Is Meta (Facebook) a Rare Opportunity?

Meta lost almost a quarter trillion dollars in market cap after its Q4 2021 earnings call. What caused the market to react this way, and is this an overreaction and a fantastic buying opportunity?

Meta (formerly Facebook) had its Q4 2021 earnings call last Wednesday and the stock fell more than 20% after hours, from $323 per share to $252. This amounts to a market cap loss of more than $230 billion. To put this in perspective, $230 billion is 18% greater than the market cap of McDonald’s. A colossal loss. What in the Q4 earnings report caused the market to react this way, and was this an overreaction that has opened a fantastic buying opportunity?

Read on to find out.

TLDR:

Meta’s stock crashed in part because of a weak revenue growth forecast for Q1 2022 (a broad range of 3-11%, when analysts were expecting 15% growth)

This broad and low range suggests the company is uncertain and pessimistic, primarily because of the new iOS data privacy changes released by Apple last year that affects Meta’s ad targeting

Other negative factors include: slowing user growth, domestic and international regulatory headwinds, uncertainty about metaverse investments, and PR troubles

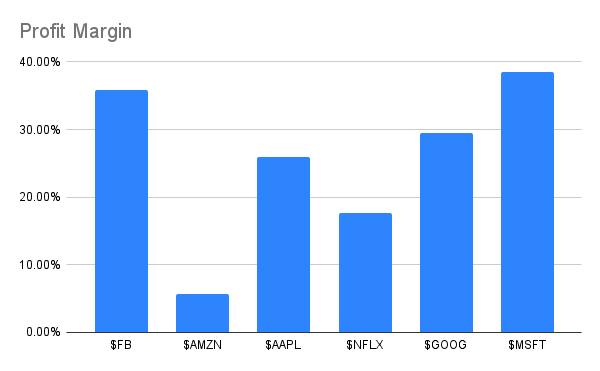

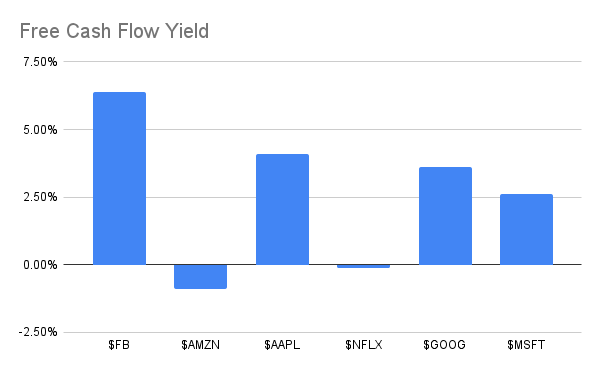

Meta could be a very good deal right now. Still a super high margin, super high free cash flow company. It has the best profit margin and free cash flow yield among its mega cap tech peers

Investments in metaverse products, especially in VR, are very exciting and compelling. The next Oculus headset could revolutionize the VR experience. Completely novel products and experiences are hard to project and price in. Naturally, Wall Street analysts bias towards caution, underpricing VR’s potential

Snapchat and TikTok thriving (in their respective niches) is good for Meta, as they make it harder for regulators to make a social media antitrust case against Meta

Let’s cut to the chase. Meta’s fourth quarter earnings was likely a big disappointment for Wall Street because of one key factor:

Apple’s iOS data privacy changes hurting short-term ad revenue growth. This became starkly clear when Meta’s Q1 2022 revenue guidance was a broad range of 3-11% (analysts were expecting 15% growth). Grounding the range at 3% shows that Meta’s execs are deeply worried about iOS’s changes. This guidance comes at a time when the company grew revenue by a whopping 37% in 2021. A 3% growth guidance in Q1 shows that the company is worried the party is over.

This underwhelming Q1 2022 guidance adds to an already negative backdrop. Here’s a quick list of the challenges Meta is facing:

Slowing user growth: Meta’s user growth is slowing because its family of apps have saturated their respective markets, especially in North America and Europe. Furthermore, competition for attention from other social media and entertainment apps like Snapchat, TikTok, and YouTube has been on a steep rise. In fact, this is the first quarter in history that Facebook’s daily active users fell quarter-over-quarter, from 1.93B in Q3 to 1.92B in Q4 (overall daily active users still increased slightly quarter-over-quarter)

Domestic and international regulatory headwinds: In the United States, Meta is facing an ongoing antitrust lawsuit from the Federal Trade Commission. In Europe, possible new data transfer legislation has prompted the company to suggest that it won’t be able to offer Facebook and Instagram in the Eurozone if the legislation passes

Uncertainty about metaverse investments: Meta has significantly ramped up research and development costs for its metaverse efforts and Wall Street analysts are unsure of how to project and price in this new line of business. One year ago, metaverse wasn’t even in Wall Street’s lexicon.

Negative PR: Meta has faced wave after wave of bad press in the past few years. The company is constantly chastised by traditional media for a melange of issues including data privacy concerns and their apps’s effects on mental health. These PR problems were especially thorny in 2021, with the company facing a massive user data hack in April, a high profile leak of internal research papers by a whistleblower in October, and an hours-long outage in its services from a technical glitch in the same month

With this negative backdrop, it’s no wonder Wall Street is easily spooked by any semblance of bad news from the earnings call, especially when results didn’t blow expectations out of the water (-4.03% on EPS, because of heavy metaverse investments and +0.69% on revenue).

With the negatives out of the way, let’s discuss why the stock’s recent violent drawdown that wiped away more than a quarter of the company’s market cap is an overreaction for an otherwise solid and high potential business. In other words, Meta’s stock at its current price appears to be a fantastic buying opportunity.

The Upside

We know that Meta’s primary business model is advertisement. It has a massive user base (everyone is either on Instagram or Facebook) and knows its users incredibly well, allowing it to create a highly effective advertisement engine that’s sucking up the lion’s share of corporate advertising budgets (no wonder traditional media outlets that earn most of their revenue from advertising are hounding Meta left, right, and center).

This has enabled Meta to become a high margin and high free cash flow business. In fact, among its FAANG + Microsoft peers, Meta has the second highest profit margin and free cash flow yield. In other words, the company is a very efficient money printer.

Based on these metrics alone, and if not for the negative factors outlined above, Meta’s current stock price is a steal. What gets the stock out of its rut is the reversal of one or more of the issues miring the company. I think this is likely to be the case in the near-to-medium term.

Metaverse Is Hard to Value, Thus Undervalued

I will on focus VR as it’s Meta’s most fleshed out metaverse product. Meta is the industry leader for VR and it’s Oculus Quest 2 headset is arguably the most accessible, cheapest, and easy-to-use VR headset out there.

The Quest 2 comes at half the price of a typical smartphone, is a standalone device that doesn’t require a hefty PC video card, and comes with a pair of spatially tracked controllers that immediately let’s you interact with the virtual world with your two hands. These accolades have enabled Quest 2 to become a hardware sales success, with Qualcomm CEO Cristiano Amon claiming in November that Meta has sold 10 million Quest 2 headsets since its release in October 2020.

However, despite the positive qualities, there are still clear impediments for its widespread adoption. The top three problems are its bulkiness, weight, and low resolution. If Meta can reduce the form factor and weight of the Quest 2 headset while drastically increasing resolution, it will create a game changing experience. Just imagine what people would do with a slim and lightweight VR headset with lifelike resolution (retina resolution).

If Meta pulls it off, it’ll create a completely new, highly immersive and addicting experience that people (especially Wall Street analysts) find hard to imagine solely because of its novelty. And best of all, Meta will own the platform, the app store, and the developers. Apple can’t change data privacy rules at Meta’s expense in this space.

Meta is already hard at work funneling billions of dollars towards this vision, and it’s getting close. Late last year, the company teased a pro version of the Quest 2 headset that looks lighter, smaller, and more comfortable to wear. We don’t know what its resolution will be but I wouldn’t be surprised if it’s close or at retina resolution.

Free Cash Flow

One of the perks of a high margin and high free cash flow business with billions in revenue is the availability of cash to deploy to whatever the company sees fit. This could be used to fix ongoing problems (e.g. in-app solutions to circumvent Apple iOS data privacy changes), stave off encroaching competition (e.g. investment in Reels to compete with TikTok), grow exciting new business lines (e.g. metaverse), or simply buy back stock.

Meta certainly has many problems plaguing the business but fortunately, it has more than enough firepower to defend itself.

Snapchat and TikTok are good for Meta

This might be a surprising take, given that the rise of Snapchat and TikTok are eating into Meta’s user base and engagement metrics, but the more Snapchat and TikTok thrives, the harder it is to build an antitrust case against Meta.

The best antitrust case that regulators can throw at Meta alleges that it’s cornering the social media market and crushing competitors. The best argument against this case is counterexamples of thriving multibillion dollar social media businesses not owned by Meta.

The risk of a fast growing Snapchat or TikTok is that they could draw younger demographics away from Instagram. It’s hard to see this happening. Snapchat remains a niche image-based messaging app while TikTok is more of an entertainment platform competitor (YouTube/Netflix/Twitch competitor) rather than a social media competitor.

Meta still maintains a solid grip and wide moat on general-purpose social media platforms. As far as an antitrust case is concerned, the thriving of niche social media platforms like Snapchat (SNAP up 40% after its Q4 2021 earnings call) and TikTok is just what Meta needs.

The worst has been priced in

Dare I say that after more than a 25% fall in stock price amounting to more than $230 billion in market cap wiped out on the best FAANG company by profit margin and free cash flow yield, Meta’s worst case scenario has been priced in? Meta’s current 16.3 PE (Price to Earnings) ratio is two thirds that of the next lowest PE ratio among the FAANG (Alphabet at 24.76). It’s incredibly cheap.

The bright side of worst cases being priced in is that any positive news will quickly buoy the stock and there’s certainly a high chance of subsequent positive news for Meta. For one, Meta could be overly pessimistic with its own Q1 2022 guidance due to uncertainty (hence the wide range of 3-11% revenue growth). We could see a sizable price rebound If Meta scores at the upper end of this guidance, or even beats it, when the company reports Q1 results 3 months from now. In addition, Meta’s heavy and growing R&D investment in 2021 will start to bear fruit in 2022, not only with the launch of its next generation Oculus Quest headset, but also with investments in existing high-growth products like Instagram Reels.

Fin

Meta might have taken a colossal short term hit after its recent earnings call but don’t count the stock out yet. It had a rough 2021 in terms of PR, continues to experience regulatory headwinds, and is now facing ad-targeting challenges with Apple’s data privacy changes on iOS. There are certainly many concerning aspects of the stock, but there are also many less appreciated potential upsides that can easily reverse its misfortunes.

Having shed about a quarter trillion in market cap since the earnings call, at a 16.33 PE ratio with a 35.88% profit margin and a 6.4% free cash flow yield, Meta’s stock is a rare and wonderful deal in this fickle market.