What Happened With SNAP's Earnings (-26%)

SNAP ended the company's 2021 Q3 earnings down more than 26%. This is a deep dive into why.

SNAP gave its Q3 2021 earnings report on Thursday last week. The stock proceeded to fall by more than 26% from $75.12 to $55.72 at the close on Friday. Needless to say, this is a massive move for a company that had over a $100B in market cap prior to this report. Many media reports attributed this sharp decline to missed revenue expectations due to lower iOS advertising demand from Apple's new iPhone privacy changes and broader supply chain issues.

Snap plummets 22% after missing on revenue expectations

Snap Stock Craters 23% After Q3 Revenue Miss Despite Hitting 306 Million Users

However, SNAP only missed revenue expectations by a measly 2.2% ($1.061B vs $1.085). Does a 2.2% miss (about $24 million less in revenue) warrant a more than 26% drop in market cap (about $26 billion)? Probably not.

This is really why SNAP's earnings were so disappointing for investors.

A better explanation

Before we dive into why SNAP fell this earnings, we need to understand how it got here. SNAP has been a high flying stock in the past 2 years. In 2020, its price increased by almost 3x ($16.75 to $50.4), and up till last week's earnings report, its price increased by 82% ($41.27 to $75.11). Although SNAP has definitely benefited from the Federal Reserve's massive stock market reflation in reaction to COVID, the price inflection point really happened in Q3 2020 when a highly positive earnings report propelled the stock to $43.17 from $27.83. This report caused Wall Street to revalue SNAP at a 30 price to sales (P/S) ratio instead of the 17 P/S ratio prior to the report. Subsequent earnings reports have reaffirmed Wall Street's high expectations for SNAP and the stock has remained at a precipitous 30 P/S ratio for the past year.

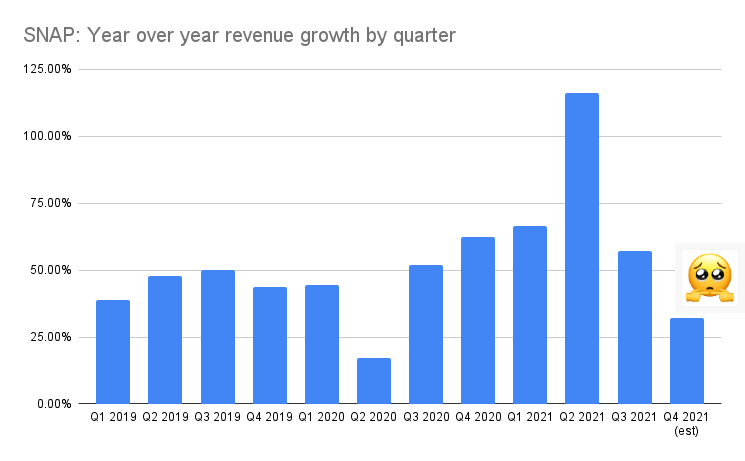

SNAP deserved these high expectations. Its revenue, along with other key business metrics, have grown at a much faster pace than before. From the average quarter over quarter revenue growth of 45.16% in 2019, SNAP had 3 quarters in 2020-2021 that saw more than 60% quarter over quarter growth. It was also touting a new Augmented Reality platform that's apparently experiencing fast technological improvements, user adoption, and advertiser adoption. Put together, no wonder Wall Street is excited at SNAP's potential.

Back to the recent earnings report. Although it's true that SNAP missed revenue expectations for Q3 2021, it only missed by a measly 2.2%. The company blamed this on Apple's new iPhone privacy changes that made it harder for advertisers to target iPhone users, as well as supply chain issues reducing overall ad spend demand. However, a 2.2% revenue miss doesn't warrant a 26% drop in market cap. The major missing piece of the story is SNAP's Q4 revenue guidance that it provided as part of the earnings report. SNAP expects revenue in Q4 to be $1.205 billion, which is only 32.27% higher than Q4 2020's revenue. That's a significant decrease from the 60%+ year-over-year growth that Wall Street has come to expect. This is likely because the company expects further advertising impact from the iOS privacy changes. These changes are also diverting significant investment away from user and monetization growth as the company focuses on developing customized ad tracking solutions.

SNAP expects revenue in Q4 to be $1.205 billion, which is only 32.27% higher than Q4 2020's revenue. That's a significant decrease from the 60%+ year-over-year growth that Wall Street has come to expect.

A precipitous valuation at 30 P/S combined with a sudden and large drop in expected growth clipped SNAP's wings. However, despite the fall, SNAP is still valued significantly higher than where it was prior to Q3 2020. At $55, it has a 25 P/S ratio, which is still 47% higher than the 17 P/S ratio it stayed at for the first half of 2020.

Looking forward

To go back to its prior highs, SNAP needs to show that the iOS advertising decline is just a short term speed hump by restoring iOS advertising demand via alternative user tracking solutions. This should be the company's primary focus in Q4 2021. The first two earnings reports in 2022 will determine whether it's successful in this endeavor.

Besides the advertising speed hump, the company's other metrics continue to push up nicely. User growth remains strong (beat expectations: 306 million vs 301.8 million) and profits are steadily growing (beat expectations: $0.17 earnings per share vs $0.08).

Nevertheless, I think it's unlikely for SNAP to reach its prior highs in this quarter barring any unexpected positive news of advertisers returning to iOS. As I mentioned above, the next few earnings reports will be pivotal in determining whether SNAP can resume its 30 P/S valuation.