Multi-Strat Hedge Funds Rule The World

The building blocks behind the wildly profitable multi-strat hedge funds that are now dominating the financial industry.

This newsletter issue is about the secret sauce behind multi-strat hedge funds, a powerful new breed of money-making institutions that has, over the last decade, replaced investment banks as the top profit generators on Wall Street.

These hedge funds are as secretive as they’re sophisticated.

You might’ve heard of some of them (Jane Street, Citadel, Millenium Management), but they largely prefer to operate in the shadows of the financial system.

Whilst their public profiles are small, their trading profits are anything but small.

Jane Street made $10.1 billion in trading profits last year. Citadel CEO Ken Griffin paid himself a $4.1 billion salary in 2023 while Millenium CEO Izzy Englander made a more modest $3.2 billion.

This issue is about how these tremendously and consistently profitable multi-strat hedge funds work, at their core.

I’ll open this newsletter issue with a quick, relevant story.

Most of us have heard about the infamous cryptocurrency ex-billionaire Sam Bankman-Fried (SBF).

He was recently sentenced to prison for 25 years for the sudden collapse of FTX and its sister hedge fund Alameda.

While SBF is famous for his FTX story, much less people know about his tenure at Jane Street prior to his short stint as the richest person in the world under 30.

This is a story from SBF’s time as a trader in the preeminent Wall Street hedge fund, Jane Street.

Jane Street recruited SBF as a trader right out of college after they noticed his remarkable potential as a trader due to his strong mathematical skills, quick thinking, and remarkable lack of emotion.

Senior Jane Street traders saw significant potential in SBF and he was quickly given a lot of agency and capital.

During the 2016 Trump vs Clinton election, SBF noticed that every time there was positive news for Trump, the market will sell off a little bit.

Seeing this, he came up with the clever idea of programmatically plugging in to all the disparate state and federal election news sources to get election news ahead of everyone else. He’d then trade on this early information by being the first to short the market.

This idea worked very well all the way up to election night.

Florida was a key swing state for both presidential candidates and SBF’s system identified Trump’s surprising decisive win of the state several minutes before cable news announced the results.

Armed with this pivotal, early information, he massively shorted the stock market.

When the rest of the country learned about Trump’s Florida victory several minutes later, the stock market sold off aggressively. SBF’s large short positions went up hundreds of millions of dollars.

For a moment in time, SBF’s shorts become one of the most profitable trades in Jane Street’s history.

However, before he could close the shorts and lock in the profits (he took a nap after the Florida results were announced), Trump was declared victorious and the market unexpected rocketed up instead.

This abrupt market reversal turned one of Jane Street’s most profitable trades into one of its largest losses, overnight!

The most intriguing outcome of the whole affair was that SBF wasn’t reprimanded for bringing such a large loss onto the firm.

He didn’t even get a slap on the wrist.

Why?

I told this story as a way to describe one interesting and seemingly unintuitive phenomenon of the modus operandi of multi-strat hedge funds.

This one experience that SBF had in Jane Street seems nonsensical at face value for a firm that generates so much money, but this is exactly why these firms are so incredibly profitable.

This serves as a good segue into what I really wanted to discuss in this newsletter issue, that is, the secret sauce behind the incredible profit machines that are today’s multi-strat hedge funds.

👋 Hello dear reader, if you’ve enjoyed FinanceTLDR so far, consider sharing the newsletter with friends and family.

FinanceTLDR is not a financial cure-all. What I can promise you, however, is my full and unbridled curiosity for how our financial system works.

If you’d be so inclined, you can financially support my work for a very small amount of $7 a month (or $70 a year for the annual deal). Thank you!

In the past few issues, I’ve written about:

How the US Treasury sidestepped the Federal Reserve to stimulate the economy and stock market

How the Bank of Japan is able to print an infinite amount of money without crashing the Yen

How exactly does the Federal Reserve print and delete money on a whim

Multi-Strat Secret Sauce

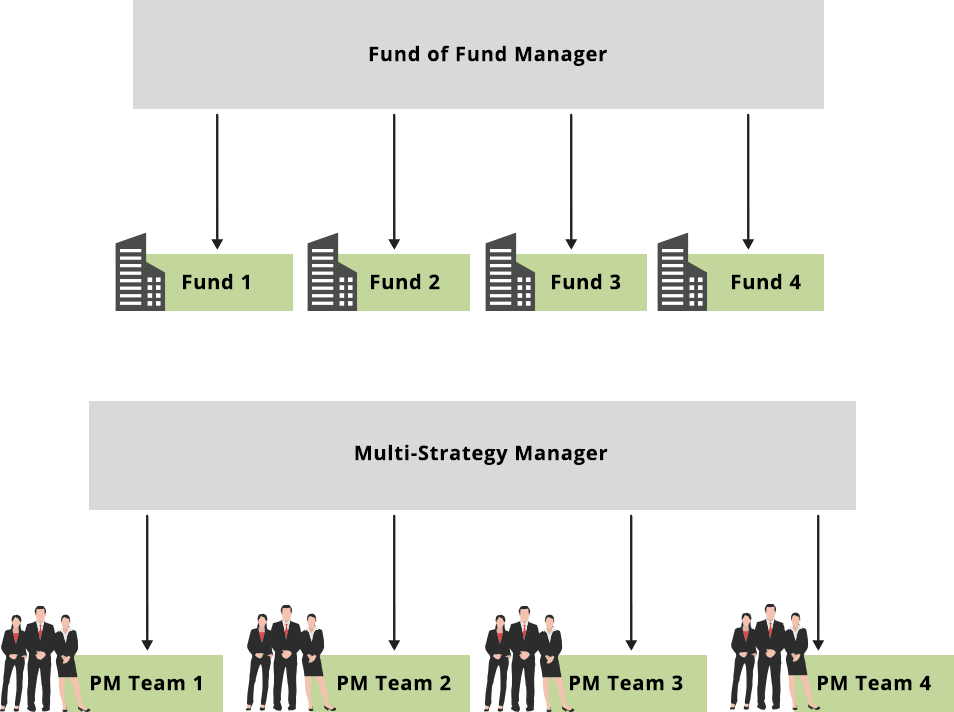

Multi-strat hedge funds, like their namesake, run multiple trading strategies at a time.

More specifically, the fund is structured as a series of “pods”. Each pod is like a separate hedge fund within the overall hedge fund.

A pod is led by a small group of Portfolio Managers (PMs) and the PMs are supported by a team of analysts.

The firm also has a central technology team that’s responsible for building the core technologies that every pod in the company relies on (e.g. proprietary software that orchestrates trading strategies).

The salaries of a pod are tied to the pod’s overall trading profits. If the pod has a particularly profitable year, the profits will be reflected in everyone’s bonuses, with the lions share going to the PMs.

The PMs are the brains behind a pod and are responsible for coming up with and executing trading strategies.

The firm has one giant pool of capital and determines the amount of capital each pod has access to to execute their strategies.

Importantly, the firm often encourages pods to push risk to the max and it’s willing to lose all the capital assigned to any one pod.

This sounds reckless, but it’s actually mathematically sound.

Fractionalized Betting and the Arithmetic vs Geometric Mean

The math works out like this.

Say a pod has the potential to make 5 times its capital in one year if its PMs are especially capable.

If they’re bad or unlucky, the pod could lose its entire bankroll.

The arithmetic expected value of this example win-loss setup is 2.5x (5 * 0.5 + 0 * 0.5 = 2.5).

So, on average, this pod is expected to make 2.5 times its assigned capital each year.

However, notice that there is a significant chance of the pod losing it all. 50%!

This means that if one pushed the pod to the max and reinvested all returns consecutively hoping to maximize the gains from this great 2.5x expected value, after just a few rounds, the chances of losing everything balloons to dominate almost the entire probability distribution.

So how does a multi-strat hedge fund try to benefit from this 2.5x expected value without being subjected to a significant risk of losing it all?

The answer is found in the fractionalization of bets.

The more the firm splits its total pool of capital among its pods, the more the overall expected value of the firm approaches the average arithmetic expected value of all its pods and the less likely the firm will be wiped out in one go.

In addition to fractionalizing bets, the firm can further increase its returns by being very careful about how much capital it assigns each pod.

This is known as bet sizing.

Ideally, the best pods should get the most capital and the worst pods the least. At the scale that these funds operate at, sophisticated bet sizing is the difference between billions of dollars of profits.

Holistic Risk Management

One very important thing to point out with this bet fractionalization framework is that it doesn’t work if there is too much correlation among all the bets.

[content for paid subscribers below]

Very quickly, when trades are correlated, it means that they move together. For example, if inflation goes up and position A and B both go down, then we can say that the two positions are correlated.

As such, when there’s high correlation, a single market event could sink a majority of the pods at once and bring down the overall fund.

Not good!

The goal, after all, is to not suddenly go bankrupt before one makes a lot of money from trading.

Here’s one example of how this risk management could work.

Let’s say Jane runs a better pod than Bob, meaning that she has historically brought in better returns than Bob, and right at this moment, both of them are heavily exposed to oil. If the firm is too exposed to oil overall, the risk management team will force Bob to sell his oil position.

Too bad, Bob.

Conclusion

This multi-strat framework is why Jane Street didn’t reprimand SBF for the bad trade.

The firm wanted him to be willing to push risk to the max and was ready to lose the whole position if the trade went south. Although it was a multi-hundred-million dollar position, it’s still a small position in the firm’s multi-billion-dollar portfolio.

The overall trade idea was sound (getting election information before anyone else) and it worked spectacularly, at least for a while.

There were just improvements that could be made to how the trade was executed (e.g. short the Mexican stock market and long the US stock market, rather than short all markets).

In line with this multi-strat framework, Jane Street is in the business of collecting and nurturing the best talent in the industry and SBF certainly showed significant potential by coming up with the idea and orchestrating the trade.

For a more detailed explanation on how this multi-strat framework works, check out this FinanceTLDR issue:

So to summarize, the secret sauce of multi-strat hedge funds is that they try to hire and nurture the best PMs and analysts, intelligently fractionalize the firm’s bets across many pods, and risk manage across the pods to make sure the trades in aggregate have minimal correlation.