Weekly TLDR - More Gold Than the World

In this week’s TLDR, we talk about airline stocks struggling even as air travel roars back, Uganda finding more gold than the entire world has combined, and another major crypto bankruptcy.

The TLDR

In this week’s TLDR, we talk about airline stocks struggling even as air travel roars back, Uganda finding more gold than the entire world has combined, and another major crypto bankruptcy.

Chart of the Week

The U.S. Transportation Security Administration (TSA) screened 2.45 million air travellers a couple weeks ago on June 24th. This was the highest daily number since February 2020. Yet the JETS 0.00%↑ ETF is down 40% for the year.

How is this possible?

Despite air travel roaring back with the economy reopening, the airlines are barely benefiting from the increased demand as high labor and fuel costs squeeze margins. In addition, investors are worried about a looming recession that will likely cause demand for air travel to nosedive. The market is a forward-looking valuation machine after all.

Stock Market TLDR

Uganda Finds $12 Trillion Worth of Gold

The Short: The Ugandan government recently announced the discovery of 31 million tonnes of gold ore in the Karamoja region. It’s estimated that all this ore can be turned into 320,000 tonnes of refined gold. At today’s gold price, that’s worth $12 trillion!

The Long: As expected, the Ugandan government’s claim has been met with skepticism. The total amount of gold held in global reserves is only 244,000 tonnes. If the estimated figure for the amount of gold in this region is correct, then Uganda will be sitting on 30% more gold than what the entire world has combined.

The government has licensed Chinese firm Wagagai Gold Mining Company to start mining and refining operations. The firm expects to produce around 5,000 kg of refined gold a day by the end of the year. Even if the total gold available in this region is a fraction of the headline estimate, this discovery should still transform the Ugandan economy, suppress global gold prices as markets are flooded with Ugandan gold, and further elevate China’s global financial status.

"If this is indeed the volume that we have, it is time to clean our house, and do business, in developing ourselves and our country, by going to the middle income status and beyond."

Winnie Ngabirwe, Ugandan mineral development expert

A Global Recession?

The Short: Head of the International Monetary Fund (IMF) Kristalina Georgieva said today that the global economic outlook has “darkened significantly” and a global recession in 2023 can’t be ruled out.

The Long: With an ongoing war in Eastern Europe disrupting global food and energy supplies and inflation ravaging through the global economy, it’s no wonder the IMF is substantially cutting back on its global growth expectations. The post-pandemic world has found itself in a perilous political and economic situation with no line-of-sight to relief. It feels like the world order we’re so used to living in is tearing at the seams.

Russia’s abrupt severance from Western economies serves as a stark reminder that war is never far away, no matter how intertwined national economies are. So far, neither side in the Eastern European conflict appears willing to relent anytime soon, even as global food and energy supplies are heavily disrupted. While the West is distracted by the Eastern European conflict, China is stepping up it’s global presence by attempting to expand BRICS, creating an alternative BRICS-based global currency that challenges the US Dollar, and wooing traditional Western allies to the East such as Saudi Arabia. We’re certainly living in a time of flux. Let’s hope global policymakers are able to navigate the turbulence without further conflict.

First Approved Gene-Editing Therapy By Next Year?

The Short: Here's a lighter and more positive topic. A promising CRISPR-based gene-editing therapy that treats beta thalassemia and sickle cell disease, both blood disorders, might be FDA-approved as soon as next year. If so, it’ll be the first commercially available gene-editing therapy.

The Long: This gene-editing therapy, called exa-cel (short for exagamglogene autotemcel), is the product of a $900 million collaboration between two biotech companies Vertex VRTX 0.00%↑ and CRISPR Therapeutics CRSP 0.00%↑. The companies hope to submit the therapy for regulatory approval by the end of this year. This means that it could be authorized for commercial use in as early as 2023. The two blood disorders that exa-cel treats reduce the amount of effective hemoglobin, and thus oxygen, in blood. Not good. The therapy fixes this by first extracting stem cells from a patient, modifying their DNA such that they can produce correct hemoglobin, and inserting the modified stem cells back into the patient. If exa-cel is approved, it'd be an exciting step forward for gene-editing technology. Let’s hope this is the start of a wave of new gene-editing therapies that transforms healthcare and extends human healthspans.

If you use Gmail, be sure to check your Promotions tab for FinanceTLDR newsletter issues.

Gmail occasionally drops newsletter issues in there. It’s a common and mysterious pet-peeve for newsletter publishers. To make sure FinanceTLDR consistently hits your inbox, drag and drop our emails from the Promotions tab to the Primary tab.

Thanks for sticking with FinanceTLDR! We greatly appreciate your readership.

Trillions of Excess Pandemic Savings

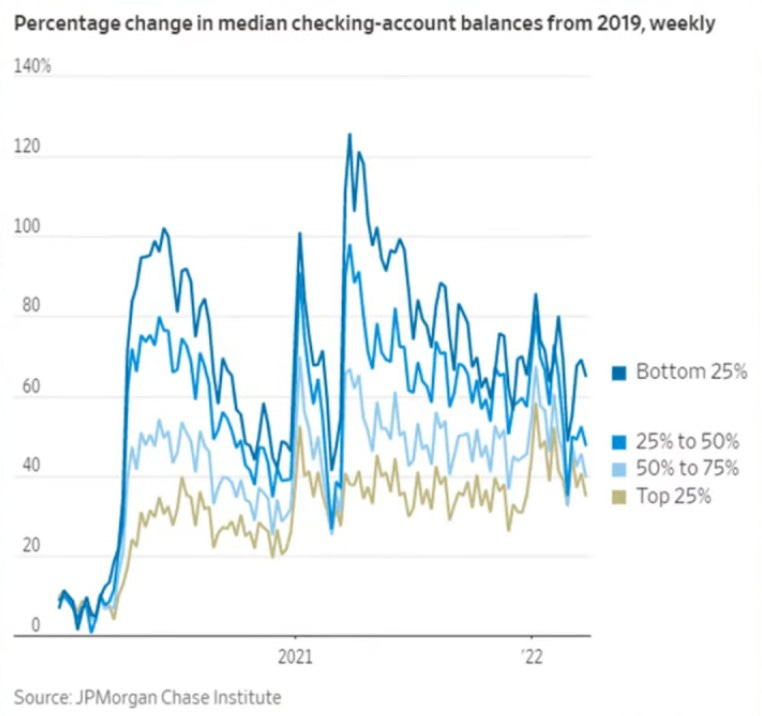

The Short: American consumers entered 2022 with $2.4 trillion in excess savings. The bottom 25% of Americans by household wealth experienced the highest percentage increase in savings.

The Long: With so much excess savings, which by the way, doesn’t account for asset price appreciation, it’s no wonder that we’re experiencing a super tight labor market and strong consumer demand. This is why the Fed’s inflation fight is so hard. The Fed needs to deplete trillions of dollars in excess savings to bring people back into the workforce and hope that less spending power and lower wages will cool inflation. An unpopular policy indeed. On top of this, the Fed has to grapple with high energy and food prices that are out of their control, but are significant antagonists to their most important mandate of price stability. The Fed still has a LOT of tightening to do.

Crypto TLDR

Another Bankrupty

The Short: Major crypto broker and lender Voyager Digital has filed for bankruptcy.

The Long: Voyager Digital said today that the company has filed for bankruptcy. The company’s stock, listed on the Toronto Stock Exchange, was swiftly suspended from trading. Voyager paused all deposits, withdrawals, and trading on its platform only a week ago. It appears Voyager’s financial troubles largely stems from an outstanding $650 million loan made to crypto hedge fund Three Arrows Capital that the now-insolvent hedge fund has been unable to repay.

Celsius Avoids Liquidation

The Short: Beleaguered crypto lender Celsius is working hard to avoid liquidation by paying off massive loans it took out from several DeFi lending platforms. Enough has been paid off that the firm’s loan positions will only be liquidated if Bitcoin's price falls below $2,722.11.

The Long: To provide unusually high yields on crypto assets held with the lender, Celsius had to go far out on the risk curve by leveraging up customer funds through DeFi lending platforms, then depositing the funds on other DeFi platforms to “yield farm”. With the rapid decline of crypto prices, Celsius’s DeFi loans have come dangerously close to liquidation. If that happens, the company will be plunged into insolvency. Fortunately, the company is rapidly unwinding these loans. So far this month, it has paid off $183.6 million in loans from MakerDAO and $67 million in loans from Aave and Compound. This has dropped their liquidation price to $2,722.11, meaning that they will only be liquidated if Bitcoin falls below this price. Withdrawals and transfers on Celsius have been suspended for almost a month now and the company has also laid off 150 employees (23% of its workforce).

NFTs vs the British Army

Over the weekend, the British Army’s Twitter and YouTube accounts were compromised by hackers promoting NFT projects. On Twitter, the hackers changed the British Army account’s profile picture, banner, and description to promote two NFT collections. On YouTube, they uploaded videos to the British Army’s channel promoting cryptocurrencies that often featured images of Elon Musk. The British Army regained control of their accounts on Sunday evening.