Weekly TLDR - To Kill a Twitterbird

This week, we talk about falling mortgage capacity and rising new home prices, Musk’s plans for Twitter, self-driving cars in China, and the US Department of Labor saying “not so fast!” to Fidelity.

The TLDR

This week, we talk about falling mortgage capacity and rising new home prices, Musk’s plans for Twitter, self-driving cars in China, and the US Department of Labor saying “not so fast!” to Fidelity.

Chart of the Week

Something has to give as the average price of a new home is now greater than what the average family can afford. If you look at the years preceding the 2008 real estate bubble, there was roughly 4 years of home price above mortgage capacity. In these years, to stretch the “good times”, lenders became increasingly aggressive in stretching affordability and offering prospective homebuyers credit that they ultimately could not afford. Something to keep an eye on in terms of upcoming real estate bubbles.

Stock Market TLDR

Musk’s Plan for Twitter - Cut Costs and Make More Money

In his pitch to banks to secure debt financing, Elon highlighted a few ways he expects to improve Twitter’s flagging financials. Cutting jobs and obtaining “efficiencies” was one major avenue while monetizing popular tweets or tweets that contain important information. A bigger subscription plan that includes verification programs as well as charging third parties to embed tweets are also on the table. Add that to combating bots, authenticating all users, and open sourcing their algorithms; it's clear that Musk has a lot of product improvements in mind. However, Twitter is not exactly known for shipping new features quickly so something has to give. My best bet is a year or two of turnover and churn at Twitter before Elon is able to really get down his wishlist of features. However, Twitter engagement is likely to remain high as Elon is quite good at producing headlines and interest.

China Lockdown Impacting Chip Supply Chain

We are heading into month 2 of lockdown for Shanghai, one of the world's largest cities. While it's certainly turning into a huge issue for citizens of Shanghai, we are starting to see the worldwide impact of China’s zero cases approach in a global economy. Recently, Apple just reported a $4-$8 Billion hit to its revenues due to supply constraints. That's roughly 4-8% to the largest customer any supplier will have. If even Apple is seeing a 4-8% hit, you can imagine other companies that source heavily from China will face even more challenges.

Nokia, Volvo, and Daimler have all reported chip shortages and Intel’s CEO has predicted that chip shortages will go away in 2024. It seems like the state of shortages is here to stay for the next couple of years.

EU Passes DSA Act, Advocates for Algorithm Transparency

In another round of sweeping regulations for tech companies to deal with, the EU is looking to provide more transparency around algorithms and other features that influence customer behaviour and use of data. Ad targeting based on religion, sexual orientation, and ethnicity will be banned. “Dark” UI patterns will be prohibited but I have no clue on how that will be enforced. Large platforms will have to reveal the secret sauce of its algorithms and recommendation engines. Funnily enough, I think TikTok will be the biggest loser here as its algorithm currently runs laps around anything besides maybe Youtube. No expected impact today but this could mean less ad revenue and less competitive advantages for companies like Meta and TikTok, who really juice user activity and monetization by playing into human habits and exploiting user data.

First Self Driving Taxi License Approved in China

Not to be outdone by the US, China has approved its first self-driving taxi service provided by start-up Pony.ai. It's just a trial license for now in a single city but Pony.ai is confident in expanding into new cities soon. Given the current tense situation around lockdowns, self-driving cars may get a fast lane to test and be deployed in China. Self-driving service providers may also get to train more robust decision making engines as driving in China is significantly more complicated than in the US due to the amount of pedestrians and cyclists on the road and how poorly drivers follow the rules.

Crypto TLDR

Not So Fast Fidelity

Just as we got bullish with Fidelity announcing plans to allow Bitcoin investments in their 401(k) plans, the US Department of Labor says, “not so fast!” Ali Khawar, acting assistant secretary of the Employee Benefits Security Administration, told the Wall Street Journal that they have “grace concerns with what Fidelity has done” and will discuss concerns with the company over its Bitcoin in 401(k) plans.

However, this likely won’t result in Fidelity cancelling its plans. Khawar says that the DOL’s “grave concerns” are mostly around Fidelity’s proposal to allow up to 20% of the assets in 401(k) accounts to be invested in Bitcoin, citing Bitcoin’s high volatility. Fidelity has already stated that this number is subject to change.

Although Bitcoin has indeed been historically volatile, given its unregulated origins and youth as an asset class, it has done very well in the pandemic-era market and is a top performing asset. In contrast, assets that are typically considered safe and stable have tumbled dramatically in the last few months. Take, for example, the popular long-term US Treasury Bond ETF TLT which has fallen almost 25% since December. Bitcoin’s volatility concerns, although valid, might be overblown. In addition, the best kind of retirement portfolios are those that are highly diversified and Bitcoin certainly is quite uncorrelated to equities and bonds.

Leading Blockchain Solana Down for 7 Hours

The classic trilemma for blockchain technology is that, given security, scalability, and decentralization, you can only choose two. With Bitcoin and Ethereum 1.0, security and decentralization are prioritized. However, as adoption increased, scalability became an issue as more and more people try to concurrently use scarce resources. This prompted the creation of many alternative cryptocurrencies that prioritized scalability over security and decentralization.

A hyper-focus on scalability is a key underpinning of Solana, which is currently a top-10 cryptocurrency by market cap. Solana is incredibly fast and cheap to use, but this comes at a cost. The blockchain has undergone multiple downtimes in the past year, with the most recent downtime lasting for 7 hours as a massive spike in traffic crashed the blockchain and prompted its small group of validator operators to shut down their services, regroup, apply an emergency patch to temporarily censor NFT applications, before turning on the blockchain again. If Solana wants to continue growing adoption, it certainly needs to figure out how to solve its DDoS issues and find a healthier balance between security, scalability, and decentralization.

$181 Million in Ethereum Fees Spent on New NFT Mint

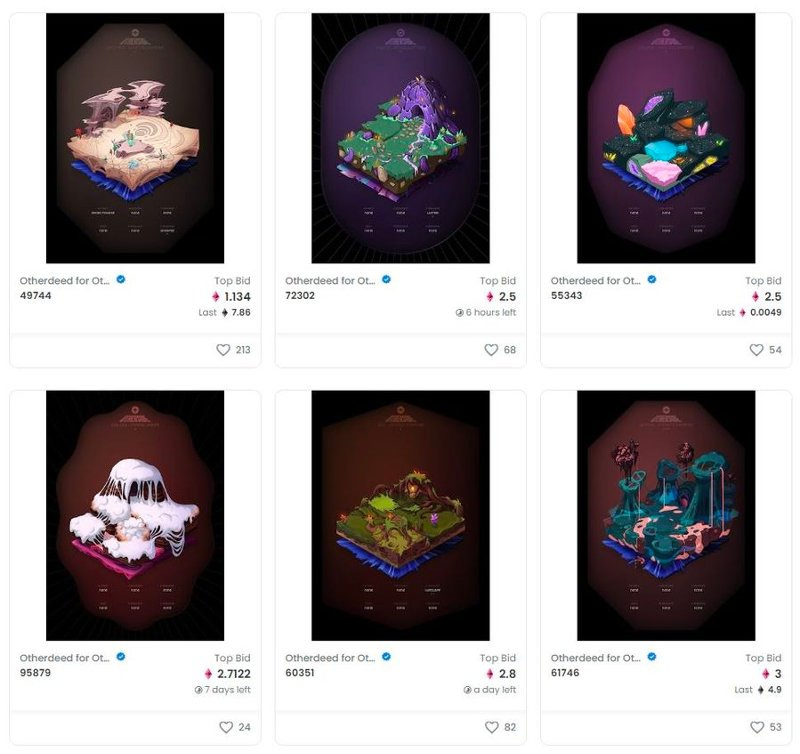

Yuga Labs, the developer of the top NFT collection Bored Ape Yacht Club and cryptocurrency ApeCoin, held a minting event over the weekend for a new NFT collection that will be used in their upcoming metaverse project called Otherside. The NFTs, called Otherdeeds, will represent plots of land.

There was tremendous demand for the 55,000 Otherdeed NFTs available to be minted. Ethereum network fees spiked massively and each mint cost buyers between $4,000 and $10,000. In total, $181 million was spent on network fees with Yuga Labs making $317 million from the event.

Not surprisingly, many users complained about the minting cost, with some pointing out that Yuga Lab’s smart contracts were painfully unoptimized. The company stated, in response to the high network fees, that they might migrate the Otherside metaverse project from Ethereum to a more scalable blockchain.

Warren Buffett Hates Crypto

Berkshire Hathaway’s annual shareholder’s meeting was held over the weekend. Buffett, staying true to his prior negative position on cryptocurrencies, gave some scathing remarks about Bitcoin. For example, he stated that he wouldn’t buy all the Bitcoin in the world for $25. Buffett’s reasoning is that Bitcoin doesn’t produce anything and was thus like “rat poison squared”. In contrast, companies that built things like Apple or Coca Cola, staples in Berkshire Hathaway’s portfolio, were constantly creating value and thus infinitely better than Bitcoin.

However, Buffett seems to be misvaluing the fundamental human need for security, transparency, and dependability. Bitcoin can meet these needs, financially, for many people. Whereas the US dollar can be printed in massive quantities on a whim by the Federal Reserve, which is what was done during the pandemic, Bitcoin’s total supply is fixed and transparent. While inflation is soaring in the world, hammering equities and bonds alike, Bitcoin has remained the top performing asset in the pandemic-era market. So perhaps the question is not whether Bitcoin is a productive asset or not, but whether human beings value security, transparency, and dependability, and how much is that worth exactly?