Buyer Beware on Chinese Stocks

Reasons why you should leave Chinese stocks in the bargain bin in 2022

Bargain hunting can be a lucrative adventure for investors. Markets often overreact and create buying opportunities for investors who can identify quality companies that have seen large declines in their stock price. One of the hardest hit sectors in the past year are Chinese companies listed on US exchanges with performances like Alibaba (BABA -48% year-over-year) and Baidu (BIDU -38% YoY) trailing the S&P 500 (+20%YoY) by a huge margin. Are Chinese stocks a huge bargain as we look forward to 2022? We don’t think so.

The Case Against Chinese Stocks

When we look at the major bull thesis for Chinese stocks, we see the case for lower valuations due to the stock price pull back, the case for mean reversion if/when the bad news train on Chinese stocks stop, and the case for strong GDP (8%+) growth projections from the Chinese government. Seems like a slam dunk scenario right? Not so fast! We see major risks to all of the major bull thesis and why you are better off avoiding Chinese stocks in 2022.

The Bad News Will Continue

Chinese Regulatory Action

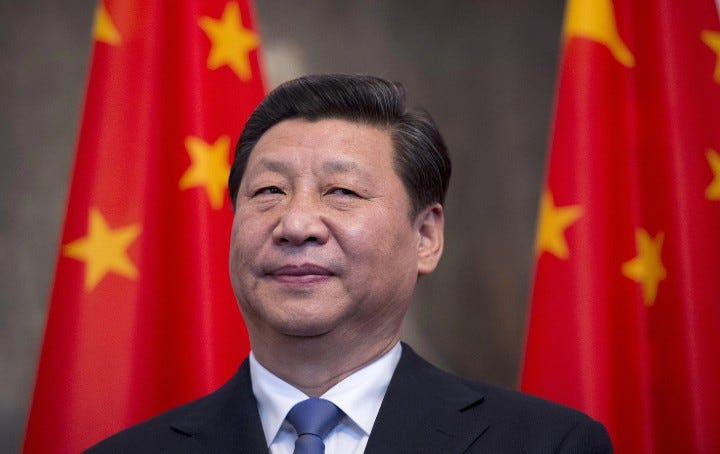

Operating in China means the government will always be your most important stakeholder, a lesson Jack Ma and other Chinese CEOs have been re-educated on in 2021. Looking at recent regulatory actions around having the Evergrande CEO personally guarantee company debt, breaking apart the Tencent empire, “disappearing” Alibaba CEO Jack Ma, and forcing DiDi to delist from US markets, it’s clear the Chinese government is looking to put what they perceive as the needs of the people and the country ahead the needs of companies and investors, reversing the relatively long period letting the free market take its course.

Controlling the wealth disparity between the hyper rich and regular citizens is going to be a major focus for the Chinese government, which will result in a less friendly business environment for the foreseeable future. This will be a negative for all Chinese companies and and their domestic growth prospects as companies weigh their traditionally aggressive growth initiatives against the risk of regulatory disapproval.

Delisting Pressure

As a US-based investor, investing in China generally means investing in US-listed Chinese companies. As we have written before, the ownership structure is very murky, and that murkiness is made worse from increasing pressure for US-listed Chinese companies to delist from US exchanges. The Chinese government has aspirations to boost the profile of its domestic stock exchanges (Hong Kong Stock Exchange or Shanghai Stock Exchange) to keep capital investments within China. For instance:

The recently IPO’d DiDi, an Uber equivalent in China - its shares are down 60% YTD in 2021.

Alibaba (BABA) also had pressure from the Chinese government to list on the Hong Kong exchange

The Alibaba subsidiary, Ant Financial (Chinese Paypal) has all but removed a US listing as a possibility.

We see this as a macro trend of fewer Chinese companies listing in the US as well as pressures for already US-listed Chinese companies to delist. With uncertainties around what US investors actually own when a Chinese company delists, investors will face questions around the long-term viability of investing in US-listed Chinese companies at all.

2022 Reelection, Olympics, and Geopolitical Risk

Foreign policy is always a topic of discussion in US politics and particularly during reelection cycles. Every politician will want to be seen as “tough” against foreign competitors, and no country is seen as more of a competitor to the US than China. The 2020 reelection cycle threatened a TikTok ban as well as potential bans on Chinese telecom/server equipment providers.

Looking forward to the 2022 reelection cycle, I expect Chinese internet companies, Chinese semiconductor supply chain, rare earth metal providers, and other Chinese companies to be targets of negative headlines. This is a risk to US-listed Chinese companies as they will be caught in the middle of some serious geopolitical sword fighting.

Additionally, with China hosting the 2022 Olympics, we are already seeing political posturing with countries like the US and Australia talking about boycotting the Olympics due to human rights issues. The Chinese government typically responds in kind with political and economic reactions that could escalate to threatening a full blown trade war like in 2020. I would also watch out for US companies with large Chinese sales footprints (e.g. Apple, Tesla) if tensions rise to a potential trade war.

Valuations Need to Discount Poor International Growth Prospects

Anti-China sentiment isn’t exclusively a US political phenomenon. Stronger anti-China sentiment can be seen in major international markets like India and much of Southeast Asia. Chinese companies have historically found it tough to expand to already developed markets in North America and Europe and instead rely on less developed regions for international expansion. In 2020, India banned many Chinese tech companies from operating in the country after border skirmishes, and Chinese companies have been facing many challenges operating in Southeast Asia despite significant investment.

Great examples include:

DiDi’s poor performance in Southeast Asia vs local competitors like Grab and Gojek,

Alibaba’s struggle to gain e-commerce traction, and

Tencent’s straggling market share with its WeChat messaging app.

If the Chinese domestic market is facing slowing growth for Chinese companies, international expansion will become increasingly important, and challenges expanding into India and Southeast Asia puts a significant damper on the markets Chinese companies can expand into for growth.

Chinese GDP Targets Look Aggressive

Recent weakness in the Chinese real-estate sector (Evergrande & Shimao) highlights potential continued risk in real estate and highlights the highly levered business environment for Chinese companies. High leverage creates a more fragile economy as growth needs to be high to support the capital structures of many Chinese firms. GDP growth also has to be balanced with the governments intent to reduce a growing wealth disparity between the hyper-rich and the poor. This is particularly pertinent as the Chinese economy continues to struggle with city shutdowns and labor shortages from Omicron and any future potential COVID variants. With a currency soft-pegged to the US dollar, China has fewer tools in their monetary policy toolkit when compared to the US Federal Reserve and also have to respond to US monetary policy changes. It may all start crumbling down if fast GDP (8%+ targeted for 2022) growth doesn’t return for the Chinese economy this year.

Buyer Beware

While the dip in Chinese stocks may seem alluring, major hurdles exist for Chinese stocks. A continued bad news cycle, lower international expansion opportunities, and weak economic growth drive why we don’t anticipate a rebound in stock prices in 2022. Most of these issues are complicated and unlikely to be resolved in 2022. I wouldn’t be surprised if we will still be talking about US-China tensions, trade-wars etc. in 2032. Buyer beware and leave Chinese stocks in the bargain bin in 2022.