What Happened to the United States?

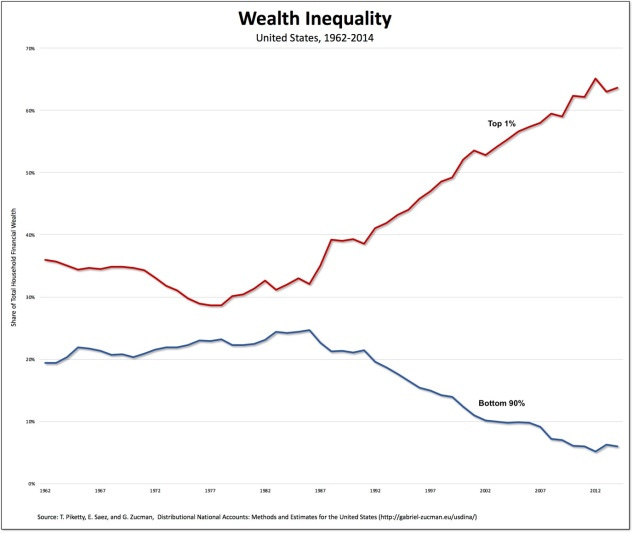

Economic inequality is at all-time-highs and rising. Everything is so expensive, yet incomes haven't risen to match. Let's explore how we got here to better understand where we're going.

Speaking specifically about the United States, though this is probably true for many Western first world nations, there’s a feeling of unease in the air. It’s a general sense of unrest, spurred by rising wealth inequality and an increasing difficulty for most Americans to achieve the vaunted American Dream. Asset prices have risen rapidly, while wages have barely kept up. There is a drought of high paying jobs in the US. Many Americans have resorted to debt and renting rather than owning to maintain the same lifestyle their parents had. These problems have all been exacerbated in the COVID economy that’s characterized by skyrocketing asset prices, job losses, and consumer goods inflation (hurts the poor and the middle class rather than the rich).

So what happened to the United States? When did this begin? Read on to find out…

The United States Dollar as the World Reserve Currency

During World War II, the United States, having vast natural resources and protected on both sides by two expansive oceans, was able to ramp up war production unhampered while the rest of the world shot and blew each other up without the same geographical protection afforded to the United States. As such, desperate Allied warring nations relied heavily on the United States for war production. This came at a heavy cost, usually in the form of the export of tons and tons of gold (Britain even gave the US the vast majority of its military and scientific patents via the Tizard Mission).

By the end of the war, the rest of the world was devastated while the North American continent was completely unscathed. Unsurprisingly, the US stood tall and strong in the world with a vast domestic production capacity, the majority of the world’s gold, and with the help of the Tizard Mission, was technologically ahead of everyone as well. The other victorious Allied nations suffered mostly pyrrhic victories while the Axis nations were utterly devastated.

As such, when it was time to create the new world order, the US wrote the terms and it enthusiastically pushed for a new era of globalisation with the United States Dollar (USD) as the world’s reserve currency, a status most recently held by the British Pound. Like the bitter quote spitefully uttered by fictional billionaire Bobby Axelrod to fictional US Attorney Chuck Rhoades in the TV drama Billions, “a boy never really becomes a man until he’s buried his father”.

In this new financial order, national currencies are pegged to the US dollar at a fixed exchange rate while national governments can convert USD to gold at a fixed exchange rate via the US government. In this arrangement, known as the Gold Standard, the USD would underpin global trade as the world’s reserve currency. This made sense, since the US had all the world’s gold, and with the world’s strongest military, could easily back and enforce the Gold Standard.

The Black Gold Standard

Unfortunately for the United States, this arrangement was more fragile than it seemed at its inception. In the ensuing decades, domestic and international pressures for liquidity to sustain world economic growth forced the United States to print more dollars than it had gold to back them. This slowly became apparent to the rest of the world which quickly took advantage of the arbitrage opportunity to convert the USD flooding the world for US gold. Many European nations, like France, enthusiastically pursued this arbitrage, likely seeing it as a way to repatriate their national gold lost through both world wars. The situation quickly became untenable, leading to US president Richard Nixon “temporarily” suspending the Gold Standard in 1971. This event would be known as the Nixon shock.

Without the Gold Standard, how did the US maintain the USD as the world reserve currency? It evidently did, given that to this day, the USD continues to hold this role.

The US pulled this off by making a series of pivotal agreements with newly oil-rich Middle Eastern nations, such as Saudi Arabia, wherein the US will prop up and protect these rich but fragile national governments with its military might, in exchange for them pricing their oil exclusively in USD.

Oil is aptly called black gold. The fast-growing and energy-hungry global economy is powered by it. With the withdrawal of the Gold Standard and the price of oil denoted in USD, the US deftly swapped the universally-desired asset backing the USD and created an international financial order of free floating currencies, not backed by a fixed supply of gold, but by a dynamic supply of black gold perfect for the needs of a fast-growing global economy. This new arrangement would be known as the petrodollar system (or as I like to call it, the Black Gold Standard).

Dutch Disease, Triffin’s Dilemma, and US Decline

As the FT described in an article in 2019, this new petrodollar system gave the United States a form of Dutch Disease. Coined by the The Economist magazine in 1977, Dutch Disease is used to describe a crisis that occurred in the Netherlands after the discovery of vast natural gas deposits in the North Sea in 1959. The newfound wealth from the massive exports of this natural gas caused the value of the Dutch guilder to rise sharply, making other Dutch exports, also denoted in the Dutch guilder, much more expensive and thus uncompetitive in international markets. Dutch unemployment subsequently rose from 1.1% to 5.1%. The Dutch Disease is now widely used in economic circles to describe the interesting phenomenon of how positive economic news, like discovering vast natural resources, can negatively impact a country’s social and economic fabric.

For the US and its new petrodollar system that solidified the USD as a world reserve currency by ensuring that every oil-powered economy would need to own it, the Dutch Disease manifested as an implicit but powerful demand for the US to export dollars via a structural trade deficit with the rest of the world.

Chart annotated by Lyn Alden

Put simply, if the USD was to thrive as a world reserve currency, it had to give the world lots of it, to ensure ample liquidity (i.e. availability and elasticity of the currency supply) required by fast economic growth. A liquidity crunch (i.e. lack of availability of dollars) could result in a painful global deleveraging that weakens global support for the USD as a reserve currency.

As such, the US exported lots and lots of dollars in exchange for cheap consumer goods from the rest of the world. This arrangement implicitly meant the gradual decline of US domestic production, which when the country came out of World War II, was massive and without an equal in the rest of the world. However, with a strong USD, similar to the strength of the Dutch guilder after the Netherlands discovered vast natural gas reserves, US domestic production would get priced out domestically and internationally.

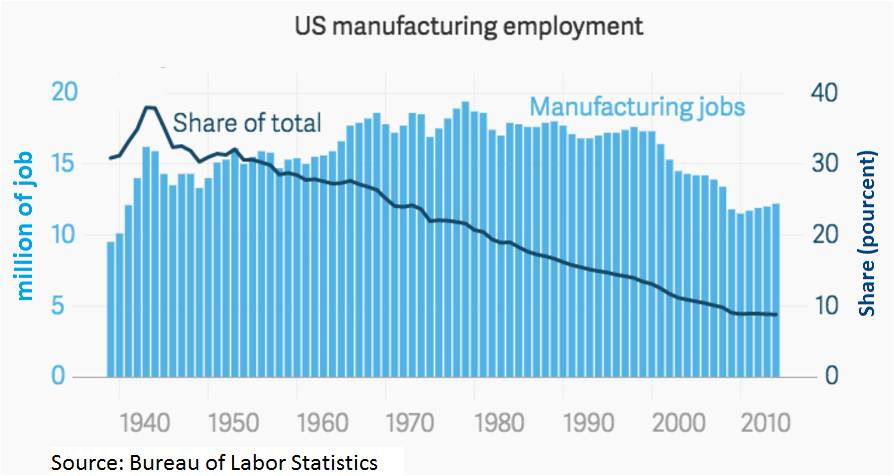

Naturally, this also meant the decline in high-paying US manufacturing jobs. The rest of the world, such as Japan and China, with cheap currencies and cheap labour, picked up the slack. As many Americans have been noticing over the past couple decades, go to Walmart or a clothing outlet and pick out any piece of merchandise. More likely than not, it’s manufactured in China or some other Asian nation.

Since the petrodollar system was put in place, the US turned from a manufacturing nation to a service nation, to the chagrin of its middle class. The new proliferation of service jobs couldn’t monetarily replace their lost manufacturing counterparts. Where American society could once easily support nuclear families with just one working adult, American families today need to have two working adults and lots of debt to maintain the same living standards.

Another side effect of rapidly exporting USD in exchange for cheap consumer goods is that foreigners, flush with dollars, have in turn entered US markets and bought productive assets from real estate to stocks. For example, according to a report by Juwai IQI, in the 10 years leading up to and including 2020, Chinese buyers have acquired close to $200 billion in American residential real estate. This figure doesn’t include office buildings and other types of productive American real estate.

US GDP is only 16% of global GDP, yet its stock market market cap is 43% of the global stock market market cap

One can see that this Dutch Disease is assaulting the American middle class on multiple fronts. Not only do Americans lose high-paying middle class jobs to the rest of the world, they’re also getting priced out by foreign investors that benefited from the export of said jobs. In exchange, Americans get cheap consumer goods and cheap debt, which are far from sufficient replacements for what was lost.

As a side note, on the other hand, the petrodollar system has been very good for American corporations due to access to cheap debt, higher prices for their equity, and the ability to relocate their production facilities worldwide.

Another term for this Dutch Disease is Triffin’s Dilemma. Identified by Belgian-American economist Robert Triffin in the 1960’s, Triffin’s Dilemma points out the conflict between domestic and international economic interests for countries with world reserve currencies. Said countries need to provide the world with an extra supply of its currency, leading to a trade deficit, which leads to declining domestic conditions. Alternatively, the country can prioritize its domestic economy at the cost of the international economy, breaking confidence in its national currency as a world reserve currency. An unfortunate double bind.

End Game

Prior to Triffin, famous economist John Maynard Keynes had anticipated the problems of a national currency serving as a world reserve currency and in 1940, proposed a supranational currency called the Bancor as a solution. Although the Bancor wasn’t implemented, the existing International Monetary Fund (IMF) Special Drawing Rights (SDR) system is the closest thing to it. The SDR is technically less of a currency and more of a unit of account for the IMF, giving the holder a claim to a variably-weighted basket of five top international currencies: USD, EUR, CNY, JPY, and GBP. As of August 5th, 2021, there are 660.7 billion SDRs in existence. Having existed since 1969, the SDR is nowhere close in adoption to becoming a world reserve currency.

The petrodollar system seems untenable, not only for the US domestically, but also internationally. In early 2009, in the midst of the global financial crisis, Zhou Xiaochuan, the Governor of the People’s Bank of China at the time, penned an essay blaming the concept of a national currency serving as a world reserve currency as a major cause of the crisis. He cited Triffin’s Dilemma.

“They may either fail to adequately meet the demand of a growing global economy for liquidity as they try to ease inflation pressures at home, or create excess liquidity in the global markets by overly stimulating domestic demand. The Triffin Dilemma, i.e., the issuing countries of reserve currencies cannot maintain the value of the reserve currencies while providing liquidity to the world, still exists.”

“The frequency and increasing intensity of financial crises following the collapse of the Bretton Woods system suggests the costs of such a system to the world may have exceeded its benefits. The price is becoming increasingly higher, not only for the users, but also for the issuers of the reserve currencies. Although crisis may not necessarily be an intended result of the issuing authorities, it is an inevitable outcome of the institutional flaws.”

However, there’s also considerable literature out there (e.g. “Triffin: Dilemma or Myth” by the Bank of International Settlements) supporting the longevity of the petrodollar system, often stating that the global financial system is complex and redundant enough to not be affected by the simple double bind of Triffin’s Dilemma.

Whatever your stance is for the US Dollar in the long run, the effects of the petrodollar system on the US is clear. The median quality of life and financial security of Americans have steadily declined since its introduction while wealth inequality has risen dramatically. The current feeling of unease in the air isn’t just a transient feeling, it’s borne of the very real and negative effects of the petrodollar system on the US domestic economy. To maintain the USD as world reserve currency and accrue its benefits, the US government has chosen the international over the domestic.

It’s currently unclear if there’s a threshold or breaking point for this system, where domestic policy is sacrificed enough resulting in severe social unrest and a re-evaluation of priorities. At the least, we have a better idea of how we got here.