, having entered 2022 with over $2 trillion in excess savings. By alleviating rising costs for Californians through stimulus checks, which have a side effect of stoking inflation, California is essentially exporting inflation to economically weaker states that can’t afford a similar amount of stimulus for their residents.

Elon vs. Twitter, Who Loses More

The Short: Elon is trying to back away from his bid to acquire Twitter for $44 billion. Twitter is suing Elon to uphold his end of the bargain. This multi-billion-dollar spat will result in both sides losing. The only question is, by how much?

The Long: Elon vs. Twitter is turning into an event-driven trader’s dream and a nightmare for everyone else. At best, Elon will be paying a $1 billion breakup fee and at worst, spending $44 billion to acquire Twitter. For Twitter, this acquisition drama is costing the company dearly and the bill grows larger every day it remains unresolved. Employee morale is likely at an all-time-low and many are probably leaving, resulting in a huge brain drain. Twitter’s management needs this episode to end as soon as possible and hopefully take $44 billion from Musk in the process.

For event-driven traders, there are so many interesting trades one could make. The market appears to be betting on some sort of concession from Elon to pay an additional breakup fee to get out of the deal. In this scenario, it’s likely Twitter’s stock has a long way down to go unless the breakup fee is something ridiculous like $10 billion. Another possible trade is to bet on when the situation will resolve. As long as things are in contention, there should be a decent floor for Twitter’s stock and a high demand for its put and call options. Selling put options with the expiration date before the date you expect this to resolve will net a significant amount of option premium. However, be warned that if things resolve before your options expire, the stock price could crash through your sold puts’s strike prices.

Uber Unethical

The Short: 124,000 Uber documents from 2013-2017 were leaked and reported on by The Guardian. The leaked documents highlight a slew of unethical and potentially illegal actions taken by the company during its hyper growth stage.

The Long: So much has been written about Uber’s unethical adventures when it was pursuing growth at all costs under former founder-CEO Travis Kalanick. From offering a different app experience for Apple employees to get around App Store rules to calling in and canceling rides at competitors to create driver churn, Uber has a long and storied history with aggressive and often questionable growth tactics. Given this track record, the new leaked documents are likely to reveal even more scandals and wild stories. Despite all the controversy, fines, and Kalanick stepping down, Uber is still the largest ride-sharing company in the world. An unfortunate takeaway here is that the cost of being unethical is much easier to digest if you end up succeeding because of it.

Crypto TLDR

Coinbase to the Rescue!

The Short: Coinbase appears to be bailing out beleaguered crypto lender Celsius by purchasing 410,513 stETH (worth over $400 million) from the company.

The Long: At the start of 2021, business for Celsius was booming as a result of a rapid market recovery from the pandemic bear market. The company’s recent success prompted cofounder David Leon to tweet a video that seemed to mock crypto-skeptic Warren Buffett. “Warren, Warren, Warren,” Leon began with a wry smile…

This high will last for quite a while. In August 2021, Celsius became the first crypto lender to cross $20 billion in assets under management. Unfortunately for David Leon and the rest of the company, Buffett would end up having the last laugh. The recent carnage in the crypto market has crippled the company. Celsius froze all customer deposits and withdrawals since early June, laid off a quarter of its workforce (150 employees) a couple weeks ago, and was recently sued by a former investment manager accusing the company of running a Ponzi scheme.

The embattled crypto lender is now in serious need of cash in order to fully meet its customers’s deposits. Thankfully, Coinbase has come to the rescue and bought over $400 million worth of stETH from Celsius. Although this purchase was not officially announced, a recent tweet from Coinbase Custody CEO Ryan Bozarth implied just as much.

1 stETH can be redeemed for 1 ETH.

stETH is already trading at a discount.

Opportunity to buy at an even bigger discount is an easy win.

Celsius is not out of the woods yet but an instant $400 million+ liquidity injection certainly helps with dodging insolvency.

Crypto Contagion

The Short: The collapse of crypto hedge fund Three Arrows Capital (3AC) is spreading like wildfire across the crypto ecosystem, with many crypto lenders and exchanges getting hit hard with hundreds of millions of dollars of unpaid outstanding loans.

The Long: Through the collapse of 3AC, of which the founders have seemingly disappeared, we learned that the hedge fund took out hundreds of millions of loans at high interest rates from any crypto exchange or lender willing to lend to them. Now, many of the firms that had exposure to 3AC are revealing the extent of the damage of 3AC’s unpaid loans.

One of the first victims to announce its exposure to 3AC is Canada-based crypto exchange Voyager, which recently filed for chapter 11 bankruptcy.

Popular US crypto lender BlockFi also suffered major losses from 3AC and was forced to take on a $400 million revolving credit facility from FTX while giving FTX the option to acquire the company at a depressed price of up to $240 million based on performance triggers.

Genesis, one of the largest crypto brokerages for institutional investors, also recently announced exposure to 3AC. The firm said it sold collateral and hedged its downside once the hedge fund failed to meet a margin call. It didn’t share the size of the loss

The most recent company to announce major exposure to the 3AC collapse is Blockchain.com, which is at risk of losing $270 million.

Crypto appears to be relearning lessons already learned by the “traditional” finance industry. Leverage is dangerous and excessive leverage is disastrous. Risk needs to be transparent and contained. The fact that there was no transparency on the total exposure of the crypto industry to 3AC when the hedge fund was leveraging up is worrisome and a sign of a need for regulation.