Market Pulse: TikTok and Dividends

High interest rates make Big Tech bigger, and the recent worrying diplomatic flurry between the US and China.

In this issue, I want to quickly discuss two things:

How Big Tech is unintuitively benefiting from high interest rates

And recent news around rising US-China tensions

Big Tech Dividends

Let’s start off with the lighter topic of the two, that of the recent emergence of Big Tech dividends and why certain Big Tech companies have started issuing them after decades of abstinence.

Earlier this week, I published a newsletter issue talking about how high interest rates could actually be benefiting the US economy.

Well, there’s one corner of the economy that’s certainly benefiting from them and it’s Big Tech.

Curiously, Google and Meta have both recently announced that they’re launching dividend programs.

This is a historical first for both companies.

The textbooks say that high interest rates are supposed to slow down the business cycle but they’re curiously having the opposite effect on the modern economy’s largest and most influential companies.

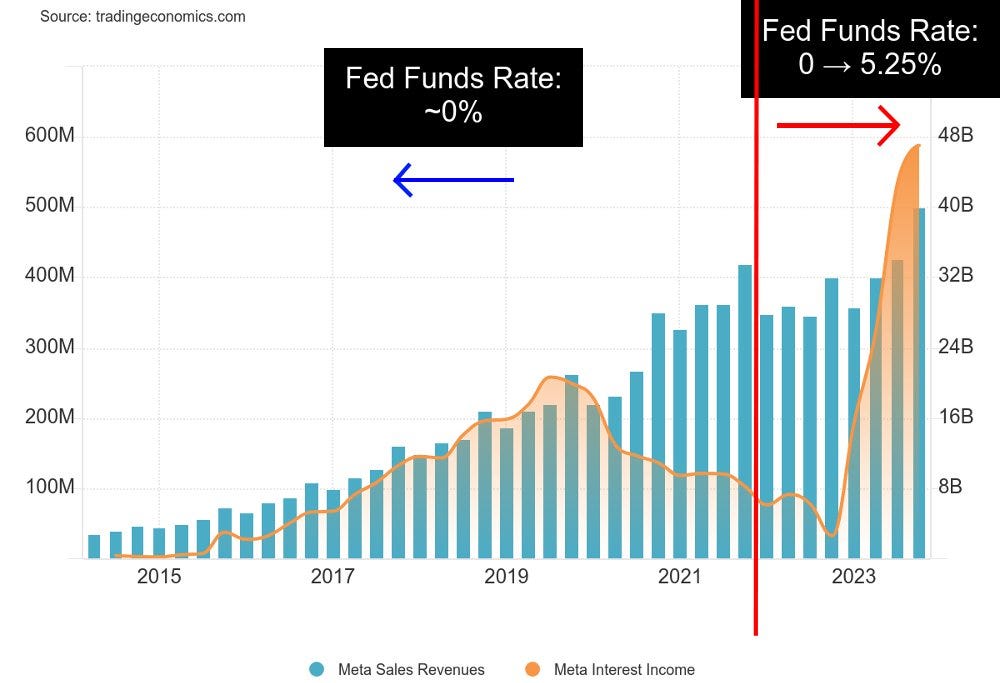

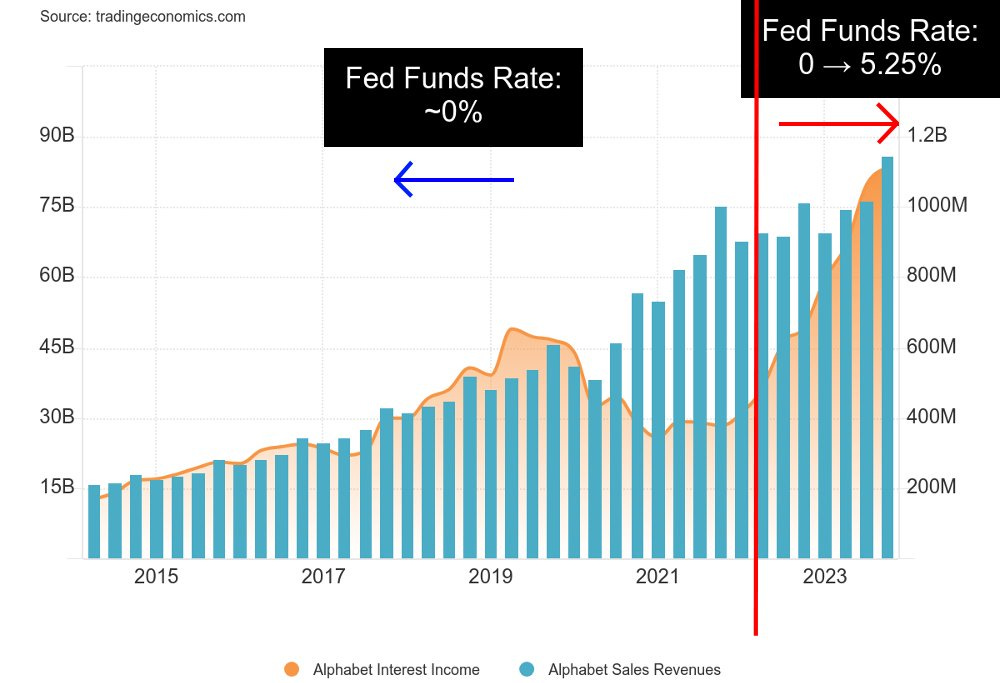

From both charts above, we see that just as high inflation has given both companies a big revenue boost, high interest rates have pushed the case farther and significantly increased their interest incomes.

Google and Meta are not hurting from high interest rates. Instead, they’re reveling in them.

Couple this with large efficiency improvements over the past year and it’s not surprising that both companies have found themselves with more cash than they know what to do with and are returning a record amount of cash to investors.

US → TikTok ← China

US-China relations will be the defining factor in how the global economy and markets move in the next few years.

As such, it’s important to review the recent flurry of high level US-China diplomatic activity that happened over the past month.

There is a diplomatic urgency afoot among top US government officials and they’re not sharing the reason for this urgency with the rest of us.

It’s up to us enterprising outsiders to pick up and analyze their furtive breadcrumbs.

Ever since Biden’s pivotal phone call with Xi Jinping at the start of the month (in which the two heads of state clashed on the topic of Taiwan), Biden has sent two of his most powerful cabinet officials to China to negotiate important matters of state.

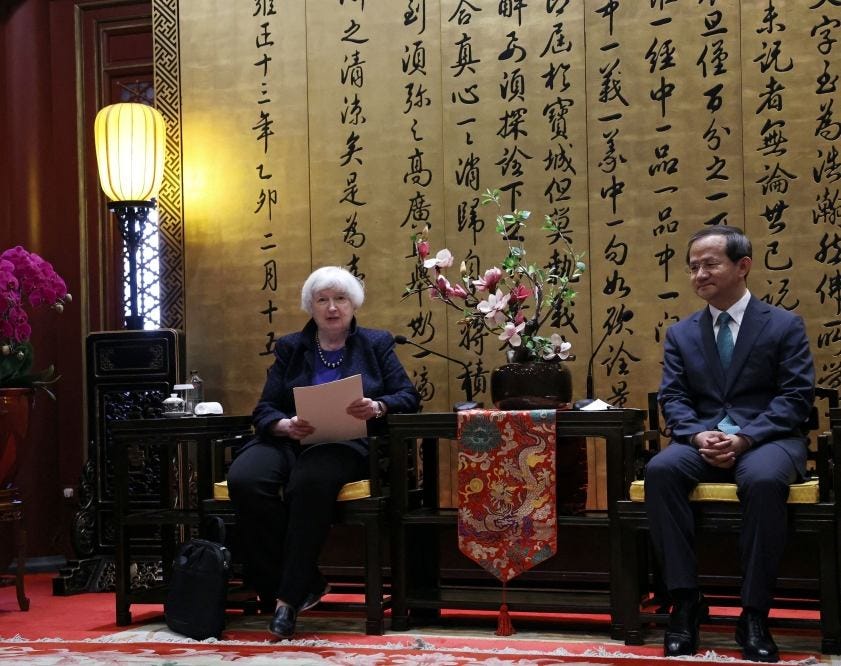

Treasury Secretary Janet Yellen (representing US financial might) spent 6 days in China from April 4th to 9th and Secretary of State Anthony Blinken (representing US military might) just concluded a 3-day visit to the Middle Kingdom.

At the same time, back at home, the US government has been rushing to pass a pivotal foreign policy bill that combines a $95 billion foreign aid package (with $9 billion earmarked for Taiwan) with a clause that forces the transfer of TikTok from ByteDance into US hands.

What’s going on? Why the sudden intensity in high-level diplomatic discourse?

Although little is publicly discussed about the impetus behind the recent diplomatic flurry, here’s what we do know:

Russia is winning in Eastern Europe. This has forced Congress to rush the passing of a massive $95 billion foreign aid bill after months of partisan gridlock.

Russia is preparing for a major summer offensive that could significantly turn the tides of war. A Russian war victory would, in the preeminent US banking CEO Jamie Dimon’s words, cause the world to “enter a little bit of chaos as people realign alliances and economic relationships”. Without mincing words, Dimon added that “[i]t could be a potential disaster”.

The US is unhappy that China is indirectly helping Russia’s war effort:

During her China visit, Yellen threatened sanctions against Chinese companies that are providing “provide material support for Russia’s war”.

Blinken followed up Yellen’s threat with threats of his own during his recent visit. The most serious of them being sanctions on Chinese banks that the US thinks are helping Russia.

Taiwan is the most important and urgent issue between the two global hegemons.

The Chinese government’s readout of Xi Jinping and Biden’s call earlier in the month had this to say about Taiwan: “President Xi Jinping stressed that the Taiwan question is the first red line that must not be crossed in China-U.S. relations. In the face of “Taiwan independence” separatist activities and external encouragement and support for them, China is not going to sit on its hands.”

Increasingly, we’re also seeing actions and rhetoric that don’t make sense.

Even as inflation remains stubbornly hot in the US (forcing economists to reconsider the possibility of rate cuts this year when many were expecting up to 6 rate cuts at the start of the year), Yellen complained during her visit that China isn’t doing enough to constrain its domestic supply glut and that it should stop exporting deflation.

Did the US suddenly stop caring about inflation? Couldn’t this complaint of Chinese overcapacity wait until after US inflation has definitively cooled down?

With Biden signing the bill forcing TikTok’s divestiture on Wednesday, ByteDance shot back and declared that they’d rather have TikTok shut down than hand it over to the US for tens if not hundreds of billions of dollars.

Did the money-loving private enterprise that is ByteDance suddenly hate money? Why Destroy rather than Exchange?

FYI, TikTok generated $14 billion in revenue last year (40%+ year-over-year growth) and 170 million Americans are active users of the app. It’s a highly, highly valuable asset.

I can draw a few conclusions from this series of events:

There are escalating tensions between the two countries.

Both sides have strong desires to solve the differences via diplomacy.

Foreign policy from both sides have become increasingly aggressive. I presume this is to put weight behind the diplomatic overtures.

Any nonsensical diplomatic rhetoric is very concerning since they hint at urgent and important, but unpublished, conflicting agendas between the two global hegemons.

What does this all mean, practically?

I think the tail risk of more geopolitical conflict is increasing significantly.

Powerful US cabinet officials don’t often visit China, and especially not at such a high frequency.

Much was said, negotiated, and disagreed upon between the two nations in the past month that was not shared with the public.

By the way, did you know that if US interest rates don’t change, US interest expenses will balloon to $1.7 trillion next year (it’s at $1 trillion right now).

Crazy!

Knowing this, I was very surprised to hear that Yellen wants China to stop exporting deflation as a result of its domestic supply glut.

As Treasury Secretary, she’s fully aware that to keep the US government’s budget under control, interest rates must fall, and for interest rates to fall, inflation must first fall.

Also, big tech benefitting from high interest rates, is that from them loaning out their cash being "net liquidity suppliers" as you previously mentioned?

If so who are they lending to? Would a reduction in rates begin to harm tech? We've been talking about the Fed losing ways to control inflation because of this, it's starting to sound like a bit of a runaway train with cash accumulating into the big boys

Could you explain "exporting deflation"? I remember that from the BoJ article and thought it would make sense to me later, but I'm still fuzzy on it.