Interest Rates Must Fall

Despite significant economic and political volatility recently, I think interest rates must fall.

I am back!

Apologies for another pause in writing recently. I have been busy in the last month making a big move across the continent (back to San Francisco, from Toronto) and acclimating to a new apartment and a new job.

The good news is that things are going well. I’m loving the new job and my apartment is (mostly) fully furnished.

The apartment looked like this a month ago…

And now it looks like this!

I’ve been guilt-ridden for the hiatus from FinanceTLDR and the itch to publish grows more intense by the day.

Today feels like the right time to restart. As a matter of perfect, it’s about time!

Before I dive into the financial markets, one more piece of important housekeeping. Given that I’m a Canadian on a work visa in the US, I probably shouldn’t be charging for FinanceTLDR so I’m going to convert the newsletter to a fully free newsletter once again.

I will continue to put the same effort into the writing and research, because I simply love it, and I am immensely grateful for everyone that has financially supported the newsletter over the past few months.

Without further ado, let’s talk about Matters of Big Money.

The market has been dominated by two big narratives lately: political turmoil (Biden stepping down, Harris stepping up, conflict in the Middle East and Eastern Europe, Trump almost getting shot) and how fast interest rates will fall.

Both are incredibly volatile narratives and the market of the past few months has been bipolar.

My modus operandi has been to ignore the political noise and focus on a thesis that interest rates must fall, and fall soon.

Last week’s Federal Reserve meeting was a big validation of this strategy: the Fed cut interest rates by 50 basis points (huge!) and signaled that they want to cut another 50 basis points by the end of the year.

A 50-basis-point sized cut is unusual since the “normal” rate of adjusting interest rates is 25 basis points at a time. Anything larger than that and it signals an urgency from the Fed.

So why is the Fed in a rush to cut interest rates? What are they seeing but not saying?

The market is currently obsessed with reading into the Fed’s motivations.

There are two ways to interpret this unexpectedly large interest rate cut:

1. The economy is in trouble

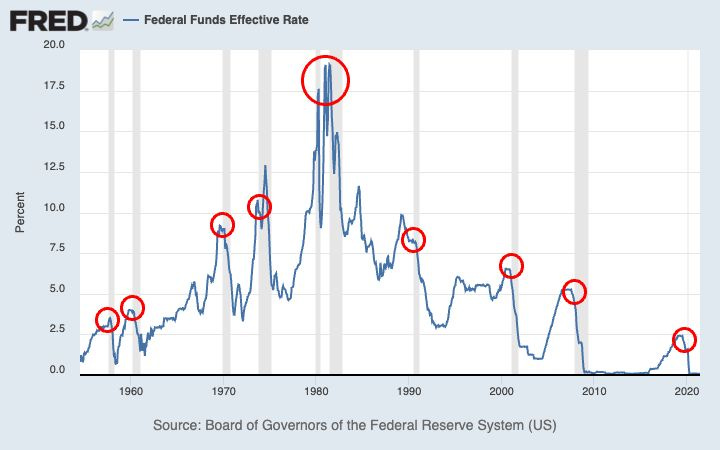

The last two times the Fed opened a rate cut cycle with a 50-basis-point rate cut, the economy was 3-4 months away from a massive downturn (i.e. 2001 and 2007).

Extrapolating from this trend, did the Fed see serious trouble ahead to compel them to rush rate cuts?

In addition, if you zoom out even more, almost every rate cut cycle in the past few decades started right before or right at the start of an official recession.

Rate cuts should be a good thing for the economy, so why are they so often tied to economic downturns?

Well, the effects of a rate cut on the economy are delayed by many months, around a year or more, and it’s almost a self-fulfilling prophecy that the two will be paired together since the first thing the Fed does to front run and support a dangerously teetering economy is to cut interest rates.

Second, rate cuts can cause immediate second order effects that hurt the stock market.

For example, when interest rates fall, call option prices fall and put option prices rise. This results in the net-selling of stocks by options market makers.

Another example is the ending of currency carry trades (short non-US currency, buy US dollar, long US stocks) as the value of non-US currencies rise. We saw this recently when the Bank of Japan raised Japanese interest rates. This put significant pressure on Japan→US carry trades and caused a steep sell-off in the US stock market.

2. The business cycle is about to boom again

The other narrative, which is simpler, is that falling interest rates is good for stocks since it’s easy for companies to borrow money when interest rates are low.

Falling interest rates also immediately make high-growth companies more valuable (since future dollars become more valuable).

What do I think?

It’s hard to say where the economy is headed. We don’t have access to the same amount of information as the Fed.

So my market strategy is to not over-index on what the Fed knows but isn’t saying. I’m strictly focused on the direct impact of falling interest rates on economic sectors that are highly sensitive to interest rates.

One example is the real estate industry. This industry is disproportionately driven by interest rates and falling interest rates is directly beneficial for real estate.

This is why I established a significant long position on Zillow a couple months ago in anticipation of falling interest rates and this position has been doing very well as of late.

Where’s the market headed?

The Presidential election is coming up in two months and I think the US government will work hard to keep markets stable and interest rates falling until then.

As such, I feel comfortable maintaining this long position in real estate and will likely re-evaluate after the election.

Fin

I’ll keep this issue short and sweet since I’m not fully caught up with the details of what’s going on in markets and only have a high level perspective in mind.

I hope to do deeper dives on markets in future issues as I catch up. Very glad to have more time to research and write about markets again.

Glad to see you back and in the Bay Area—let’s catch up sometime soon as you get settled!

Good thoughts here, and congrats on the move and new job! As for the 50bps cut, I tend to think 2001 and 2007 are more outliers here. The markets and the economy are very different and much stronger today than what was happening during those instances.