History Rhymes - Back To The 60's

"My boys are dying in Vietnam. Print money!" "No."

You might’ve heard of this famous quote from Mark Twain,

“History doesn’t repeat itself, but it often rhymes.”

This quote couldn’t be more relevant today as it relates to the financial and geopolitical quagmire the US has found itself in and the surprisingly many parallels it draws with the US of the late 60’s.

Back then, the Vietnam War was raging on, inflation was soaring, and tensions between the Federal Reserve and the elected US government had heated up so much to the point where then-President Lyndon B. Johnson cornered then-Fed Chair William McChesney Martin to demand that he print more money to support the US government’s vast spending plans.

In the scenic, quiet, and idyllic back country of LBJ’s Texas Ranch, Fed Chair Martin found himself face-to-face with an increasingly aggressive US President who exclaimed:

“My boys are dying in Vietnam, and you won’t print the money I need!”

(Paraphrased by Sarah Binder, political science professor at the George Washington University)

This is the story of how the US’s financial and economic situation degraded throughout the 1960s, leading to a breaking point that sparked this momentous confrontation between the heads of the country’s two most powerful institutions.

👋 Hello dear reader, if you’ve enjoyed FinanceTLDR so far, consider sharing the newsletter with friends and family.

In the past few issues, I’ve written about:

The US’s Two-Tiered Monetary system and how the Federal Reserve prints or deletes money

Why Thinking In Probabilities is so important for investing (and how to do so)

I have a lot more content planned and am grateful that you’re keeping up with the newsletter.

Also, if you’d be so inclined, you can financially support the work for a very small amount of $7 a month (or $70 a year for the annual deal). Thank you! 🙇♂️

The 1960s - War and Inflation

The 1960s was certainly a time of extremes.

The country was steeped in a seemingly never-ending war in Vietnam. Young males were being conscripted to the military through an unholy birthday-based lottery system that was periodically announced on TV like episodes of some hellish game show.

At the same time, the country was sprinting to send the first man to the moon.

JFK gave his famous speech in 1962 in which he boldly announced to the whole world that America was going to the moon by the end of the decade.

Talk about populism!

“We choose to go to the Moon… We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard.”

A year later, he was assassinated. A standing US President was assassinated in his own country.

What crazy times those were.

The Presidential baton was passed from JFK’s cold dead hands to the hands of a charming but brash populist politician named Lyndon B. Johnson. LBJ was the perfect populist President for a time of high populism.

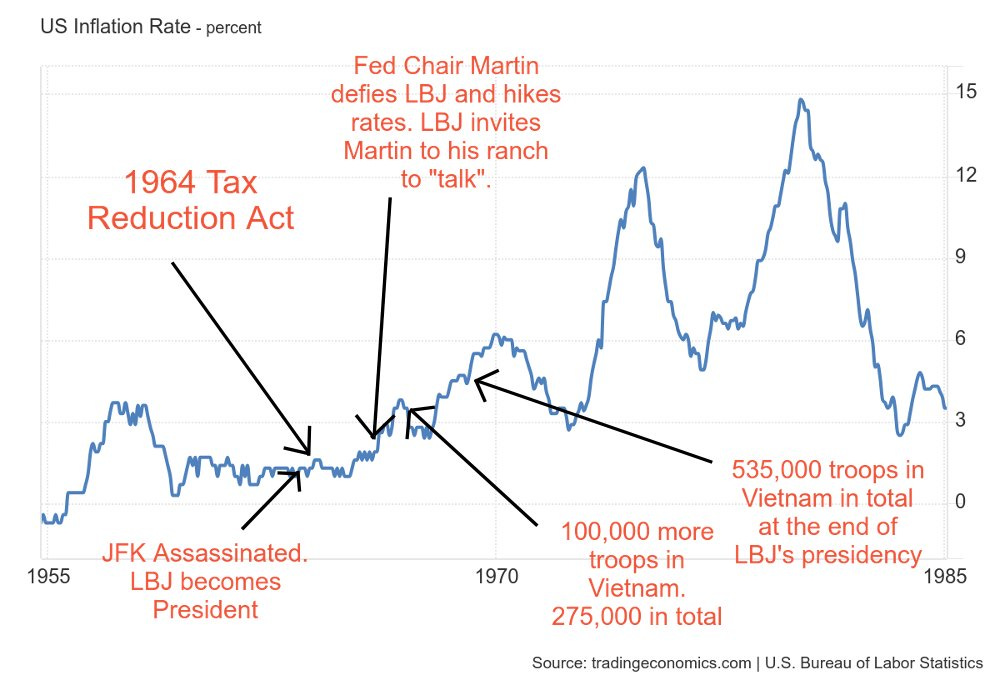

High populism usually comes hand-in-hand with high inflation and this was especially the case in the ensuing years after LBJ assumed office.

🔥 War and Populism→High Fiscal Spending→Looming Inflation

When LBJ assumed office, Congress (with significant support from President JFK before he perished) was just about done passing a sweeping tax cut bill that the newly minted President swiftly shepherded past the finish line.

Fiscal spending was soaring.

The war needed funding. Votes needed to be bought. Debt needed to be paid.

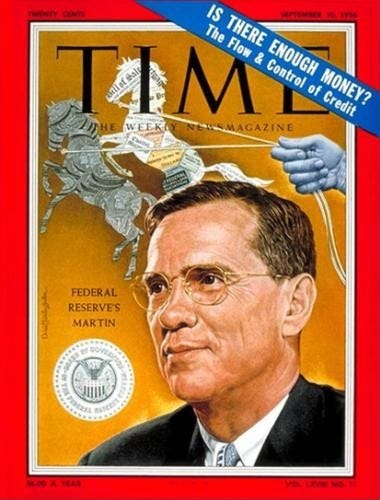

The Federal Reserve Chair who found himself in the midst of this unwieldy economic concoction was William McChesney Martin. Martin had been in the Federal Reserve’s top job since 1951 and had seen many Presidents come and go. He was determined to keep inflation down, despite what any transient headstrong President might say.

In 1965, even though inflation had held steady at ~1.5% in the past few years, there were signs that the economy was heating up.

Money market rates and bond yields were trending up, while the Fed’s discount rate began to fall behind the effective fed funds rate (this was largely set by the market at the time).

At the same time, LBJ was launching his “Great Society” initiative which was a broad set of domestic spending programs with the grandiose goal of eliminating poverty and racial injustice. The draining of government coffers didn’t stop at social spending, LBJ also planned to significantly increase the US’s military presence in Vietnam.

❌ The Federal Reserve Defies The Federal Government

With so much spending in the pipeline, LBJ needed the Federal Reserve’s cooperation to keep monetary policy loose.

In 1965, LBJ told Martin to delay raising interest rates until the following January when the White House would release next year’s budget.

Deeply worried about inflation, Martin defied LBJ and voted to raise interest rates in early December. He was the deciding vote in a sharply divided Federal Open Market Committee (FOMC). The interest rate hike was passed 4-3.

Unsurprisingly, LBJ was livid.

Up to this point, he had been on a charm offensive with Martin to try and win the Fed’s cooperation.

The Richmond Federal Reserve had this to say about LBJ: “Johnson was accustomed to getting his way — whether through bluntness or sweet-talking, as the occasion might require.”

LBJ, and his cabinet, believed that the Federal Reserve should serve the elected government, rather than, at times, what seems like the other way around.

The battle-hardened and well-studied Fed Chair Martin adamantly disagreed.

The Federal Reserve was designed to be independent and he was determined to keep it that way.

And so this was how, two days after he raised interest rates, Martin found himself in LBJ’s Lincoln Continental as it made its way from the airport to the President’s Texas Ranch. The personal car ride for Martin to the ranch was the limit to LBJ’s charm offensive, however.

Once they got there, LBJ let loose on Martin.

“You've got me in a position where you can run a rapier into me and you've done it. You took advantage of me and I just want you to know that's a despicable thing to do.”

“My boys are dying in Vietnam, and you won’t print the money I need!”

Martin held his ground.

“I've never implied that I'm right and you're wrong, but I do have a very strong conviction that the Federal Reserve Act placed the responsibility for interest rates with the Federal Reserve Board. This is one of those few occasions where the Federal Reserve Board decision has to be final.”

Defeated, a desperate LBJ even called his Treasury Secretary to ask if he could fire Martin.

“Henry, you all got to think of … where we can get a real articulate, able, tough guy that can take this Federal Reserve place.”

Of course, this was not possible. The Federal Reserve was designed as an independent institution to deal with the exact type of problems posed by a renegade President like LBJ.

Consequences, And Lessons For Today

Facing such immense pressure from the elected US government, the Fed nonetheless kept monetary policy a lot looser than it should’ve been and what followed was a decade of stagflation.

Many economists consider the 1970’s as a “lost decade” for monetary policy.

Not only that, the decade was also defined by disastrous economic and foreign policies. The Gold Standard collapsed under the weight of significant US Dollar debasement, the Great Society didn’t come close to achieving any of its goals, and the Vietnam War was decisively lost.

Enough about the past. Let’s bring our attention back to the present.

I shared this story to draw parallels between today’s economic and political landscape in the US with that of the 1960’s.

The US government is again spending uncontrollably. Populism is running amok in the cultural zeitgeist. Today’s LBJ, in the form of Donald Trump, is possibly about to serve his second Presidential term. The country is again mired in major foreign wars. Inflation is soaring.

Could the US soon find itself in a very similar situation to the 1970’s?

One of the biggest questions to answer is what is the end game of today’s uncontrolled government spending.

In 1971, the US government’s answer to uncontrolled spending was to abruptly end the Gold Standard. Do we have a Gold Standard we can end today? Will we get to a point where we are faced with our own Gold Standard-ending moment? What would that look like?

The Gold Standard Ending Was Painful, But Wildly Successful

I haven’t thought that far out but one thing I have to mention is that even though the ending of the Gold Standard was an abrupt and painful change for the world economy, and the failure of the Vietnam War was a massive international embarrassment for the US, the world still continued to play to the tune of the US marching band.

Without gold to pin down the total money supply, the US went on to massively expand its monetary base which sent both global economic growth and the US stock market soaring.

It’s hard to see whether the US of today has an exit plan similar that of ending the Gold Standard in the 1970’s. In this sense, the US is financially in familiar and treacherously unfamiliar territory at the same time.

One has to wonder about the tremendous amount of power, responsibility, and restraint that the Fed Chair of the next few years will need to wield.

Off to its own devices, a US government driven by populism will spend until its own demise, because the only way it knows how to fix problems is to spend more money. The one institution that can stand up to this uncontrolled spending is the Federal Reserve.

I can hear cryptic echoes in the dark muttering “block-chain” 🤣

These last few articles have been absolutely killer. Don’t use up all your material too fast!