The Federal Reserve Lost Control

The Federal Reserve has becoming increasingly irrelevant in guiding the economy and this newsletter issue explains why and how.

The title of this newsletter issue is not clickbait.

The Federal Reserve has becoming increasingly irrelevant in guiding the economy and this newsletter issue explains why and how.

The Federal Reserve has a dual mandate:

Price stability

Full employment

To keep the ever-changing economy within the guardrails of the dual mandate, the Fed has many “tools in its toolbox” (as it often likes to say).

These tools are often broad and high level.

The two most important are the ability to set interest rates and the ability to print and delete money.

In this issue, we’ll see how the post-pandemic financial system has become incredibly insensitive to the Fed’s tools.

In lieu of the Fed, the US Treasury now sets the economy’s tempo and is currently marching the US off a debt spiral cliff as it tries to balance getting Big Boss Biden re-elected while bankrolling major foreign wars at the same time.

Why is this important?

It’s important because the financial media is still describing and predicting the market’s behavior with the assumption that the Fed is still in control, and getting it very wrong.

For example, CNBC, The Wall Street Journal, and Bloomberg can’t seem to come up with a coherent explanation for why the S&P 500 is pushing all-time-highs and up 41% since the October 2022 nadir, despite the Fed rapidly raising interest rates from 0% to 5.25% in a year and burning $60 billion of treasuries and $30 billion of mortgage-backed securities a month.

To better understand, and predict, how this new economic environment works, one must view it through the lens of an increasingly irrelevant Federal Reserve and an insatiable US Treasury.

Credits

Big credits to Lyn Alden for coming up with many of the ideas I write about in this newsletter issue. I think she’s spot on with her analyses.

Setting the Stage - Federal Reserve vs the US Treasury

One quick thing to go over is the difference between the Federal Reserve and the US Treasury.

The Federal Reserve is designed to be an independent entity from the elected government.

The US Treasury, on the other hand, reports directly to the elected President.

The Fed has primary control over monetary policy, i.e. controlling the total money supply through broad tools like setting interest rates and printing/deleting money.

The Fed sets the size of the US Dollar Pie, and how viscous the filling is.

The Treasury has primary control over fiscal policy, i.e. choosing how to raise debt, and how to spend money earned through tax revenues and debt raises.

The Treasury determines how the US government earns and spends within the US Dollar Pie.

The Fed takes a long-term view to ensure that the US economy remains in a healthy state. That’s why it’s set up as an independent political entity that isn’t incentivized to buy votes.

The Treasury reports to the President and is incentivized to use fiscal policy to help the President get re-elected.

👋 Hello dear reader, if you’ve enjoyed FinanceTLDR so far, consider sharing the newsletter with friends and family.

In the past few issues, I’ve written about:

I have a lot more content planned and am grateful that you’re keeping up with the newsletter.

Also, if you’d be so inclined, you can financially support the work for a very small amount of $7 a month (or $70 a year for the annual deal). Thank you! 🙇♂️

Setting the Stage - US Government Spending is Soaring

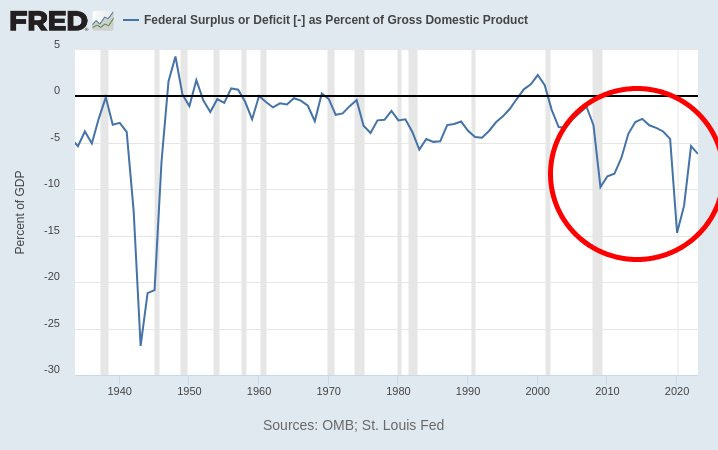

Another thing to go over before we jump into the meat of this newsletter issue: ever since the pandemic, US government spending has been sky-rocketing.

This is partly a result of soaring domestic stimulus spending, soaring war spending, and soaring interest expenses.

Today’s Federal Deficit as a % of GDP is trending like the US is back in World War 2.

At the same time, the government’s interest expenses are soaring. Interest expenses are a direct measure of the solvency of the US government.

Finally, all these trends translate to the Treasury having to incessantly issue a record amount of debt. The Federal Budget is estimated to be $6.9 trillion this year, which is a whopping $1.1 trillion larger than last year.

To fund this year’s massively oversized budget, the Treasury has to issue $1.9 trillion in net new treasuries.

Crazy.

With so much US government debt having flooded or is flooding the market, we come to this idea of Fiscal Dominance.

Fiscal Dominance is when government spending is so high that it drowns out private sector finances and dictates how the economy and market moves.

The US economy is in Fiscal Dominance mode and this can be seen by comparing the fiscal deficit to bank and corporate loans.

We see below that, in the past few years, the fiscal deficit is significantly larger than both.

The economy being in Fiscal Dominance mode is why the Federal Reserve has become a lot less influential in guiding the economy in recent years.

Let’s dive into some of the effects of Fiscal Dominance and how they manifest.

Raising Interest Rates Is Helping The Economy?!

In Fiscal Dominance mode, one of the Fed’s most powerful tools to slow down the economy, the ability to raise interest rates, is a lot less effective.

We can see this with how the S&P 500 is currently pushing all-time-highs and is 13% higher than where it was two years ago when interest rates were at 0% and the Fed just started raising rates.

Two years later, with interest rates at 5% and the S&P 500 is somehow in a raging bull market.

At the same time, GDP growth has also been very hot, significantly beating market expectations all year and ending the year with a 2.5% full-year growth rate.

This is 31% higher than 2022’s full-year growth rate, a year when interest rates were a lot lower!

If high interest rates are meant to slow down the economy, they have clearly not been working.

In fact, I’d go even as far as to say that because of Fiscal Dominance, high interest rates are actually stimulating the economy.

Why?

Because the interest expense of the US government is the interest income of private holders of government debt.

In addition, the US government owns and issues a lot of short-term debt, so when the Fed raises interest rates, the interest income of private government debt holders quickly rise.

We can see this from the rapid rise in the interest incomes of Big Tech companies since the Fed started raising interest rates in early 2022.

You may be wondering, shouldn’t rising interest rates slow down private lending and increase bankruptcies in companies filled with bad debt?

This is true, and a lot of this has happened in the past two years.

The only problem is that the US economy (and its major stock market indices) is dominated by companies that make a sh*t ton of money (think Big Tech) and aren’t reliant on debt.

In fact, they make so much money that they’re net liquidity suppliers to the economy rather than liquidity takers.

As we can see from the charts I’ve shared above, liquidity suppliers tend to benefit from high interest rates rather than be hurt by them.

Finally, even when debt stress does emerge from high interest rates (remember last year’s regional bank crisis?), the Fed will just step in and use public spending to shield the private sector from the damage of high interest rates.

In such an accomodative environment for the private sector, it’s no wonder the S&P 500 is back in a raging bull market, despite high interest rates.

Why Quantitative Tightening Is Also Ineffective

But raising interest rates is not the only tool in the Fed’s tool box to slow down the economy.

The Fed is also stepping on the brakes by reducing the total money supply through Quantitative Tightening.

Specifically, it’s letting $60 billion of US treasuries and $30 billion of mortgage-backed securities roll off its balance sheet on a monthly basis, effectively taking this much money out from circulation each month.

$90 billion removed each month! Shouldn’t this slow down the economy? Why isn’t it working?

The reason is that, as I’ve mentioned several times in past newsletter issues, the Treasury has been issuing a significantly higher amount of short-term treasuries in the past year to tap into a $2.5 trillion pool of funding that’s stored in the Fed’s Overnight Reverse Repo facility.

In other words, even if the Fed is reducing its buying demand for treasuries by $720 billion ($60 billion * 12) a year, the Treasury has found any alternative buyer with $2.5 trillion in funds!

Again, we see here that the US Treasury is in the economy’s driver’s seat, not the Fed.

What’s the End Game?

What’s the end game of Fiscal Dominance?