Market Pulse: Liquidity is Surging

In 8 minutes, understand what systemic liquidity means and why it's such an overwhelming factor in determining stock prices.

Before I start this issue, here’s a quick word on AMD.

On December 14th, I wrote to subscribers in that day’s Market Pulse issue: “On AMD, I’m exceptionally bullish. I think the stock will, at the very least, run up to its Q4 earnings report in late January on excitement from new orders for the MI300X.”

Then on December 28th, I published 2024 is AMD's Year. Here's Why to all subscribers, presenting my full research on the company.

Since then, the stock was upgraded numerous times by analysts and its price soared from $138 to over $184 earlier this week.

1/4: Bernstein’s Stacy Rasgon raises price target: $100 → $120

1/4: Piper Sandler’s Harsh Kumar raises price target: $150 → $165

1/4: KeyBanc’s John Vinh raises price target: $140 → $170

1/5: Mizuho’s Vijay Rakesh raises price target: $130 → $162

1/8: Melius Research’s Ben Reitzes sets price target to $188

1/16: KeyBanc’s John Vinh raises price target target: $170 → $195

1/16: Barclay’s Tom O’Malley raises price target: $120 → $200

1/19: Raymond James’s Srini Pajjuri raises price target: $140 → $190

1/22: Cantor Fitzgerald’s C. J. Muse initiates with an overweight rating and a $190 price target

1/24: NewStreet Research’s Pierre Ferragu upgrades rating from Hold to Buy, price target $100 → $215

1/25: UBS’s Timothy Arcuri raises price target: $135 → $220

We put our money where our mouth is and traded on this idea. Last week, we closed out 3 massive trades with a combined profit of $138,262.31.

AMD was a good call and a massively successful trade.

Back to our regularly scheduled programming.

In 8 minutes, understand what systemic liquidity means and why it's such an overwhelming factor in determining stock prices.

What is systemic liquidity? Put simply, it’s the general availability of money in a financial system.

Liquidity is determined by a variety of factors but the institutions with the most control over it are central banks. Central banks can pour liquidity into markets by printing money or lowering interest rates, or they can drain liquidity by shrinking their balance sheet or raising interest rates.

The world’s most powerful central bank is the US Federal Reserve.

For US markets, given their global nature, the two most important pools of liquidity are US liquidity and global liquidity (which US liquidity is a part of).

Why are we discussing liquidity today?

The reasons are three-fold:

Liquidity has an overwhelming impact on stock prices.

It’s an excellent tool to help explain the current bull market.

It also provides important clues on when this bull market will stall.

💡 Liquidity > Fundamentals

The general consensus on how markets price stocks is something along the lines of the company’s fundamentals. For example, many analysts value companies by predicting and discounting future cash flows to determine a present-day price target for its stock.

However, in practice, the market is not a fundamental investor, especially in short time frames.

In fact, there are studies that show that even in time frames as long as 10 years, liquidity plays a more dominant role in driving stock prices than fundamentals.

Here are a few recent practical examples:

The pandemic crash didn’t start until February’s Options Expiry (OpEx) day, even though the world knew about the virus since December and was furiously searching about it in January and early-February.

During the pandemic crash, the S&P 500 dropped to almost 2,200. In a span of just 9 months, the index more than doubled and hit a high of 4,800!

Then as the Fed tightened liquidity in response to a significant bout of inflation, the S&P 500 fell 27% to 3,500 in just 10 months.

These are gargantuan moves that the most sophisticated discounted cash flows spreadsheet could never predict.

Liquidity pushes markets around in fast and furious ways. Ignoring it is incredibly costly for traders and investors alike.

Hedge fund manager Cem Karsan likes to use an excellent analogy to describe how fundamentals and liquidity relate to stock prices.

Imagine you’re on a plane.

A stock’s fundamentals is the altitude the plane is flying at and liquidity is the engine and the fuel. When the engine is working and there’s fuel, the plane will fly no matter what altitude you’re at. The altitude (fundamentals) only becomes important in preventing the plane from crashing when the engine is not working or the fuel runs out (a liquidity shock).

In this sense, fundamentals is like an insurance policy to mitigate losses during crises. In times of normalcy, liquidity is what drives prices forwards.

💡 What about 2023?

If liquidity was really that important, why are we steeped in a bull market with the S&P 500 pushing all-time-highs, when the Fed is keeping interest rates high and shrinking its balance sheet by almost $100 billion a month?

In other words, if the Fed is pulling liquidity out of the system, shouldn’t the stock market fall as well?

Surprisingly, the 2023 bull market is yet another story of liquidity.

While the Fed is pulling liquidity from the system at face value, behind the scenes, liquidity is actually rising.

The modern stock market dances to the tune of liquidity and if you want to understand why it moves the way it does, the first place to look is liquidity.

💡 How Is This Useful, Practically?

So I’ve already written a lot about what is liquidity and why it matters but the most important thing is, how can we make money from this?

One way to do so is to monitor general liquidity trends in the US financial system.

This is definitely not a precise science given how complex the US financial system is but thankfully with all the free information out there, there’re a myriad of ways to get a rough estimate.

As a side note, it’s clear that simply looking at top-line monetary policy metrics like interest rates and the rate of quantitative easing (QE) or quantitative tightening (QT) is not enough given that if we followed just these two metrics, we’d have completely missed the current bull market.

As such, a more detailed and sophisticated approximation is necessary and one of my favorite approximations is Lyn Alden’s US liquidity equation.

The equation uses free public data from FRED, the Fed’s open data platform.

The S&P 500 tracks this indicator pretty well. For example, the indicator turned positive in September of last year, two months before the S&P 500 V-shape recovered in November.

For those that want the details:

The equation is:

Year-over-year change in total assets on the Fed balance sheet MINUS

Year-over-year change in the US Treasury General Account’s balance MINUS

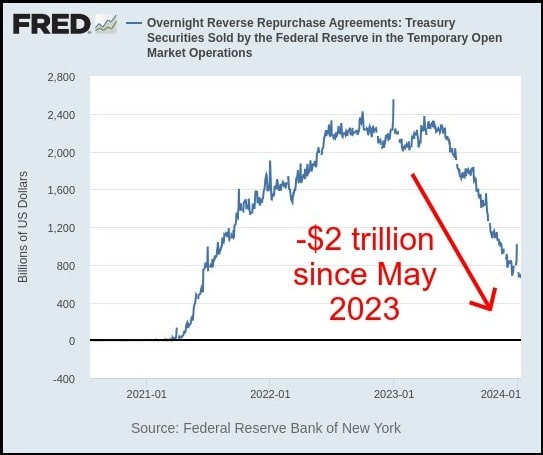

Year-over-year change in the Fed’s Overnight Reverse Repo balance

You can play around with the graph here

The general ideas for the equation are that:

A growing Fed balance sheet means the Fed is conducting QE and thus increasing liquidity.

A shrinking US Treasury General Account means the US government is spending money in the economy and thus increasing liquidity.

A shrinking Overnight Reverse Repo balance means Money Market Funds are spending this money in the economy rather than parking it statically in the Fed, which also increases liquidity.

💎 Lifting The Veil - All Our Research Made Available

We just updated FinanceTLDR premium to include more our:

Research

Trade ideas

Day-to-day market insights

Markets move incredibly fast and we use a combination of up-to-date macro market insights and market structure monitoring (e.g. net MM gamma exposure) to formulate asymmetrical trade ideas with positive convexity and capped downside.

Paid subscribers get full access to the process, ideas, insights, past trades, and active trades.

💡 Liquidity Suggests the Market Is Teetering

The most important topic I want to touch on in this issue is an impending liquidity crunch that’s likely to emerge in a couple months.

First, the Fed’s Overnight Reverse Repo (ON RRP) balance is about to run out and many project this to happen in late March / early Q2.

The ON RRP balance is where trillions of dollars that the Fed printed during the pandemic ended up. You can read more about it in a previous newsletter issue: Market Pulse: The Federal Reserve's 2 Trillion Dollar Hole.

Here’s a 10,000 foot view of the flow of money from the Fed’s “printing presses” to the ON RRP:

Fed conducts quantitative easing, printing trillions of dollars and buying US treasuries.

This money shows up in the economy as bank reserves.

Banks are flush with bank reserves and to reduce balance sheet costs, they offload some reserves to Money Market Funds to earn a higher yield.

Money Market Funds park money in the ON RRP as interest rates rise and the supply of short-term treasuries in the economy shrink during 2022.

The ON RRP balance rises from $0 to over $2 trillion!

In 2023, the debt ceiling was lifted and the US Treasury flooded the market with trillions of short-term treasuries. Money Market Funds redirect QE money from the ON RRP to buy short-term treasuries.

By using money in the ON RRP to buy treasuries, Money Market Funds are essentially pouring this money into the economy, supporting interest rates and funding the US government.

The ON RRP balance falls from a peak of $2.5 trillion to around $600 million now.

When the ON RRP balance runs dry, a major buyer of US treasuries (Money Market Funds) bows out of the market, potentially pushing interest rates higher.

Not good.

In addition, this is not a good year for weak treasury demand. The US Treasury is expected to nearly DOUBLE treasury issuance this year to $2 trillion to meet government spending.

With the ON RRP balance depleted and the US Treasury issuing treasuries at a record pace, if the Fed doesn’t intervene, bank reserves will start falling drastically throughout the year as reserves bear the brunt of buying the flood of new treasuries.

Not good. Bank reserves are a direct measure of liquidity.

Finally, the Bank Term Funding Program (BTFP), an emergency bank funding facility created by the Fed to stave off the worst effects of last year’s regional bank crisis, is set to expire in March.

The BTFP’s expiration is yet another significant blow to liquidity that will emerge in March.

As such, all eyes will be on the March FOMC meeting (March 19th) to see how the Fed will respond to this impending liquidity crunch. In the meantime, we think an anxious and overheated market will likely sell off in the weeks leading up to this FOMC meeting.

💎 Important Market Update (for paid subscribers)

We’re in a post-OpEx lull period in the market and it’s good to take it slow from here.

Here’s where we think markets are headed as well as single stock opportunities that we’re eyeing.