The Japanese Yen End Game

Why the Japanese Yen is falling and why it's not a problem.

Recently, the Japanese Yen has yet again been making headlines.

The currency continues to slide against the US Dollar. The JPY/USD currency pair has fallen 30% over the past 5 years and 17% in the past year.

It might be easy to draw the conclusion that something is wrong with the Japanese economy given the Yen’s rapid and prolonged decline against the Dollar.

This could not be farther from the truth.

This newsletter issue dives into why the Yen is falling and why this isn’t a problem.

📉 Why Is The Yen falling?

Two major factors determine the Yen’s value relative to the Dollar.

First, the difference between US interest rates and Japanese interest rates plays a large role.

Second, the price of oil also plays a significant role.

US-Japan Interest Rates

US interest rates are currently significantly higher than Japanese interest rates. The Fed Funds Rate is at 5.25% while the Bank of Japan’s policy interest rate is at 0%.

0%!

This creates a trade opportunity, commonly referred to as the Japanese Yen Carry Trade, where traders borrow Yen for cheap, convert Yen to Dollars, and lend Dollars (i.e. buy US treasuries or US corporate bonds) to earn the higher interest rate.

The profit in this case is the difference between the lend (US) and borrow (Japanese) interest rates.

Price Of Oil

Japan is an export economy with no natural energy resources. As such, its large export economy is primarily powered by imported oil.

When global oil prices (generally denominated in US dollars) go up, more Yen needs to be sold for Dollars to import oil and the Yen weakens as a result.

Back To The Falling Yen

You can probably guess where I’m going with this.

The recent depreciation of the Yen against the Dollar is largely the result of:

A widening gap between US-Japan interest rates (or at least rising expectations of a widening gap, as US inflation remains hot, making it difficult for the Federal Reserve to cut interest rates, while the Bank of Japan insists of 0% interest rates)

The recent rise in global oil prices.

The biggest short-term driver of this recent depreciation though, appears to be the wide gap between US and Japanese interest rates, since the Yen spiked against the Dollar after Federal Reserve’s recent FOMC meeting where the US central bank signaled a significant easing of monetary policy.

👋 Hi, from FinanceTLDR.

FinanceTLDR is not a financial cure-all.

What I can promise you, however, is my full and unbridled curiosity for how our financial system works.

If you’ve found the research and writing useful or interesting, you can financially support my work for a very small amount of $7 a month (or $70 a year for the annual deal).

Thank you!

In the past few issues, I’ve written about:

How the Federal Reserve is being torn asunder by a global tug of war of epic proportions

How multi-strat hedge funds are so wildly and consistently profitable

Why the US stock market won’t stop rising despite interest rates being at multi-decade highs

How the US Treasury rebelled against the Federal Reserve to stimulate the financial system

How the Bank of Japan is able to print an infinite amount of money without crashing the Yen

👍 It’s Not A Problem

As sensational as some financial media headlines have been on the recent slide of the Yen (“collapse“, “doom“, etc.), the weakening Yen is nowhere close to being a problem for Japan.

In fact, it’s actually somewhat of a Good Thing.

An Export-Driven Economy With Weak Inflation

Japan benefits two-fold from a weak Yen.

First, Japan’s economy is export-driven and a weak Yen makes the country’s exports more competitive.

Second, Japan has been struggling with anemic inflation ever since the late 90’s and so a weakening Yen is very much welcome as it spurs inflation.

Japan Holds A LOT Of Dollars

Japan spent the last few decades turning its vast export incomes into Dollar-denominated foreign investments and now own a foreign investment war chest with over $1 trillion.

This massive Dollar war chest now serves as a potent defense against any unruly selling of the Yen.

Note: the Government Pension Investment Fund (GPIF) is a Japanese government agency that manages the pensions for Japanese public sector employees. It’s the largest pool of retirement savings in the world with $1.5 trillion in assets under management.

When the value of the Yen falls too fast, Japanese policymakers could easily deploy this foreign investment war chest and sell Dollars for Yen to defend the currency.

That’s exactly what Japan’s Ministry of Finance did, twice, over the past week. On Monday and on Wednesday.

Large US Dollar Investment Income

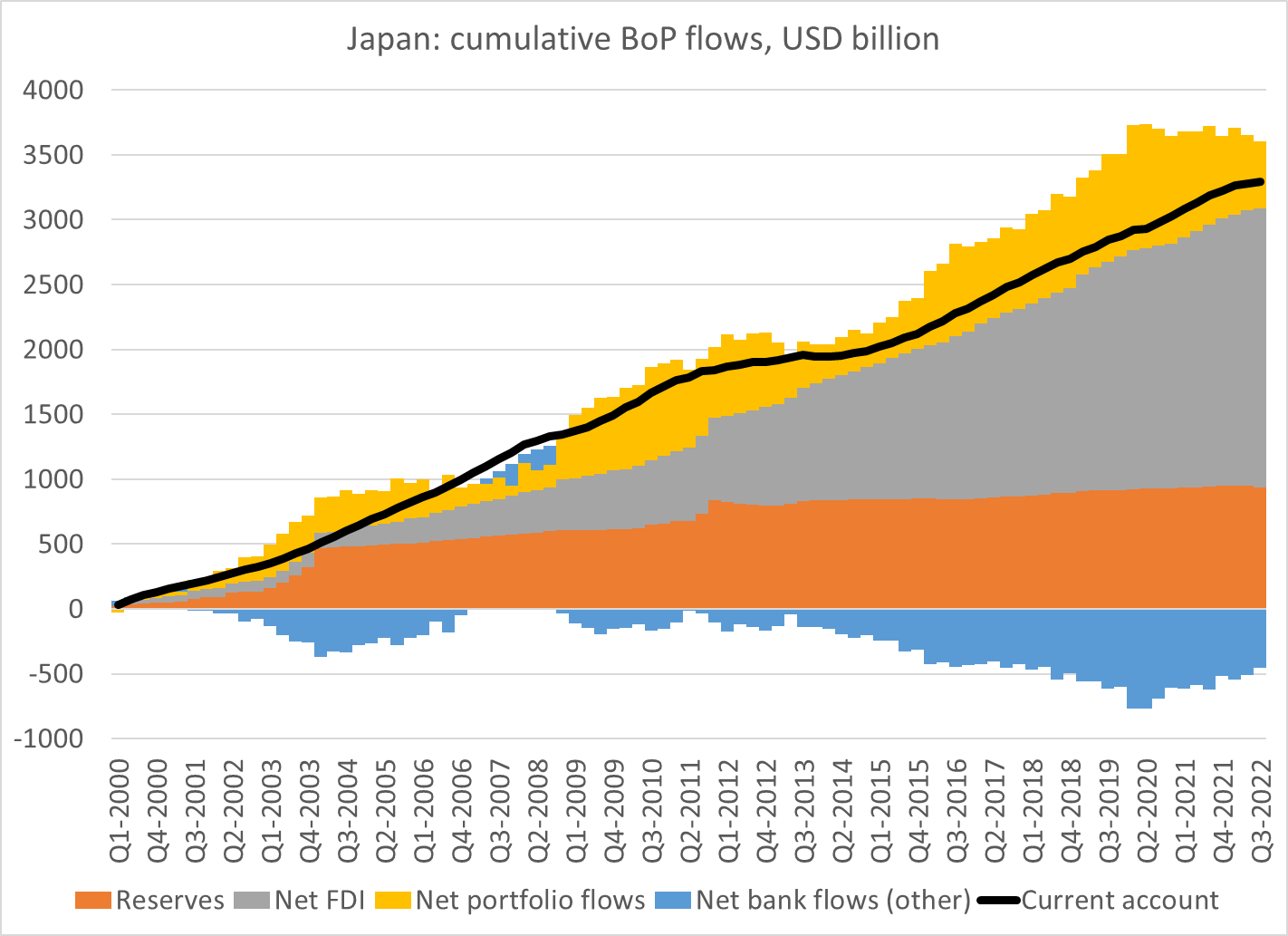

Even as the Yen has been incessantly falling against the Dollar over the past few years, one of the best clues that Everything Is Okay comes from the country’s Balance Of Payments.

Japan’s Balance Of Payments has consistently been positive (in other words, aggregate flows of Dollar-denominated money into the country remains deeply positive year-on-year) despite the weakening Yen.

As I mentioned in a previous newsletter issue, The Curious Case of the Bank of Japan, the main reason for this consistently positive Balance Of Payments is significant Dollar-denominated investment income.

Japan’s once-mighty export economy has weakened quite a bit since its glory days in the 90s (China has taken a lot of its business), but the country made good investments during its economic hay days from all the export income and now those investments are paying off in a big way.

Real Narrow Effective Exchange Rate

The Real Narrow Effective Exchange Rate is an overall valuation of a currency relative to a basket of other currencies AND takes into account inflation differences between the different countries.

As such, the Real Narrow Effective Exchange Rate is a much better measure of the Yen’s value than by just looking at the JPY/USD exchange rate.

The Federal Reserve plots the Yen’s Real Narrow Effective Exchange Rate on its open data platform, FRED.

This measure of the Yen’s value is close to historic lows, but it’s certainly not in uncharted territory.

⏳ The End Game for the Yen

So what’s the End Game for the Yen?

What does Japan’s financial policy makers intend for the country’s seemingly free-falling currency? And what are the implications for the US stock market?