Market Pulse: Saving On Used Cars

Discussing last week’s CPI report, a quick macro overview, and investment updates from Buffett and Druckenmiller.

In this issue, I write about last week’s CPI report, a quick macro overview, and investment updates from Warren Buffett and Stanley Drunkenmiller.

🥶 April CPI: Saving On Used Cars

TLDR: the April CPI report came in cool. However, a lot of this coolness is caused by steeply falling Used Car prices while Energy remains hot. Nevertheless, a falling topline number gives the Federal Reserve much needed cover to loosen monetary policy, which it sorely needs to do.

In a big win for the Federal Reserve, April’s CPI report came in exactly in line with expectations, instead of being hotter-than-expected.

This was the first CPI reading in the past 4 months that came in line with expectations, rather than being hotter-than-expected.

Falling inflation means the Federal Reserve can ease monetary policy (i.e. slow quantitative tightening, lower interest rates).

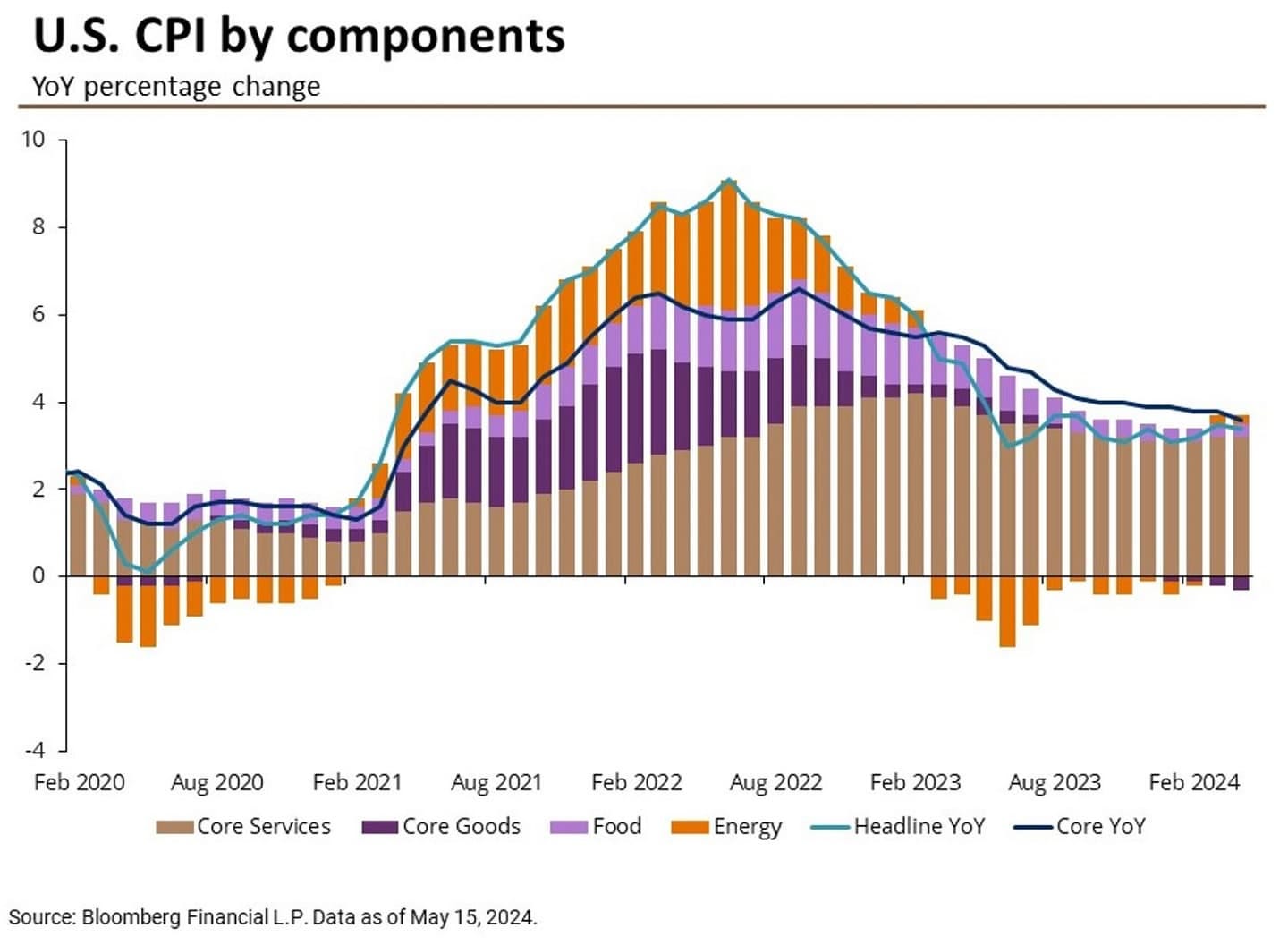

Here are two important views of this CPI report that explains this cool inflation reading.

(1) You can see here that the “Used Cars and Trucks” category is really pulling the overall number down, while almost everything else continues to grow.

(2) Here’s another view of CPI. You can see that Core Goods (which Used Cars and Trucks are a part of) have been negative while services remain hot.

Is inflation really falling? Or is it just used cars? How often does one buy a used car?

The most worrying component of the CPI is Energy. It continues to remain hot as geopolitical conflicts keep oil prices high.

A snippet from a JP Morgan analyst on the April CPI report:

“We expect energy to stay elevated and volatile in the near-term given looming geopolitical tensions and the approaching summer months. High energy prices could provide a headwind for consumer confidence going forward and dampen consumer spending.”

The Federal Reserve, the US Treasury, and Inflation

TLDR: It’s hard to fight the Federal Reserve.

They are staring down the barrel of inflation, and beholden to geopolitical risks, but they’ll try their best to keep monetary policy loose to help the US government fund itself, to stabilize foreign economies, and for the Presidential Election in November.

This means markets are likely to keep going up in the next few months.

There are heightened geopolitical risks, but it’s always a losing trade when one accounts too heavily for them.

The top macro story of the day continues to be a Federal Reserve that’s forced to navigate the treacherous passage between:

Keeping monetary policy tight to cool inflation

And easing monetary policy from pressure from a slew of titanic foreign and domestic forces

These other forces include:

Foreign central banks

And this year’s Presidential Election

While inflation remains high in the US, inflation has cooled elsewhere in the world and their central banks are chomping at the bit to cut their own interest rates.

But they can’t cut as much as they’d like, since cutting interest rates before the Federal Reserve cuts US interest rates will weaken their currencies against the US Dollar, making imports more expensive, which ultimately hurts their economies.

Finally, the Presidential Election later this year is another force pushing the Federal Reserve to cut.

In theory, the Federal Reserve should be apolitical. In practice, this is not always the case.

In fact, the Federal Reserve has a track record of keeping monetary policy loose during Presidential Election years, and this is especially true during a time of high populism. This year is unlikely to be different.

The Federal Reserve is already succumbing to the pressures to loosen monetary policy.

In May’s FOMC meeting earlier this month, they announced a sudden and massive cut to Quantitative Tightening, reducing US treasury run-off from its balance sheet from $60 billion a month to a mere $25 billion a month.

By the way, the announcement of this cut gave the Japanese Yen a big boost after its massive slide against the Dollar over the past few months.

You can bet that Japan’s economic policymakers had been frantically calling the Federal Reserve, as the Yen slid aggressively against Dollar, for the Federal Reserve to give the Yen some reprieve.

As for us investors, it’s important to know that it’s hard to fight the Federal Reserve, it’s hard to fight the US Treasury, and it’s hard to fight central banks all around the world.

Buffett and Druckenmiller’s portfolio updates

Warren Buffett and Stanley Drunkenmiller’s investment firms recently filed 13F forms which reflect the firms’s holdings at the end of Q1 (end of March).

Both investors have made some very interesting adjustments to their portfolios.

Here are the highlights.

Druckenmiller cut his exposure to Nvidia by 72%

In his recent interview on CNBC, Druckenmiller mentioned that he started a position in Nvidia even before the launch of ChatGPT, sized up the position over time, and rode the stock from $150 to $900.

As much as he’s bullish on AI for the long term, a 500% gain in under 2 years is just too good to not lock in.

“[W]hen the stock went from 150 to 900, I’m not Warren Buffett. I don’t own things for 10 or 20 years. I wish I was Warren Buffett. And 150 to 900, yes, we did -- we did cut that position and lot of other positions in late March. I just need a break. We’ve had a -- we’ve had a hell of a run… But no, long-term, we’re as bullish on AI as we’ve ever been.”

Druckenmiller put on a massive bet on small cap stocks

Druckenmiller bought $664 million worth of call options on the Russell 2000 (small cap stocks) in the past quarter.

Small cap stocks are highly sensitive to interest rates, given that many are reliant on debt to grow / sustain themselves.

Druckenmiller’s bullishness on small cap stocks shows that the thinks monetary conditions are likely to loosen in the next few months, which is in line with what I wrote about above.

Buffett started a massive position in Swiss insurance company Chubb

Buffett’s bread and butter investment sector is Insurance. Berkshire Hathaway has owned insurance companies throughout its history of growth and today owns several insurance giants, the most famous of which is Geico.

Insurance companies are not only an investment for Berkshire Hathaway, their large insurance floats (pools of cash built up from premiums collected from customers that have not yet been paid out to claimants) also serve as a source of cheap leverage for the investment firm.

Buying a large stake (6.7% of the company worth $6.7 billion) in Chubb is Buffett going back to his roots.

This is yet another example of Buffett’s increasing conservative stance in his approach to the current US economy and stock market.

Buffett continues to sell Apple

Berkshire Hathaway’s cash pile is growing faster than he’s investing it. Much faster.

This growth is brought on by an ongoing, incessant trimming of the firm’s largest investment, Apple.

Buffett had this to say about building Berkshire’s cash pile at its annual shareholders meeting earlier this month:

“So our cash and treasury bills were $182 billion at the quarter end. And I think it’s a fair assumption that they brought probably about $200 billion at the end of this quarter. We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money.”

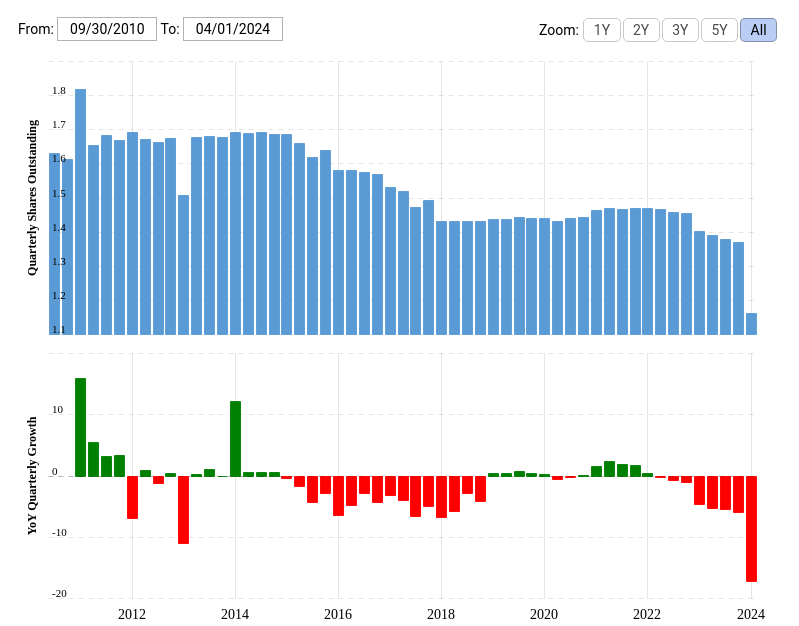

General Motors Buyback

Did you know that General Motors recently bought back and retired 13% of the company’s outstanding shares in just one quarter (Q4) last year?

After last year’s 1.5 month long workers strike affecting several GM factories that ended in October, management decided to leap the company out of the throes of the strike by increasing dividends by 33% and launching a $10 billion accelerated share buyback plan.

To execute this buyback plan, the company gave $10 billion to a group of banks, including Bank of America, Goldman Sachs, Barclays, and Citigroup.

The first step of the buyback plan is an immediate retiring of $6.8 billion of the company’s shares, with $3.2 billion held in reserve to buy back shares over time.

At the end of last year, GM’s market cap is $50 billion. As such, this initial $6.8 billion share buyback was about 13% of the company’s outstanding shares at the time!

Massive.

I’ve said this many times before: one mustn’t overlook GM as the most promising underdog that can challenge Tesla’s throne as North America’s most valuable automaker.

Yeah this inflation data is concerning. I do feel like the Fed is giving this vague story of “we want to cut rates” and the market is buying into it and look for any data that promotes rate cuts.

It’s great used car sales are down, but energy controls inflation for…everything that needs transport.

I’m half expecting next CPI to show an uptick and market will wildly react thinking it’s an inflation trend reversal. But it’s always still been going up, just sandbagged by used cars.

I think that’s what I consider the major risk is for these geopolitical events. Risk to energy costs or another import/export slowdown (blocked ports?) would give a timid market a readjustment.

I’ve kept some puts out to September. I don’t feel like they’re going to pay out, but they make me more comfortable to trade now.

Torn on NVIDIA. I think it’ll shoot up, but Idk if I can stomach the risk of 4K on 1 call