Week In Review - April 20th

Summarizing newsletter issues from the past week, from how Hot Inflation is a problem to how Money-Printing works to how the Fears Of War are affecting the market.

I wrote a lot for the newsletter in the past week.

This issue summarizes all this material for readers that didn’t have time to read everything.

Here are the newsletter issues from the past week:

(April 13th) Market Pulse: Sugar High

Reviewing the hot March CPI report and why inflation is likely to be a problem this summer.

(April 15th) Market Pulse: Paying The Bill

Why the US Treasury’s debt issuance plan in Q2 might spell trouble for the market.

(April 17th) Money Printing 101

How the Federal Reserve prints and deletes money through Quantitative Easing/Tightening in an easy-to-read but informative manner (at least that was my goal 😅).

(April 18th) History Rhymes - Back To The 60’s

How the economic and geopolitical mess of the 60’s is very similar to what the US is experiencing today.

Did you know brash and headstrong populist President Lyndon B. Johnson demanded that the Federal Reserve to print more money for the Vietnam War? The Federal Reserve said “No.” LBJ was furious.

(April 19th) Market Pulse: Tit For Tat

What the ongoing tit-for-tat conflict in the Middle East means for the market.

Looking at what Israel wants and what Iran wants to have a rough sense of what might happen next in the conflict.

The Details

💡 March Inflation Was Hot. What this means for the market.

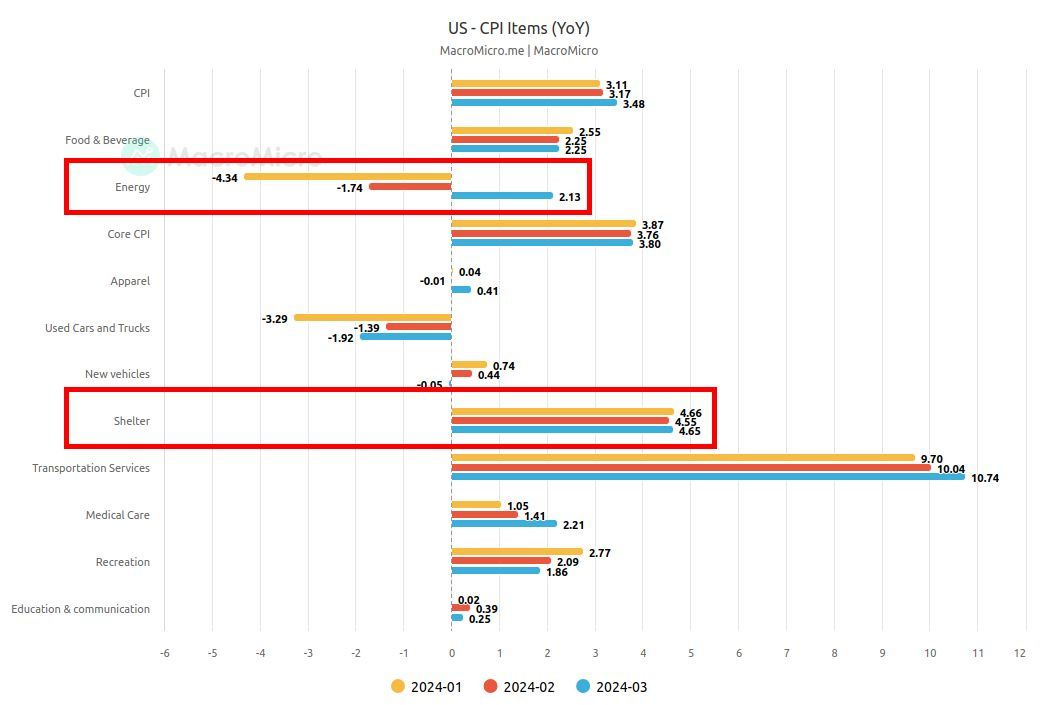

March CPI: 3.5% higher year-over-year and 0.4% higher than February, beating expectations of 3.4% and 0.3% respectively.

This hot CPI report was driven primarily by stubbornly high shelter prices and rising energy prices.

War and fears of war are driving up energy prices.

Energy prices are the top input to inflation, so rising energy prices is very worrying for inflation.

Higher inflation delays the Fed cutting interest rates.

Delayed rate cuts is a major problem for the US government and the Commercial Real Estate sector, which have been “extending and pretending” their debt and hoping for rate cuts soon.

Read More: (April 13th) Market Pulse: Sugar High

💡 What Is Fiscal Dominance? Why the US Treasury’s debt issuance plan in Q2 might spell trouble for the market.

The US economy is in Fiscal Dominance mode. This means that government spending is drowning out the private sector and has become a major market-moving force. Two direct implications of this:

Economic growth (i.e. GDP growth) is now a lot more dependent on government spending.

US Treasury auctions (debt issuance) are now setting the tempo of the financial markets.

Treasury bills (t-bills) are short-term US government debt that expire in at most a year. They are incredibly low risk and treated like cash in the financial system.

The US Treasury has been issuing a lot more t-bills over the last year which is boosting liquidity in the system while paying for massive government spending. It’s like having your cake and eating it too.

However, this quarter, total t-bill supply will fall by $245 billion. In contrast, last quarter, total t-bill supply expanded by $442 billion.

A large decline in total t-bill supply is not good for the stock market.

Read More: (April 15th) Market Pulse: Paying The Bill

💡 How Does The Federal Reserve Print Money? Two-tiered monetary system and the specifics of quantitative easing and tightening.

The Two-Tiered Monetary System is where there are two big pools of dollars in the financial system. One pool of money consists of bank reserves that banks with Master Accounts at the Federal Reserve have access to. Another pool of money consists of bank deposits that customers of private banks have access to.

With Quantitative Easing, the Fed buys treasuries from private investors, and its balance sheet magically expands with $100 more in bank reserve liabilities and $100 more in treasury assets.

With Quantitative Tightening the reverse happens and the Federal Reserve loses treasuries on its balance sheet and deletes the money it receives.

Read More: (April 17th) Money Printing 101

💡 History Rhymes. Why the troubling 60’s is similar to today and what lessons we can draw from that era.

In the 60’s, inflation in the US was hitting up, a wave of populism was sweeping over the country, the Vietnam War was in full swing, and the government was spending uncontrollably on social programs and the war.

This is very similar to what we’re experiencing today.

Populist President Lyndon B. Johnson even demanded that the Federal Reserve print more money for him to pay for the Vietnam War. The Federal Reserve said “No.”

“You've got me in a position where you can run a rapier into me and you've done it. You took advantage of me and I just want you to know that's a despicable thing to do.”

“My boys are dying in Vietnam, and you won’t print the money I need!”

US spending was so out-of-control that the world financial system broke. LBJ’s successor, Richard Nixon, had to end the Dollar Gold Standard.

Although abrupt and tumultuous at the time (it was basically the US forcing a debt jubilee of its own debt on the rest of the world), this ended up being very good for both the US and the global financial system.

Read More: (April 18th) History Rhymes - Back To The 60’s

💡 Middle East Conflict. What this means for the market.

One thing that should be of particular interest to every market analyst is what happens next in the conflict between Israel and Iran.

ISR wants escalation to draw in the US. The US and IRN want de-escalation.

On April 1st, ISR bombed IRN’s Damascus consulate. On April 13th, the IRN retaliated with a historically momentous and massive missile and drone strike on ISR. On April 18th, ISR retaliated with a missile strike on IRN. IRN doesn’t want to retaliate.

The ball is now in ISR’s court.

Can the US convince ISR to hold its fire, or does ISR think that it has no choice but to continue pressing the issue?

These things are very hard to predict as they rest on the volatile whims of a few top military strategists and politicians. That’s why it’s incredibly tenuous to invest in the market right now.

Read More: (April 19th) Market Pulse: Tit For Tat

Good stuff this week 🙌